ANA Holdings (TSE:9202) investors are sitting on a loss of 20% if they invested five years ago

For many, the main point of investing is to generate higher returns than the overall market. But the main game is to find enough winners to more than offset the losers At this point some shareholders may be questioning their investment in ANA Holdings Inc. (TSE:9202), since the last five years saw the share price fall 21%.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for ANA Holdings

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, ANA Holdings moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

We don't think that the 1.7% is big factor in the share price, since it's quite small, as dividends go. Revenue is actually up 2.8% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

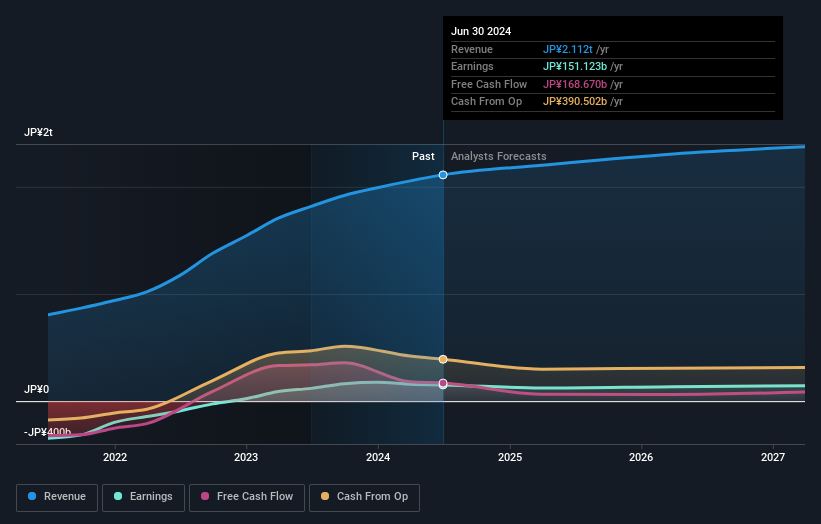

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

ANA Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling ANA Holdings stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

ANA Holdings shareholders gained a total return of 0.8% during the year. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 4% per year, over five years. It could well be that the business is stabilizing. Before forming an opinion on ANA Holdings you might want to consider these 3 valuation metrics.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9202

ANA Holdings

Provides air transportation services in Japan and internationally.

Excellent balance sheet and fair value.