- South Korea

- /

- Auto Components

- /

- KOSDAQ:A065500

Recent 17% pullback isn't enough to hurt long-term Orient Precision Industries (KOSDAQ:065500) shareholders, they're still up 349% over 1 year

The Orient Precision Industries Inc (KOSDAQ:065500) share price has had a bad week, falling 17%. But that cannot eclipse the spectacular share price rise we've seen over the last twelve months. Few could complain about the impressive 349% rise, throughout the period. So the recent fall isn't enough to negate the good performance. The real question is whether the fundamental business performance can justify the strong increase over the long term.

Although Orient Precision Industries has shed ₩37b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Check out our latest analysis for Orient Precision Industries

Orient Precision Industries wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Orient Precision Industries grew its revenue by 9.8% last year. That's not a very high growth rate considering it doesn't make profits. So the 349% gain in just twelve months is completely unexpected. We're happy that investors have made money, but we can't help questioning whether the rise is sustainable. It just goes to show that big money can be made if you buy the right stock early.

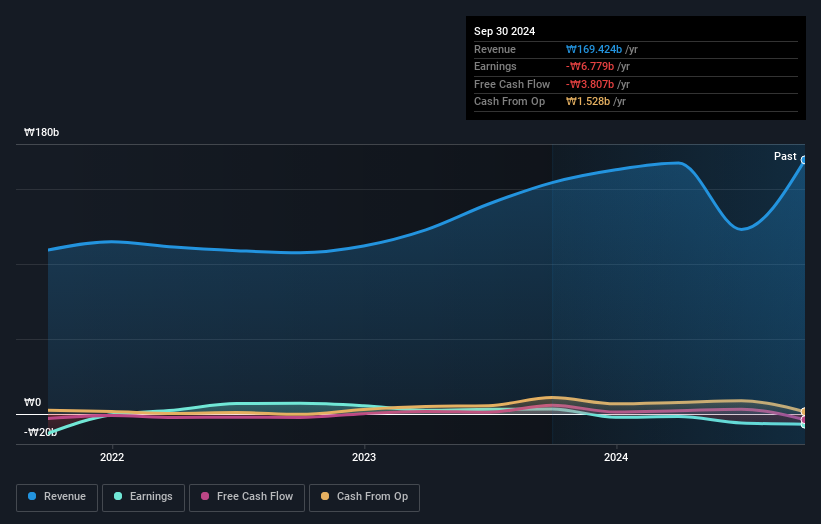

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that Orient Precision Industries shareholders have received a total shareholder return of 349% over one year. That gain is better than the annual TSR over five years, which is 26%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Orient Precision Industries has 1 warning sign we think you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A065500

Orient Precision Industries

Manufactures and sells automobile parts in South Korea and internationally.

Mediocre balance sheet minimal.