- Japan

- /

- Gas Utilities

- /

- TSE:9531

Tokyo Gas (TSE:9531): Assessing Valuation After Steady Share Price Gains and Quiet Trading

Reviewed by Simply Wall St

Tokyo GasLtd (TSE:9531) has been making waves on investor watchlists recently. There may not have been any headline-grabbing news or major events this week, but the mere fact that the stock is moving quietly could be enough to pique interest for those looking to spot early signals. Sometimes, it is these subtle shifts that prompt investors to ask whether a meaningful change is brewing beneath the surface.

Over the past year, Tokyo GasLtd’s stock has climbed an impressive 75%, with momentum picking up pace in recent months. The stock has seen an 18% gain in the past 3 months and more than 30% growth year-to-date. This sustained performance comes despite only marginal growth in annual revenue and a dip in net income, suggesting the market might be re-evaluating Tokyo GasLtd’s long-term potential or risk profile. Investors have seen similar low-key stretches followed by bursts of activity in the past, so even a seemingly quiet period can be worth a closer look.

With the stock trending upward this year, is Tokyo GasLtd genuinely undervalued at current levels, or has the market already priced in expectations for future growth?

Price-to-Earnings of 12.6x: Is it justified?

Tokyo GasLtd is currently trading at a Price-to-Earnings (P/E) ratio of 12.6x, which is lower than both its peers in the industry and the broader Japanese market. This suggests that, relative to comparable companies, investors may see Tokyo GasLtd as undervalued or more attractively priced on an earnings basis.

The Price-to-Earnings ratio measures how much investors are willing to pay for each unit of a company’s earnings. It is a widely used metric for evaluating whether a stock is expensive or cheap, especially when comparing similar companies in the same sector.

Given that Tokyo GasLtd’s earnings have grown significantly in recent years and exceeded both industry and market returns, this lower multiple could indicate the market has not fully priced in the company's growth potential. It could also reflect concerns about the future earnings outlook, as company forecasts point to declining profits in the coming years.

Result: Fair Value of ¥5144 (OVERVALUED)

See our latest analysis for Tokyo GasLtd.However, declining net income and a recent share price that is above analyst targets suggest caution may be warranted before expecting further upside.

Find out about the key risks to this Tokyo GasLtd narrative.Another View: What Does Our DCF Model Say?

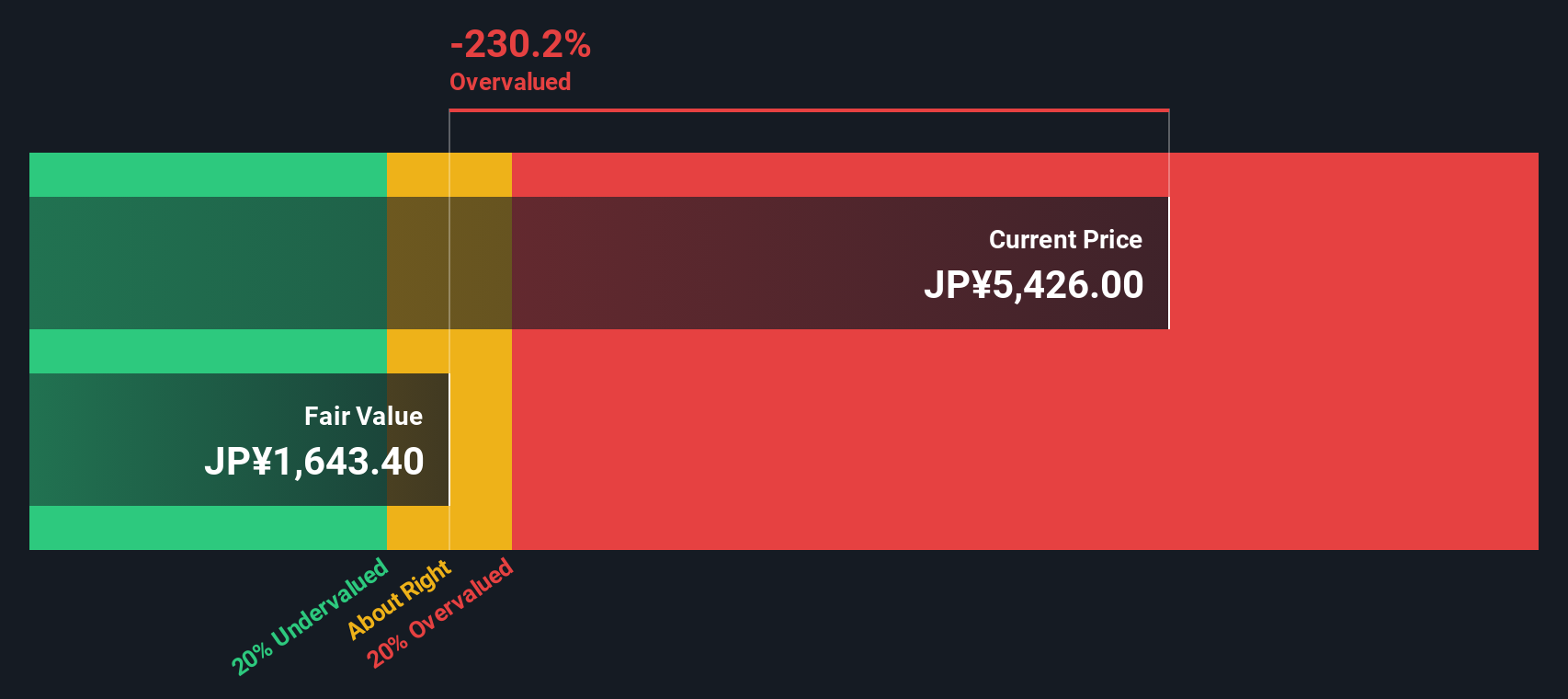

Switching perspectives, the SWS DCF model offers a different take and points to overvaluation rather than a bargain. This result challenges what the low earnings multiple suggests. Which approach better reflects the real story here?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Tokyo GasLtd Narrative

If you think there’s more to the story or prefer hands-on research, you can quickly build your own perspective about Tokyo GasLtd in just a few minutes. Do it your way.

A great starting point for your Tokyo GasLtd research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Broaden your investing horizon and uncover fresh opportunities you might have missed. The Simply Wall Street Screener can help you zero in on standout stocks in fast-moving markets, powerful trends, and essential income plays.

- Spot potential in early-stage companies packed with serious growth by pursuing penny stocks with strong financials. These companies are surging ahead with strong financials and unique market positions.

- Accelerate your portfolio with trailblazers at the heart of cutting-edge healthcare technology through healthcare AI stocks. These innovators are powering advancements in diagnosis, patient care, and medical breakthroughs.

- Capture reliable income streams and stability, even in uncertain markets, by seeking out dividend stocks with yields > 3%. These options offer attractive yields above 3% alongside resilient fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo GasLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9531

Tokyo GasLtd

Engages in the production, supply, and sale of city gas and LNG in Japan.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives