- Japan

- /

- Hospitality

- /

- TSE:7085

Japanese Exchange Value Stocks Trading Below Estimated Worth October 2024

Reviewed by Simply Wall St

Amidst a backdrop of uncertainty surrounding Japan's general election, the country's stock markets have experienced a downturn, with the Nikkei 225 Index and TOPIX Index both seeing declines. This environment has investors on the lookout for opportunities in undervalued stocks that may be trading below their estimated worth. Identifying such stocks often involves assessing companies' fundamentals and market position to determine if they are priced lower than their intrinsic value, especially during periods of market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| CURVES HOLDINGS (TSE:7085) | ¥785.00 | ¥1527.54 | 48.6% |

| Avant Group (TSE:3836) | ¥2101.00 | ¥3952.12 | 46.8% |

| Pilot (TSE:7846) | ¥4710.00 | ¥8936.78 | 47.3% |

| Forum Engineering (TSE:7088) | ¥860.00 | ¥1607.03 | 46.5% |

| S-Pool (TSE:2471) | ¥347.00 | ¥684.04 | 49.3% |

| KeePer Technical Laboratory (TSE:6036) | ¥4045.00 | ¥7848.79 | 48.5% |

| BayCurrent Consulting (TSE:6532) | ¥4960.00 | ¥9318.25 | 46.8% |

| Kokusai Electric (TSE:6525) | ¥2742.00 | ¥5097.94 | 46.2% |

| BuySell TechnologiesLtd (TSE:7685) | ¥4105.00 | ¥7942.04 | 48.3% |

| Mercari (TSE:4385) | ¥2096.50 | ¥4169.48 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

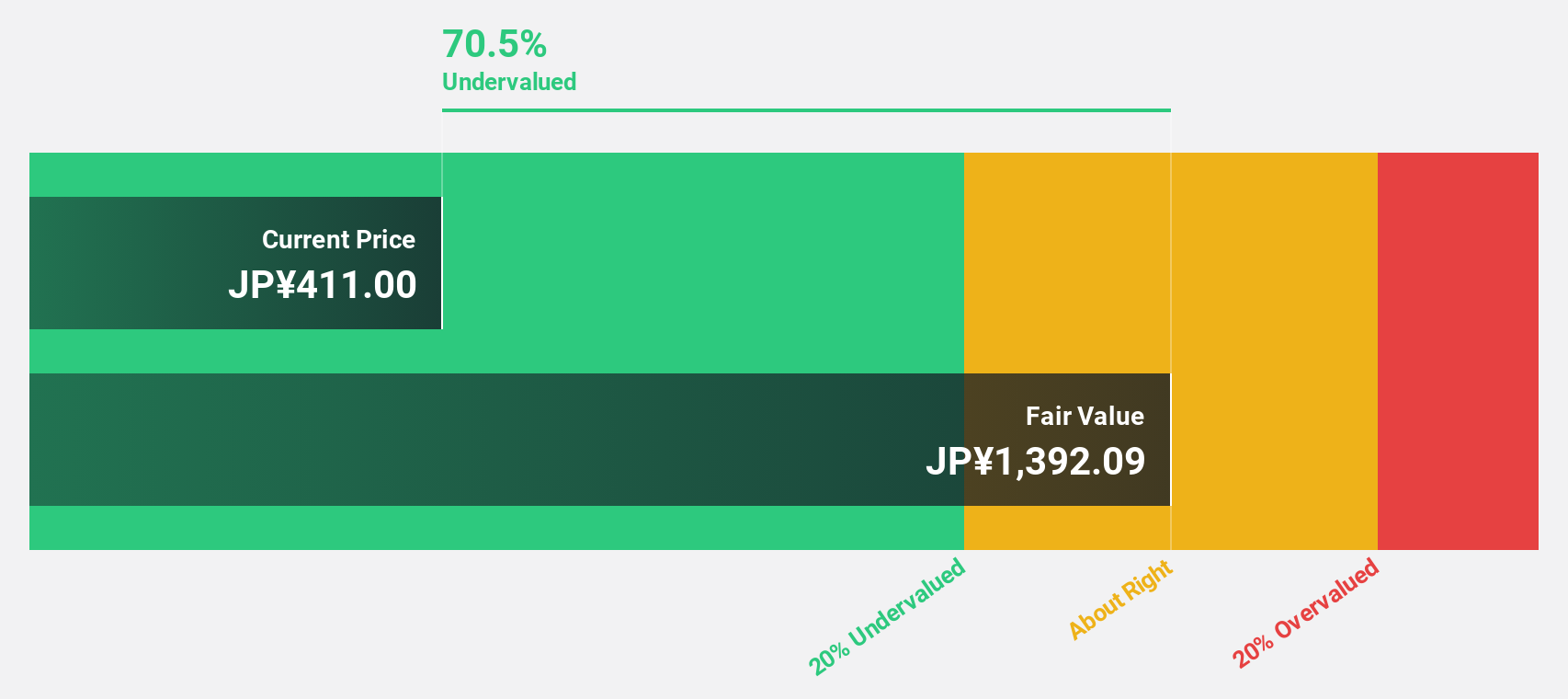

Infomart (TSE:2492)

Overview: Infomart Corporation operates an online BtoB e-commerce trading platform for the food industry in Japan, with a market cap of ¥80.11 billion.

