- South Korea

- /

- Trade Distributors

- /

- KOSE:A005440

Undiscovered Gems In South Korea To Watch This September 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has dropped 5.4%, driven by declines in every sector, and it is also down 3.8% over the past year. Despite these challenges, earnings are forecast to grow by 29% annually, making this an opportune moment to identify stocks with strong growth potential that may be currently undervalued or overlooked.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.98% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| Namuga | 14.47% | 0.88% | 38.25% | ★★★★★★ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

VT (KOSDAQ:A018290)

Simply Wall St Value Rating: ★★★★★★

Overview: VT Co., Ltd. produces and exports laminating machines and films worldwide, with a market cap of ₩1.19 billion.

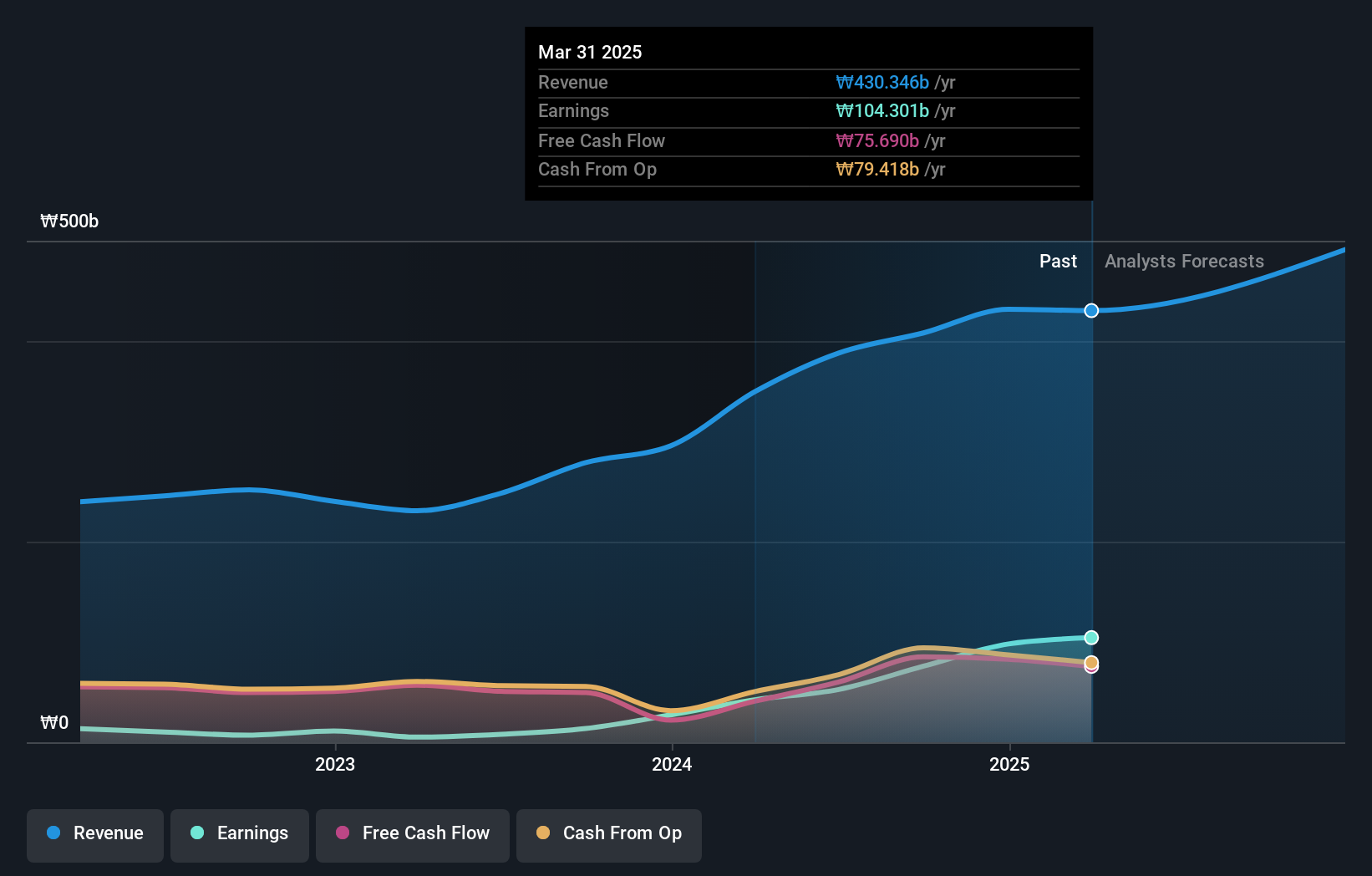

Operations: VT Co., Ltd. generates revenue primarily from its Cosmetic segment (₩256.27 billion), followed by Entertainment (₩93.74 billion) and Laminating (₩33.86 billion).

