- Japan

- /

- Electric Utilities

- /

- TSE:9501

Why We're Not Concerned About Tokyo Electric Power Company Holdings, Incorporated's (TSE:9501) Share Price

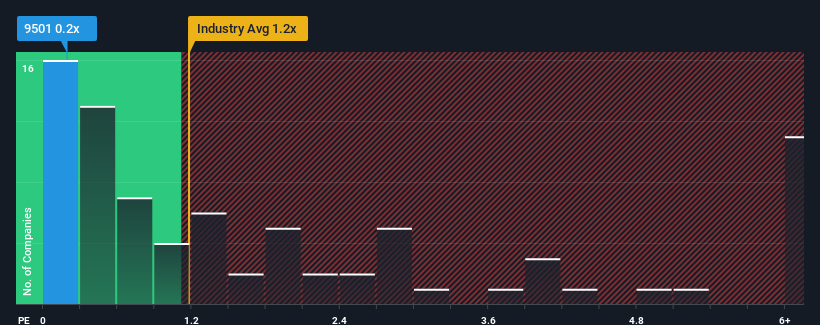

It's not a stretch to say that Tokyo Electric Power Company Holdings, Incorporated's (TSE:9501) price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" for companies in the Electric Utilities industry in Japan, where the median P/S ratio is around 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Tokyo Electric Power Company Holdings

What Does Tokyo Electric Power Company Holdings' P/S Mean For Shareholders?

Recent times haven't been great for Tokyo Electric Power Company Holdings as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on Tokyo Electric Power Company Holdings will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Tokyo Electric Power Company Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 18% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 1.0% each year over the next three years. That's shaping up to be similar to the 0.1% per annum growth forecast for the broader industry.

With this in mind, it makes sense that Tokyo Electric Power Company Holdings' P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Tokyo Electric Power Company Holdings' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Electric Utilities industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Tokyo Electric Power Company Holdings (1 makes us a bit uncomfortable!) that you need to be mindful of.

If you're unsure about the strength of Tokyo Electric Power Company Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Electric Power Company Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9501

Tokyo Electric Power Company Holdings

Engages in the generation, transmission, distribution, and retail of electric power in Japan and internationally.

Fair value low.

Market Insights

Community Narratives