- Japan

- /

- Renewable Energy

- /

- TSE:9519

Earnings Working Against RENOVA, Inc.'s (TSE:9519) Share Price Following 31% Dive

RENOVA, Inc. (TSE:9519) shareholders won't be pleased to see that the share price has had a very rough month, dropping 31% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 36% share price drop.

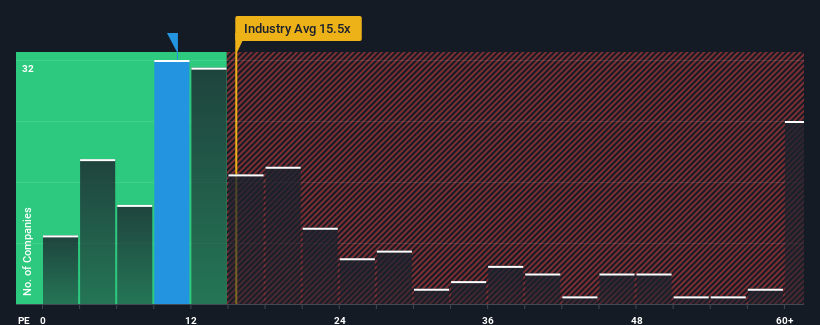

Even after such a large drop in price, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 14x, you may still consider RENOVA as an attractive investment with its 10.8x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's superior to most other companies of late, RENOVA has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for RENOVA

How Is RENOVA's Growth Trending?

In order to justify its P/E ratio, RENOVA would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 230% last year. Still, incredibly EPS has fallen 35% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 15% per year during the coming three years according to the six analysts following the company. Meanwhile, the broader market is forecast to expand by 9.3% each year, which paints a poor picture.

In light of this, it's understandable that RENOVA's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From RENOVA's P/E?

RENOVA's P/E has taken a tumble along with its share price. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that RENOVA maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware RENOVA is showing 5 warning signs in our investment analysis, and 3 of those are significant.

If you're unsure about the strength of RENOVA's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9519

RENOVA

Engages in the development and operation of renewable energy power plant in Japan.

Moderate and slightly overvalued.

Market Insights

Community Narratives