- Japan

- /

- Electric Utilities

- /

- TSE:9505

Hokuriku Electric Power Company (TSE:9505) Investors Are Less Pessimistic Than Expected

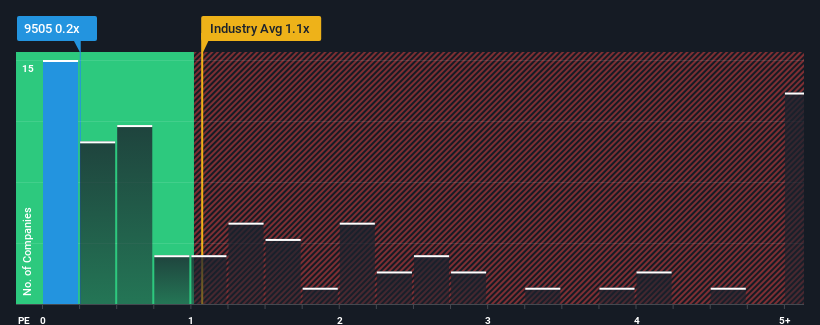

There wouldn't be many who think Hokuriku Electric Power Company's (TSE:9505) price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S for the Electric Utilities industry in Japan is similar at about 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Hokuriku Electric Power

What Does Hokuriku Electric Power's P/S Mean For Shareholders?

Recent times have been more advantageous for Hokuriku Electric Power as its revenue hasn't fallen as much as the rest of the industry. Perhaps the market is expecting future revenue performance fall back in line with the poorer industry performance, which has kept the P/S contained. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hokuriku Electric Power.How Is Hokuriku Electric Power's Revenue Growth Trending?

Hokuriku Electric Power's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.2%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 31% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 1.1% each year as estimated by the four analysts watching the company. With the industry predicted to deliver 0.3% growth per annum, that's a disappointing outcome.

With this information, we find it concerning that Hokuriku Electric Power is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

While Hokuriku Electric Power's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

You should always think about risks. Case in point, we've spotted 3 warning signs for Hokuriku Electric Power you should be aware of, and 1 of them is concerning.

If these risks are making you reconsider your opinion on Hokuriku Electric Power, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hokuriku Electric Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9505

Hokuriku Electric Power

Supplies electricity through integrated power generation, transmission, and distribution systems in Japan.

Good value with proven track record.

Market Insights

Community Narratives