- South Korea

- /

- Auto Components

- /

- KOSDAQ:A107640

HanJung Natural Connectivity System.co.Ltd (KOSDAQ:107640) shareholder returns have been fantastic, earning 881% in 5 years

We think all investors should try to buy and hold high quality multi-year winners. And we've seen some truly amazing gains over the years. For example, the HanJung Natural Connectivity System.co.,Ltd (KOSDAQ:107640) share price is up a whopping 881% in the last half decade, a handsome return for long term holders. If that doesn't get you thinking about long term investing, we don't know what will. It's also good to see the share price up 53% over the last quarter. But this could be related to the strong market, which is up 24% in the last three months. It really delights us to see such great share price performance for investors.

Since the stock has added ₩46b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

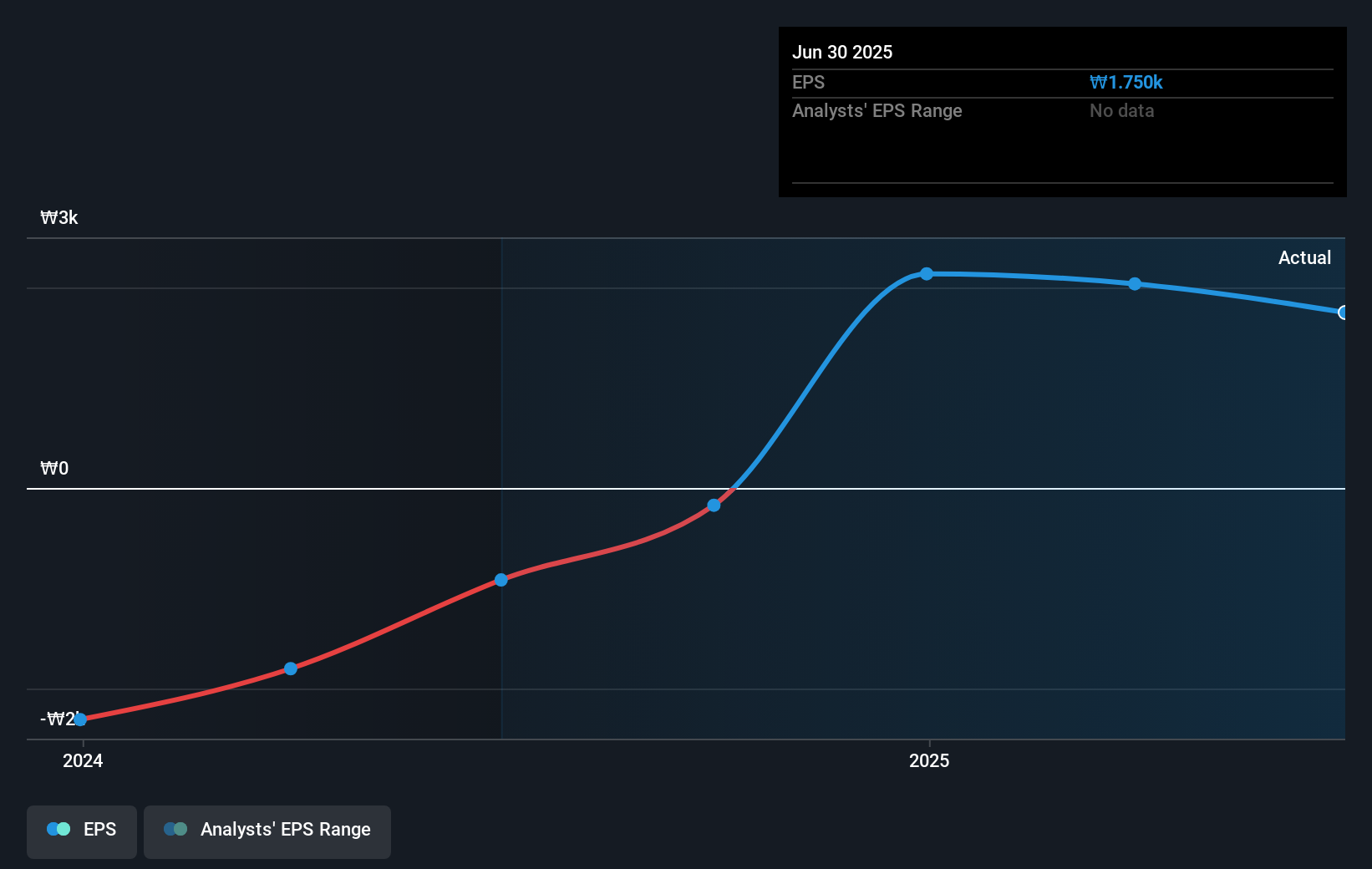

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last half decade, HanJung Natural Connectivity System.co.Ltd became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into HanJung Natural Connectivity System.co.Ltd's key metrics by checking this interactive graph of HanJung Natural Connectivity System.co.Ltd's earnings, revenue and cash flow.

A Different Perspective

HanJung Natural Connectivity System.co.Ltd provided a TSR of 41% over the last twelve months. But that was short of the market average. If we look back over five years, the returns are even better, coming in at 58% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand HanJung Natural Connectivity System.co.Ltd better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with HanJung Natural Connectivity System.co.Ltd (including 2 which are a bit unpleasant) .

But note: HanJung Natural Connectivity System.co.Ltd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HanJung Natural Connectivity System.co.Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A107640

HanJung Natural Connectivity System.co.Ltd

Manufactures and sells automobile and energy storage device parts.

Adequate balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)