- South Korea

- /

- Auto Components

- /

- KOSDAQ:A013310

A-Jin IndustrialLtd (KOSDAQ:013310) earnings and shareholder returns have been trending downwards for the last year, but the stock pops 13% this past week

A-Jin Industrial Co.,Ltd. (KOSDAQ:013310) shareholders should be happy to see the share price up 13% in the last week. But in truth the last year hasn't been good for the share price. The cold reality is that the stock has dropped 49% in one year, under-performing the market.

The recent uptick of 13% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for A-Jin IndustrialLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

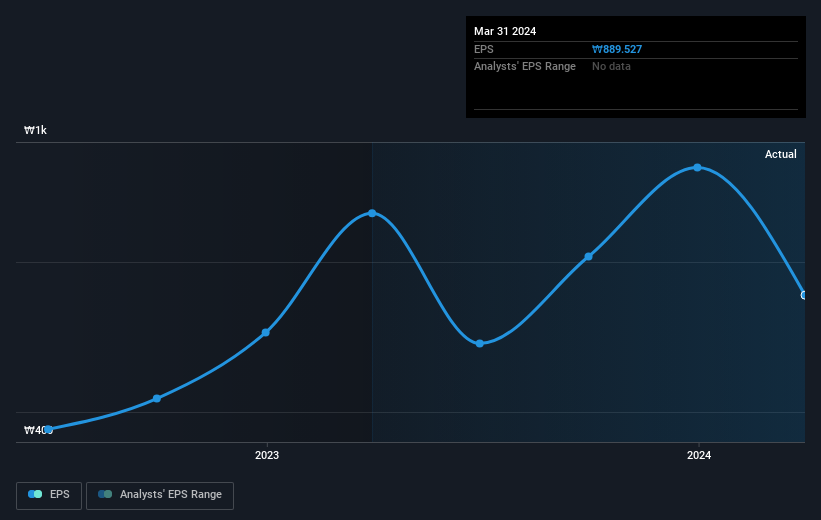

Unhappily, A-Jin IndustrialLtd had to report a 23% decline in EPS over the last year. This reduction in EPS is not as bad as the 49% share price fall. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock. The P/E ratio of 3.45 also points to the negative market sentiment.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into A-Jin IndustrialLtd's key metrics by checking this interactive graph of A-Jin IndustrialLtd's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 0.6% in the twelve months, A-Jin IndustrialLtd shareholders did even worse, losing 48% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 1.1%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 5 warning signs we've spotted with A-Jin IndustrialLtd (including 1 which doesn't sit too well with us) .

We will like A-Jin IndustrialLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A013310

A-Jin IndustrialLtd

Engages in the manufacture and sale of automotive parts in South Korea and internationally.

Moderate and slightly overvalued.

Market Insights

Community Narratives