- Japan

- /

- Auto Components

- /

- TSE:5334

Top Dividend Stocks On The Tokyo Exchange To Boost Your Portfolio

Reviewed by Simply Wall St

Amid recent fluctuations in Japan's stock markets, with the Nikkei 225 and TOPIX indices both experiencing declines due to election uncertainties, investors are increasingly looking towards stable income sources such as dividend stocks. In this environment, selecting stocks that offer consistent dividends can provide a reliable income stream and potentially enhance portfolio stability during periods of market volatility.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.36% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| Globeride (TSE:7990) | 4.35% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 4.14% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.56% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.89% | ★★★★★★ |

| Innotech (TSE:9880) | 4.85% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.70% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

Click here to see the full list of 461 stocks from our Top Japanese Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Kirin Holdings Company (TSE:2503)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kirin Holdings Company, Limited operates in the food and beverages, pharmaceuticals, and health science sectors with a market cap of ¥1.84 trillion.

Operations: Kirin Holdings Company, Limited generates revenue from its core segments: Medicine at ¥476 billion.

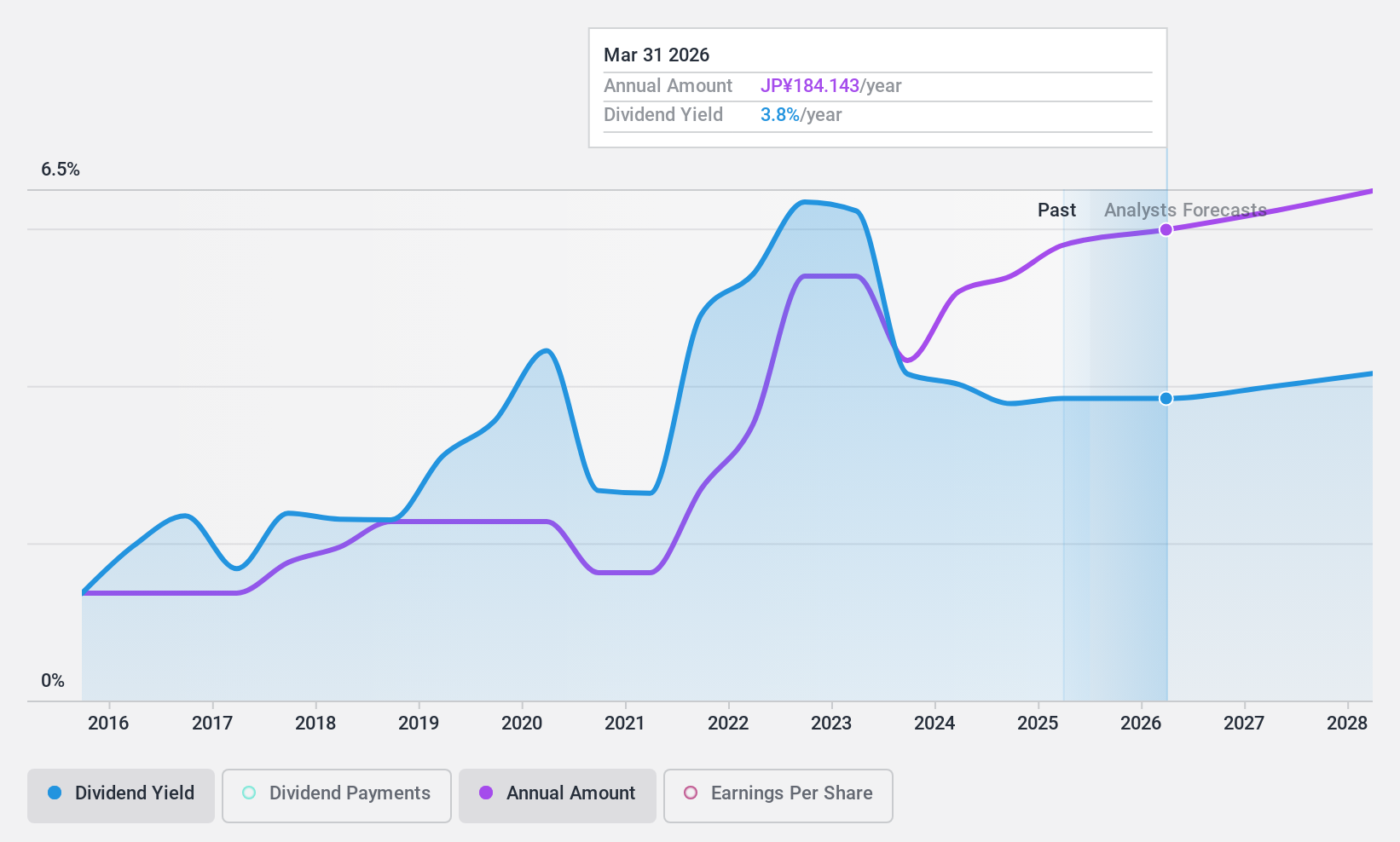

Dividend Yield: 3.2%

Kirin Holdings Company offers a stable and growing dividend profile, with dividends well covered by earnings and cash flows, as indicated by its payout ratios of 42.3% and 44.9%, respectively. Over the past decade, dividends have been reliable and increased steadily. Although its current yield of 3.17% is lower than Japan's top quartile payers, Kirin trades at a significant discount to fair value, enhancing its attractiveness for value-oriented investors seeking dependable income streams.