VT Co., Ltd. has shown impressive earnings growth of 563.7% over the past year, significantly outpacing the Personal Products industry’s 30.2%. The company reported second-quarter sales of KRW 113,352 million and net income of KRW 15,400 million, compared to KRW 74,694 million and KRW 5,085 million a year ago respectively. Additionally, VT's debt to equity ratio improved from 71.2% to 22.4% over five years while trading at approximately 15% below its estimated fair value.

- Take a closer look at VT's potential here in our health report.

Examine VT's past performance report to understand how it has performed in the past.

Hankook (KOSE:A000240)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hankook & Company Co., Ltd. manufactures and sells storage batteries with a market cap of ₩1.70 trillion.

Operations: Hankook & Company Co., Ltd. generates revenue through the manufacturing and sale of storage batteries. The company has a market cap of ₩1.70 trillion.

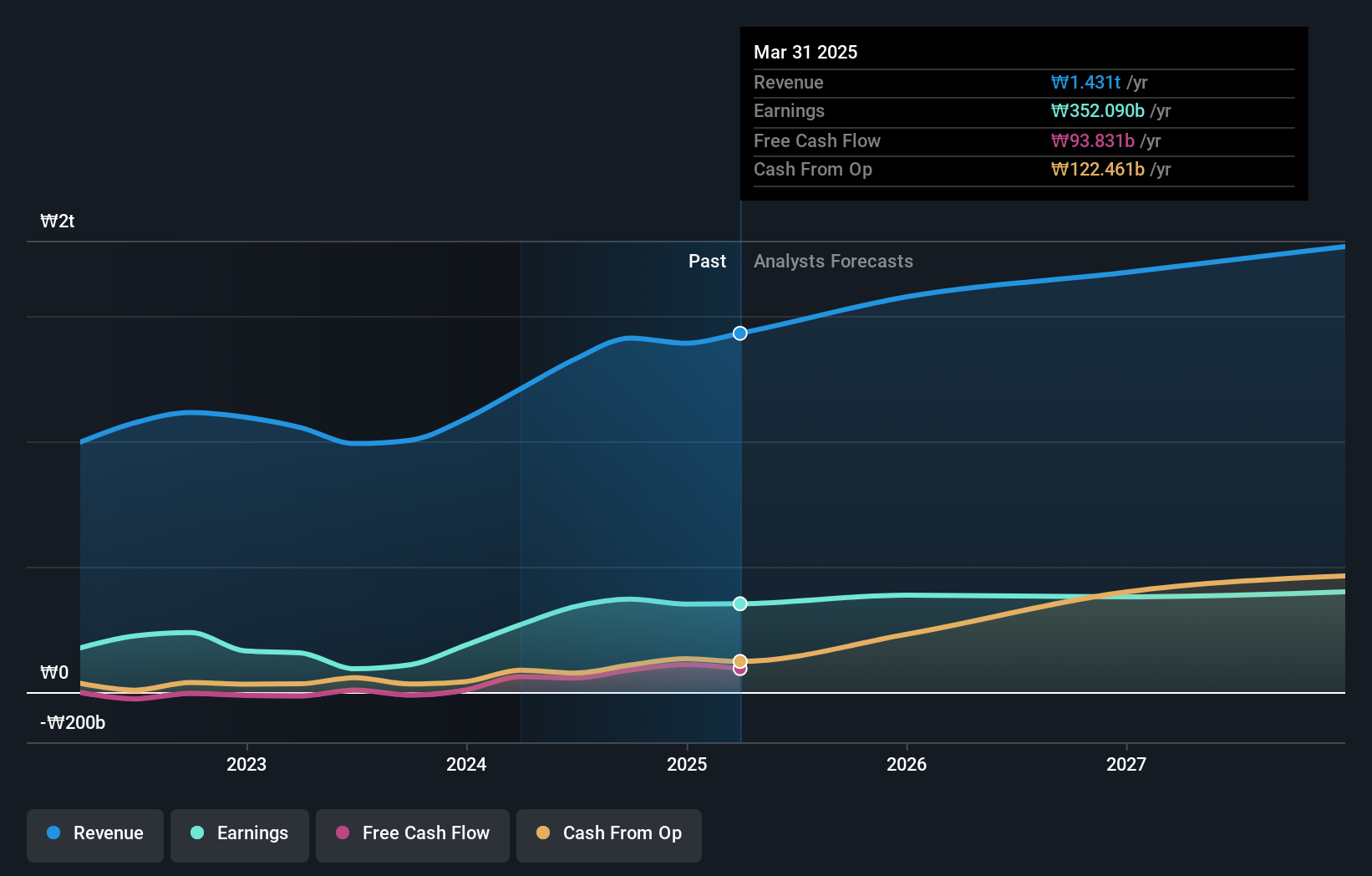

Hankook's recent performance showcases its potential as an undervalued player in the market. For Q2 2024, sales reached KRW 4.81 billion, up from KRW 4.43 billion last year, while net income soared to KRW 108.48 million from KRW 36.32 million a year ago. The company's debt to equity ratio of 1.4% is satisfactory and interest payments are well covered by EBIT at a coverage of 40x. With a P/E ratio of just 5x compared to the market's average of 11.1x and earnings growth that outpaces the industry, Hankook is positioned for continued success in the auto components sector.