Operations: The company generates revenue through its B2B-PFES segment, amounting to ¥5.52 billion, and its B to B-PF FOOD segment, which contributes ¥8.79 billion.

Estimated Discount To Fair Value: 42.9%

Infomart is trading at ¥354, significantly undervalued compared to its estimated fair value of ¥619.65, offering potential for investors focused on cash flow valuation. Despite a volatile share price recently, its earnings grew by 36.7% last year and are forecasted to increase by 39.11% annually over the next three years, outpacing the Japanese market average of 8.7%. Revenue growth is also expected to surpass market trends at 11.2% per year.

- Our expertly prepared growth report on Infomart implies its future financial outlook may be stronger than recent results.

- Take a closer look at Infomart's balance sheet health here in our report.

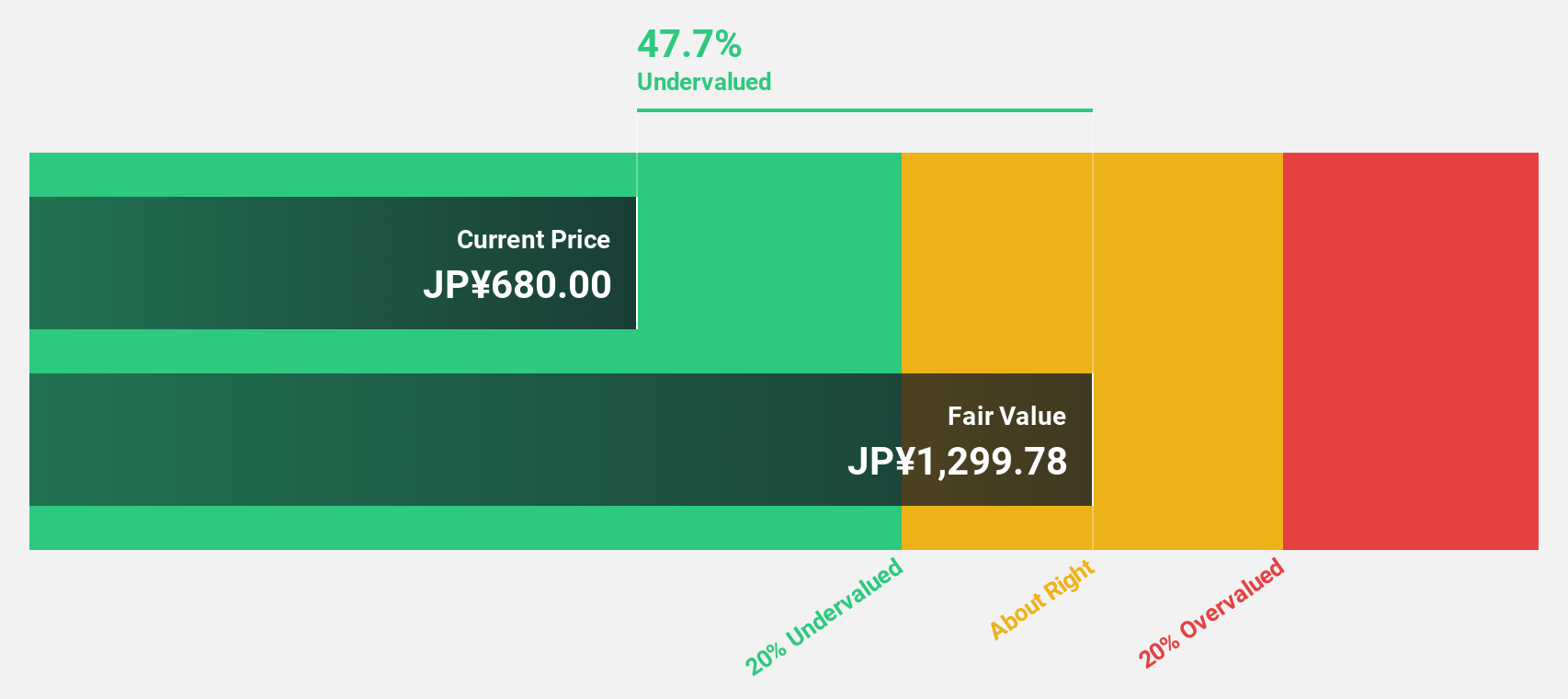

CURVES HOLDINGS (TSE:7085)

Overview: CURVES HOLDINGS Co., Ltd. operates and manages women's fitness clubs under the Curves brand in Japan, with a market cap of ¥72.27 billion.

Operations: The company generates revenue of ¥35.47 billion from its women's fitness club operations in Japan under the Curves brand.