- Take a closer look at Kirin Holdings Company's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Kirin Holdings Company is trading behind its estimated value.

Niterra (TSE:5334)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Niterra Co., Ltd. manufactures and sells spark plugs and related products for internal-combustion engines, as well as technical ceramics, operating both in Japan and internationally, with a market cap of ¥841.27 billion.

Operations: Niterra Co., Ltd.'s revenue segments include Automobile Connection, generating ¥522.93 billion, and Ceramic (including Medical-Related), contributing ¥97.19 billion.

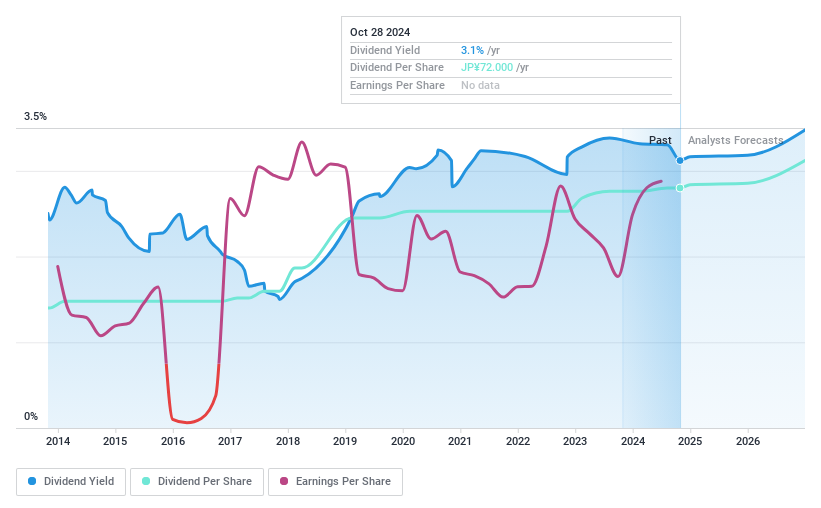

Dividend Yield: 3.9%

Niterra's dividend payments have increased over the past decade, supported by a low payout ratio of 38.1%, indicating strong coverage by earnings and cash flows. However, its dividend history is marked by volatility and unreliability, with significant annual drops in some years. The recent completion of a share buyback program for ¥19.99 billion may impact future payouts positively or negatively depending on management's strategic focus moving forward.

- Dive into the specifics of Niterra here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Niterra is priced lower than what may be justified by its financials.

Advan Group (TSE:7463)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Advan Group Co., Ltd. imports and sells building materials in Japan and has a market cap of ¥31.65 billion.

Operations: Advan Group Co., Ltd.'s revenue primarily comes from its operations in importing and selling building materials within Japan.

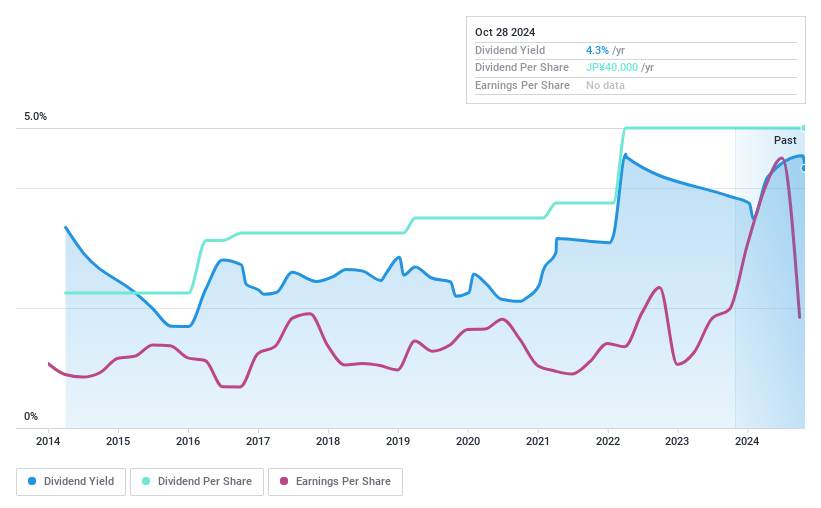

Dividend Yield: 4.5%

Advan Group's dividend payments have been stable and growing over the past decade, with a low payout ratio of 46.5%, suggesting strong coverage by earnings. However, the dividends are not well-supported by free cash flows, raising sustainability concerns despite a competitive yield of 4.49%. The company's price-to-earnings ratio of 6.8x indicates it may be undervalued compared to the broader Japanese market average of 13x, potentially offering value for investors seeking income opportunities in Japan.

- Click to explore a detailed breakdown of our findings in Advan Group's dividend report.

- In light of our recent valuation report, it seems possible that Advan Group is trading beyond its estimated value.

Taking Advantage

- Take a closer look at our Top Japanese Dividend Stocks list of 461 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Niterra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5334

Niterra

Manufactures and sells spark plugs and related products for internal-combustion engines and technical ceramics in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.