- Japan

- /

- Gas Utilities

- /

- TSE:9533

Toho Gas (TSE:9533) Valuation Check After New E‑Methane Decarbonization Partnership in Nebraska

Reviewed by Simply Wall St

Toho Gas (TSE:9533) just deepened its decarbonization push, signing a joint development and operating agreement for the Live Oak e methane project in Nebraska, a long dated move tied directly to Japan’s carbon neutral gas ambitions.

See our latest analysis for Toho Gas.

Despite a choppy week, with a 7 day share price return of minus 4.11 percent, Toho Gas still shows building momentum. It has posted an 11.53 percent year to date share price return and a 25.35 percent 1 year total shareholder return.

If this decarbonization move has you rethinking your energy exposure, it could be worth scanning fast growing stocks with high insider ownership for other under the radar opportunities with aligned leadership incentives.

Yet with earnings under pressure, a value score of zero, and the stock trading above consensus targets, investors face a key question: is Toho Gas now a stretched decarbonization play or still a mispriced growth story?

Price-to-Earnings of 15.9x: Is it justified?

Toho Gas last closed at ¥4,709 and trades on a 15.9x price to earnings multiple, a clear premium to peers that indicates the market is paying more for its earnings.

The price to earnings ratio compares the current share price to the company’s earnings per share and is a common gauge for mature, cash generative utilities like Toho Gas. A higher multiple usually reflects expectations of resilient or growing profits relative to the rest of the sector.

In Toho Gas’s case, that premium appears demanding. The stock is described as expensive versus its own estimated fair price to earnings ratio of 7.3x, a level our work suggests the market could eventually gravitate toward if expectations cool. It also appears expensive compared with the Asian gas utilities industry average of 13.6x and a peer average of 14.1x, despite forecasts pointing to declining earnings and revenue over the next three years.

Explore the SWS fair ratio for Toho Gas

Result: Price-to-Earnings of 15.9x (OVERVALUED)

However, sliding revenue and double digit profit contraction, alongside a share price already above analyst targets, could quickly puncture the decarbonization premium thesis.

Find out about the key risks to this Toho Gas narrative.

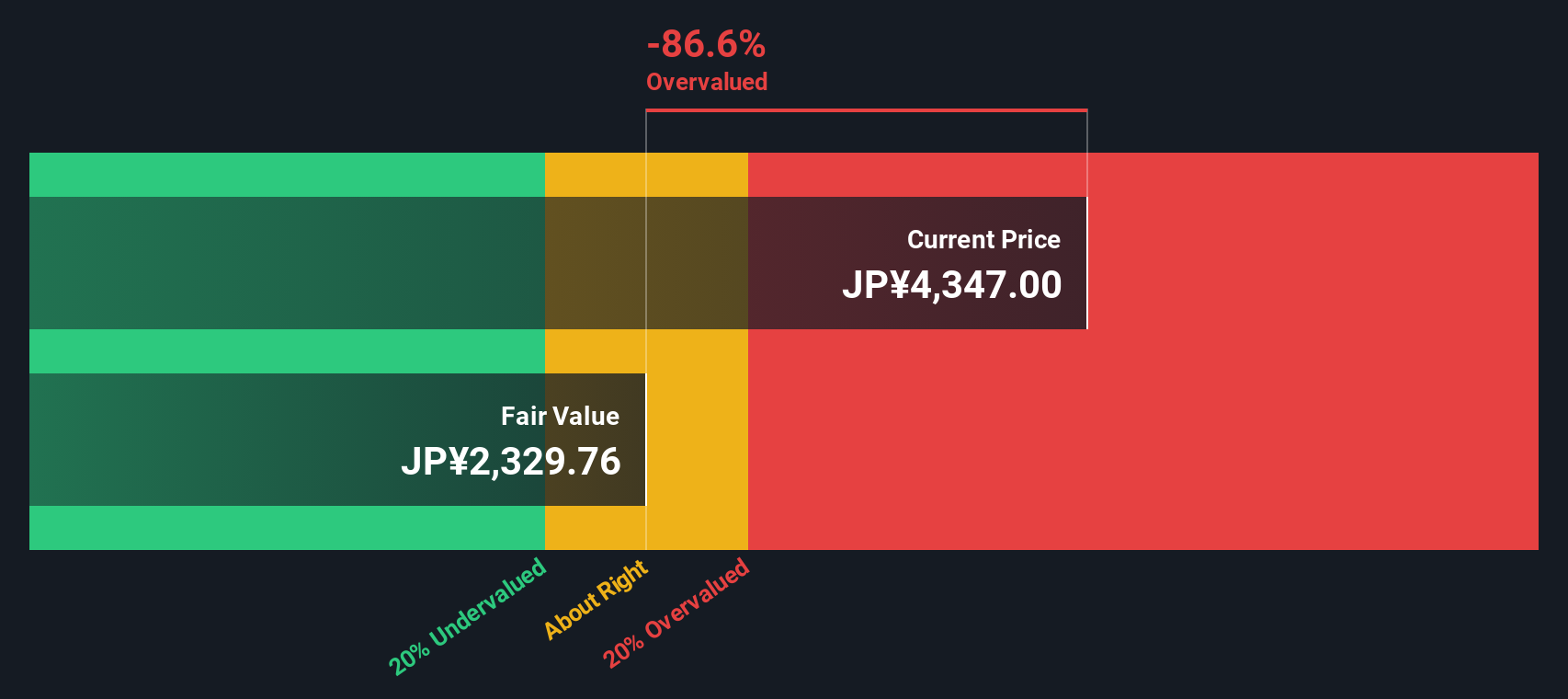

Another View: Our DCF Suggests Even Less Value

Our DCF model paints an even starker picture. It pegs fair value near ¥2,330 versus the current ¥4,709, which implies Toho Gas could be significantly overvalued. If both earnings multiples and cash flow point down, what exactly is the market pricing in?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toho Gas for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toho Gas Narrative

If this view does not align with your own, or you would rather dig into the numbers yourself, you can craft a complete narrative in just a few minutes, Do it your way.

A great starting point for your Toho Gas research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one stock; use the Simply Wall Street Screener to uncover fresh, data driven opportunities that other investors may be overlooking right now.

- Capture potential bargain opportunities by scanning these 910 undervalued stocks based on cash flows built on cash flow strength rather than market hype.

- Position your portfolio for structural growth trends by reviewing these 30 healthcare AI stocks that merge medical innovation with advanced algorithms.

- Tap into market volatility with focus by filtering these 81 cryptocurrency and blockchain stocks that are shaping the future of digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toho Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9533

Toho Gas

Engages in the gas, LPG and other energy, electric power, and other businesses in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026