- South Korea

- /

- Auto Components

- /

- KOSDAQ:A038110

How Does Ecoplastic Corporation (KOSDAQ:038110) Fare As A Dividend Stock?

Dividend paying stocks like Ecoplastic Corporation (KOSDAQ:038110) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

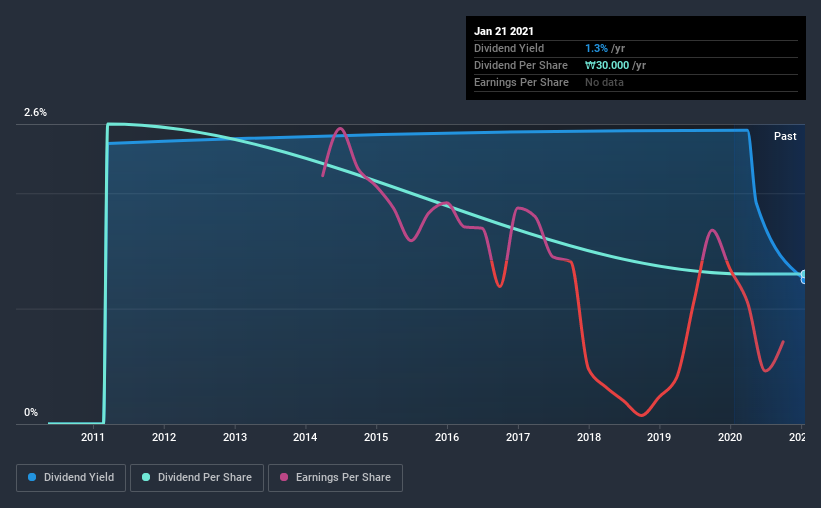

While Ecoplastic's 1.3% dividend yield is not the highest, we think its lengthy payment history is quite interesting. That said, the recent jump in the share price will make Ecoplastic's dividend yield look smaller, even though the company prospects could be improving. There are a few simple ways to reduce the risks of buying Ecoplastic for its dividend, and we'll go through these below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Although it reported a loss over the past 12 months, Ecoplastic currently pays a dividend. When a company is loss-making, we next need to check to see if its cash flows can support the dividend.

Ecoplastic paid out 1.7% of its free cash flow as dividends last year, which is conservative and suggests the dividend is sustainable.

Remember, you can always get a snapshot of Ecoplastic's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of Ecoplastic's dividend payments. This company's dividend has not fluctuated wildly, but its dividend per share payments have still decreased substantially over this time, which is not ideal. During the past 10-year period, the first annual payment was ₩60.0 in 2011, compared to ₩30.0 last year. The dividend has shrunk at around 6.7% a year during that period.

We struggle to make a case for buying Ecoplastic for its dividend, given that payments have shrunk over the past 10 years.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Ecoplastic's earnings per share have shrunk at 41% a year over the past five years. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Ecoplastic's earnings per share, which support the dividend, have been anything but stable.

We'd also point out that Ecoplastic issued a meaningful number of new shares in the past year. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're not keen on the fact that Ecoplastic paid dividends despite reporting a loss over the past year, although fortunately its dividend was covered by cash flow. Moreover, earnings have been shrinking. While the dividends have been fairly steady, we'd wonder for how much longer this will be sustainable if earnings continue to decline. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Ecoplastic out there.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 4 warning signs for Ecoplastic (1 is concerning!) that you should be aware of before investing.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you decide to trade Ecoplastic, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ecoplastic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A038110

Ecoplastic

Engages in the research, development, production, and sale of automotive plastic parts in South Korea.

Moderate risk unattractive dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)