- South Korea

- /

- Auto Components

- /

- KOSDAQ:A122690

Seojin Automotive Co.,Ltd.'s (KOSDAQ:122690) Low P/E No Reason For Excitement

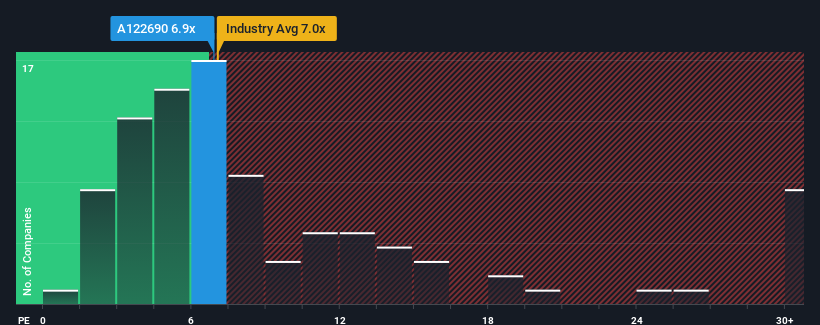

Seojin Automotive Co.,Ltd.'s (KOSDAQ:122690) price-to-earnings (or "P/E") ratio of 6.9x might make it look like a buy right now compared to the market in Korea, where around half of the companies have P/E ratios above 13x and even P/E's above 27x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For instance, Seojin AutomotiveLtd's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Seojin AutomotiveLtd

Is There Any Growth For Seojin AutomotiveLtd?

Seojin AutomotiveLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing that to the market, which is predicted to deliver 33% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why Seojin AutomotiveLtd is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Seojin AutomotiveLtd maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - Seojin AutomotiveLtd has 4 warning signs (and 1 which is significant) we think you should know about.

If you're unsure about the strength of Seojin AutomotiveLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A122690

Seojin AutomotiveLtd

Produces, supplies, and sells automobile clutches and components in South Korea and internationally.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives