- Japan

- /

- Electric Utilities

- /

- TSE:9509

Hokkaido Electric Power Company, Incorporated's (TSE:9509) Popularity With Investors Under Threat As Stock Sinks 28%

The Hokkaido Electric Power Company, Incorporated (TSE:9509) share price has softened a substantial 28% over the previous 30 days, handing back much of the gains the stock has made lately. The good news is that in the last year, the stock has shone bright like a diamond, gaining 105%.

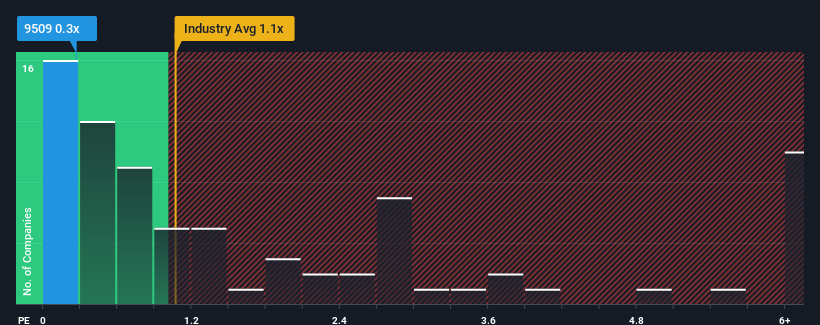

Although its price has dipped substantially, it's still not a stretch to say that Hokkaido Electric Power Company's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Electric Utilities industry in Japan, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Hokkaido Electric Power Company

How Has Hokkaido Electric Power Company Performed Recently?

Hokkaido Electric Power Company certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Hokkaido Electric Power Company will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Hokkaido Electric Power Company would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.3%. The latest three year period has also seen a 29% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 2.6% per year during the coming three years according to the four analysts following the company. Meanwhile, the broader industry is forecast to expand by 0.1% each year, which paints a poor picture.

With this in consideration, we think it doesn't make sense that Hokkaido Electric Power Company's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Hokkaido Electric Power Company's P/S?

With its share price dropping off a cliff, the P/S for Hokkaido Electric Power Company looks to be in line with the rest of the Electric Utilities industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our check of Hokkaido Electric Power Company's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Hokkaido Electric Power Company that you should be aware of.

If you're unsure about the strength of Hokkaido Electric Power Company's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Hokkaido Electric Power Company, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hokkaido Electric Power Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9509

Hokkaido Electric Power Company

Generates, transmits, and distributes electricity in Japan.

Very undervalued moderate.

Market Insights

Community Narratives