Estimated Discount To Fair Value: 48.6%

CURVES HOLDINGS is trading at ¥785, significantly undervalued compared to its estimated fair value of ¥1,527.54. The company's earnings grew by 39.8% last year and are expected to increase by 10.9% annually, outpacing the Japanese market average of 8.7%. Revenue growth is forecasted at 7.9% per year, exceeding the market's 4.2%. Despite an unstable dividend track record, CURVES HOLDINGS presents a strong cash flow valuation opportunity.

- Our comprehensive growth report raises the possibility that CURVES HOLDINGS is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of CURVES HOLDINGS stock in this financial health report.

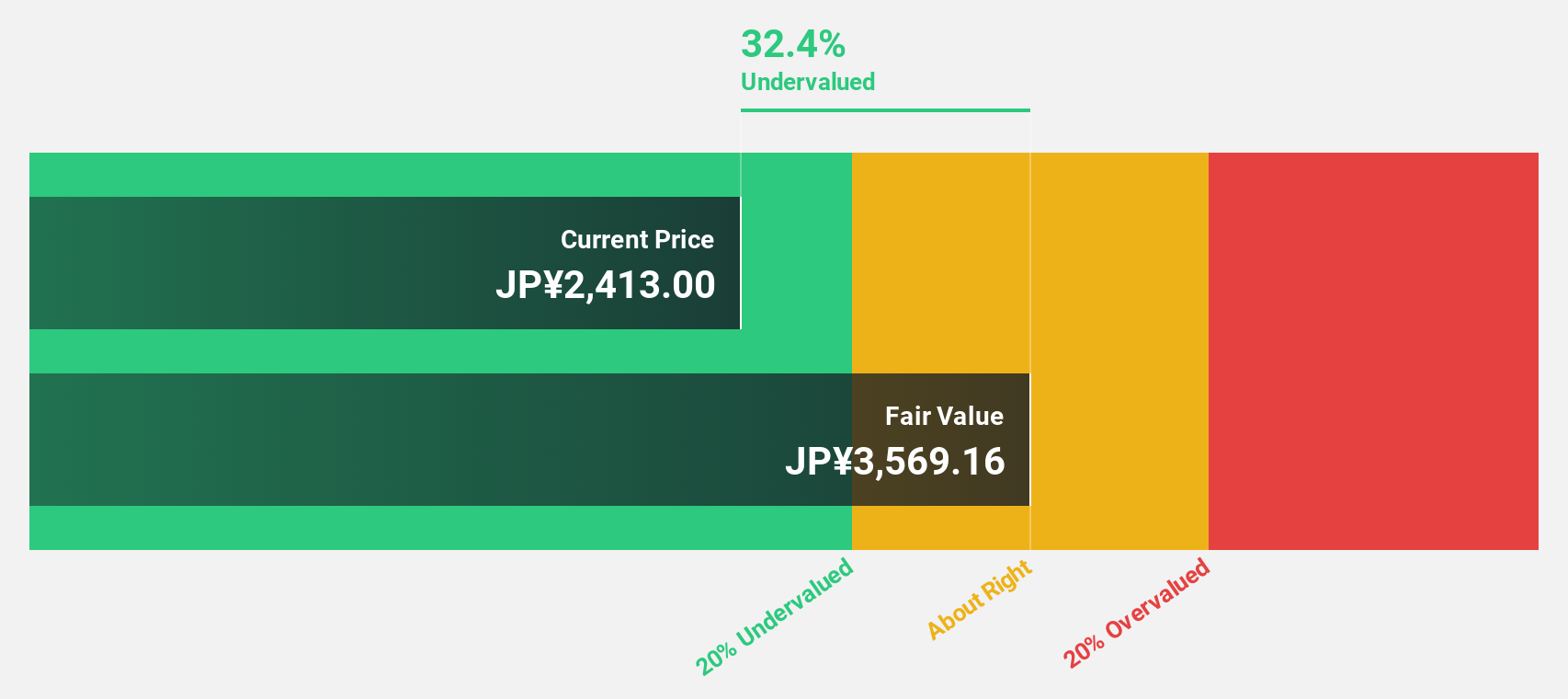

KATITAS (TSE:8919)

Overview: KATITAS CO., Ltd. specializes in surveying, purchasing, refurbishing, remodeling, and selling used homes to individuals and families in Japan with a market cap of ¥150.12 billion.

Operations: The company's revenue is primarily generated from its House for Resale Reproduction Business, which amounts to ¥126.30 billion.

Estimated Discount To Fair Value: 39%

KATITAS is trading at ¥1,921, well below its estimated fair value of ¥3,148. The company has shown strong earnings growth of 43.2% over the past year and is expected to continue growing at 9.9% annually, surpassing the Japanese market average of 8.7%. Despite being dropped from the FTSE All-World Index recently and having an unstable dividend history, it remains significantly undervalued based on cash flow analysis.

- Our growth report here indicates KATITAS may be poised for an improving outlook.

- Dive into the specifics of KATITAS here with our thorough financial health report.

Taking Advantage

- Explore the 87 names from our Undervalued Japanese Stocks Based On Cash Flows screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7085

CURVES HOLDINGS

Engages in the operation and management of fitness club for women under the Curves brand name in Japan.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives