- Japan

- /

- Electric Utilities

- /

- TSE:9502

Market Participants Recognise Chubu Electric Power Company, Incorporated's (TSE:9502) Revenues

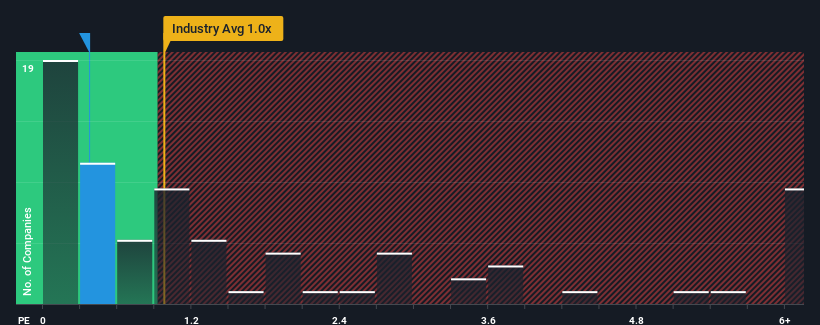

There wouldn't be many who think Chubu Electric Power Company, Incorporated's (TSE:9502) price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S for the Electric Utilities industry in Japan is similar at about 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Chubu Electric Power Company

What Does Chubu Electric Power Company's P/S Mean For Shareholders?

Chubu Electric Power Company's revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chubu Electric Power Company.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Chubu Electric Power Company's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.8% last year. The latest three year period has also seen an excellent 34% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 4.2% per year as estimated by the four analysts watching the company. Meanwhile, the industry is forecast to moderate by 2.8% per year, which suggests the company won't escape the wider industry forces.

In light of this, it's understandable that Chubu Electric Power Company's P/S sits in line with the majority of other companies. Nonetheless, with revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Bottom Line On Chubu Electric Power Company's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our findings align with our suspicions - a closer look at Chubu Electric Power Company's analyst forecasts shows that the company's similarly unstable outlook compared to the industry is keeping its price-to-sales ratio in line with the industry's average. Right now, shareholders are comfortable with the P/S as they have faith that future revenue will not uncover any unpleasant surprises. However, we're slightly cautious about the company's ability to resist further pain to its business from the broader industry turmoil. In the meantime, unless the company's prospects change they will continue to support the share price at these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Chubu Electric Power Company (2 are a bit concerning) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9502

Chubu Electric Power Company

Engages in the generation, transmission, distribution, and retail of electricity in Japan and internationally.

Undervalued average dividend payer.