- Navigate through the intricacies of Hankook with our comprehensive health report here.

Evaluate Hankook's historical performance by accessing our past performance report.

Hyundai G.F. Holdings (KOSE:A005440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hyundai G.F. Holdings Co., Ltd. focuses on rental and investment businesses with a market cap of ₩779.52 billion.

Operations: Hyundai G.F. Holdings generates revenue primarily from rental and investment activities. The company's cost structure and specific financial data are not provided in detail.

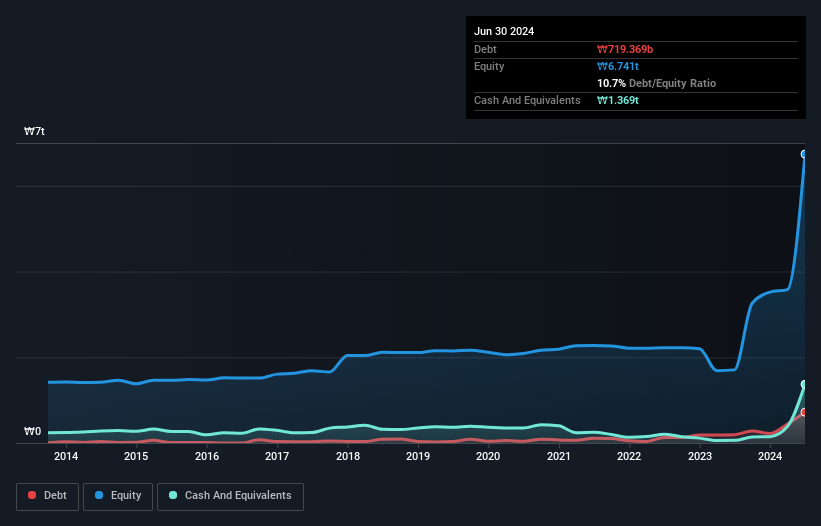

Hyundai G.F. Holdings, a relatively smaller player in South Korea's market, has shown impressive earnings growth of 242291% over the past year. The company’s debt-to-equity ratio increased from 1.6 to 10.7 over the last five years, indicating higher leverage but manageable interest coverage due to its profitability. Trading at 43.2% below estimated fair value and with revenue forecasted to grow by 20.82% annually, Hyundai G.F.'s prospects seem promising despite recent challenges in working capital management and capital expenditure adjustments.

- Dive into the specifics of Hyundai G.F. Holdings here with our thorough health report.

Assess Hyundai G.F. Holdings' past performance with our detailed historical performance reports.

Taking Advantage

- Access the full spectrum of 182 KRX Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyundai G.F. Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005440

Undervalued with excellent balance sheet and pays a dividend.