- Japan

- /

- Electric Utilities

- /

- TSE:9505

Hokuriku Electric Power Company (TSE:9505) Looks Just Right With A 25% Price Jump

Despite an already strong run, Hokuriku Electric Power Company (TSE:9505) shares have been powering on, with a gain of 25% in the last thirty days. The last 30 days bring the annual gain to a very sharp 51%.

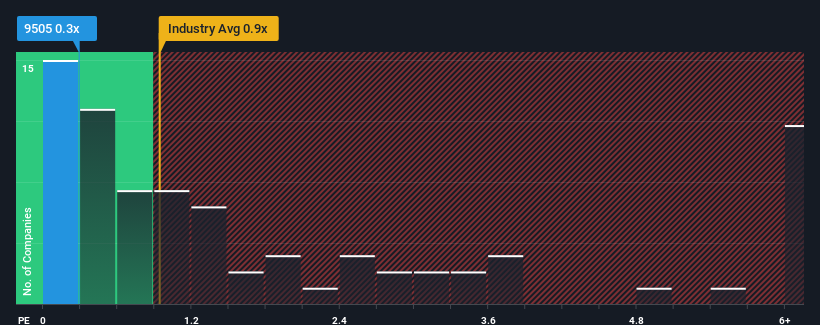

Although its price has surged higher, there still wouldn't be many who think Hokuriku Electric Power's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when it essentially matches the median P/S in Japan's Electric Utilities industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Hokuriku Electric Power

How Hokuriku Electric Power Has Been Performing

With only a limited decrease in revenue compared to most other companies of late, Hokuriku Electric Power has been doing relatively well. It might be that many expect the comparatively superior revenue performance to vanish, which has kept the P/S from rising. You'd much rather the company continue improving its revenue if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hokuriku Electric Power.How Is Hokuriku Electric Power's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Hokuriku Electric Power's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 1.1% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 26% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 2.1% per annum during the coming three years according to the four analysts following the company. With the rest of the industry predicted to shrink by 0.6% each year, it's set to post a similar result.

With this in consideration, it's clear to see why Hokuriku Electric Power's P/S stacks up closely with its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There is still potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Final Word

Hokuriku Electric Power's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, we see that Hokuriku Electric Power maintains its moderate P/S thanks to a revenue outlook that's pretty much level with the wider industry. Right now, shareholders are comfortable with the P/S as they have faith that future revenue will not uncover any unpleasant surprises. Although, we are somewhat concerned whether the company can maintain this level of performance under these tough industry conditions. For now though, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Hokuriku Electric Power (1 can't be ignored!) that we have uncovered.

If you're unsure about the strength of Hokuriku Electric Power's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hokuriku Electric Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9505

Hokuriku Electric Power

Supplies electricity through integrated power generation, transmission, and distribution systems in Japan.

Good value with proven track record.

Market Insights

Community Narratives