- Japan

- /

- Electric Utilities

- /

- TSE:9503

The Kansai Electric Power Company, Incorporated (TSE:9503) Stock Rockets 25% But Many Are Still Ignoring The Company

The Kansai Electric Power Company, Incorporated (TSE:9503) shares have continued their recent momentum with a 25% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 78%.

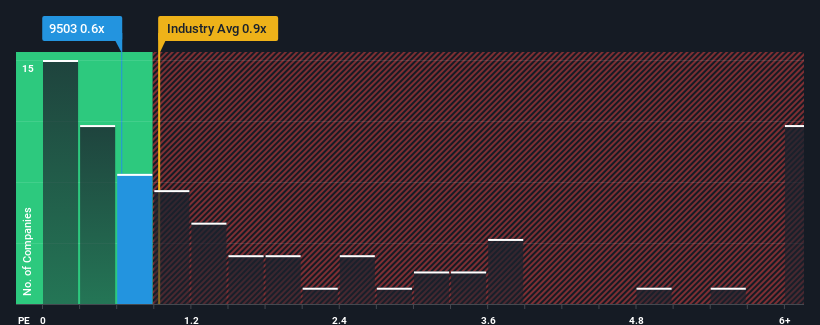

In spite of the firm bounce in price, it's still not a stretch to say that Kansai Electric Power Company's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Electric Utilities industry in Japan, where the median P/S ratio is around 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Kansai Electric Power Company

How Has Kansai Electric Power Company Performed Recently?

Kansai Electric Power Company certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Kansai Electric Power Company will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Kansai Electric Power Company's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 2.7% gain to the company's revenues. The latest three year period has also seen an excellent 31% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth will show minor resilience over the next three years growing only by 1.5% each year. Meanwhile, the broader industry is forecast to contract by 0.2% per year, which would indicate the company is doing better than the majority of its peers.

Even though the growth is only slight, it's peculiar that Kansai Electric Power Company's P/S sits in line with the majority of other companies given the industry is set for a decline. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Final Word

Its shares have lifted substantially and now Kansai Electric Power Company's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Kansai Electric Power Company currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware Kansai Electric Power Company is showing 3 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kansai Electric Power Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9503

Kansai Electric Power Company

Engages in electricity, gas and heat supply, and telecommunication businesses in Japan.

Good value with mediocre balance sheet.

Market Insights

Community Narratives