- Japan

- /

- Renewable Energy

- /

- TSE:9519

Little Excitement Around RENOVA, Inc.'s (TSE:9519) Earnings As Shares Take 33% Pounding

Unfortunately for some shareholders, the RENOVA, Inc. (TSE:9519) share price has dived 33% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

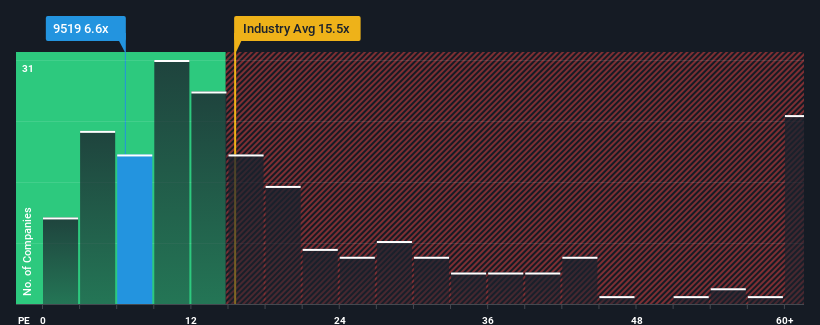

In spite of the heavy fall in price, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 14x, you may still consider RENOVA as an attractive investment with its 6.6x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

RENOVA certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for RENOVA

Does Growth Match The Low P/E?

RENOVA's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered an exceptional 230% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 35% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 20% per annum during the coming three years according to the five analysts following the company. That's not great when the rest of the market is expected to grow by 9.6% per year.

In light of this, it's understandable that RENOVA's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

RENOVA's P/E has taken a tumble along with its share price. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that RENOVA maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 4 warning signs for RENOVA (3 shouldn't be ignored!) that you should be aware of.

If these risks are making you reconsider your opinion on RENOVA, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade RENOVA, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9519

RENOVA

Engages in the development and operation of renewable energy power plant in Japan.

Moderate and slightly overvalued.