- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6804

Undiscovered Gems in Japan to Explore This October 2024

Reviewed by Simply Wall St

Amidst the backdrop of Japan's stock markets losing ground, with the Nikkei 225 Index and TOPIX Index both experiencing declines due to election uncertainties, investors are increasingly looking toward small-cap opportunities that may offer unique growth potential. In this environment, identifying stocks with strong fundamentals and innovative business models can be key to uncovering undiscovered gems in Japan's market.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Toho | 69.52% | 2.84% | 55.65% | ★★★★★★ |

| QuickLtd | 0.73% | 9.61% | 14.56% | ★★★★★★ |

| Intelligent Wave | NA | 6.92% | 15.18% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| Ohashi Technica | NA | 1.57% | -20.55% | ★★★★★★ |

| Icom | NA | 4.68% | 14.92% | ★★★★★★ |

| NPR-Riken | 15.31% | 10.00% | 44.55% | ★★★★★☆ |

| Pharma Foods International | 145.80% | 30.07% | 22.61% | ★★★★★☆ |

| MIRARTH HOLDINGSInc | 266.33% | 3.00% | -2.40% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Kaken Pharmaceutical (TSE:4521)

Simply Wall St Value Rating: ★★★★★★

Overview: Kaken Pharmaceutical Co., Ltd. is engaged in the production, marketing, and sale of medical products, medical devices, and agrochemicals both domestically in Japan and internationally, with a market cap of ¥147.69 billion.

Operations: Kaken Pharmaceutical generates revenue primarily through the sale of medical products, medical devices, and agrochemicals. The company's cost structure includes production and marketing expenses related to these segments. Notably, its net profit margin has shown variability over recent periods.

Kaken Pharmaceutical, a smaller player in Japan's pharmaceutical sector, reported first-quarter sales of ¥18.25 billion and net income of ¥1.75 billion, with earnings per share at ¥46.32. Despite its size, the company has demonstrated robust earnings growth of 44.1% over the past year, outpacing the broader industry growth rate of 16.2%. It also boasts high-quality past earnings and a reduced debt-to-equity ratio from 3.2 to 2.7 over five years, indicating strong financial management. However, future forecasts suggest an average annual earnings decline of 44.6% over the next three years, which may pose challenges ahead.

- Unlock comprehensive insights into our analysis of Kaken Pharmaceutical stock in this health report.

Evaluate Kaken Pharmaceutical's historical performance by accessing our past performance report.

Hosiden (TSE:6804)

Simply Wall St Value Rating: ★★★★★★

Overview: Hosiden Corporation is engaged in the development, manufacturing, and sale of electronic components both domestically and internationally, with a market capitalization of ¥114.39 billion.

Operations: Hosiden generates its revenue primarily from mechanical parts, which account for ¥185.27 billion, followed by audio parts at ¥21.10 billion. The company also has smaller revenue streams from display parts and composite parts, contributing ¥2.42 billion and ¥11.72 billion respectively.

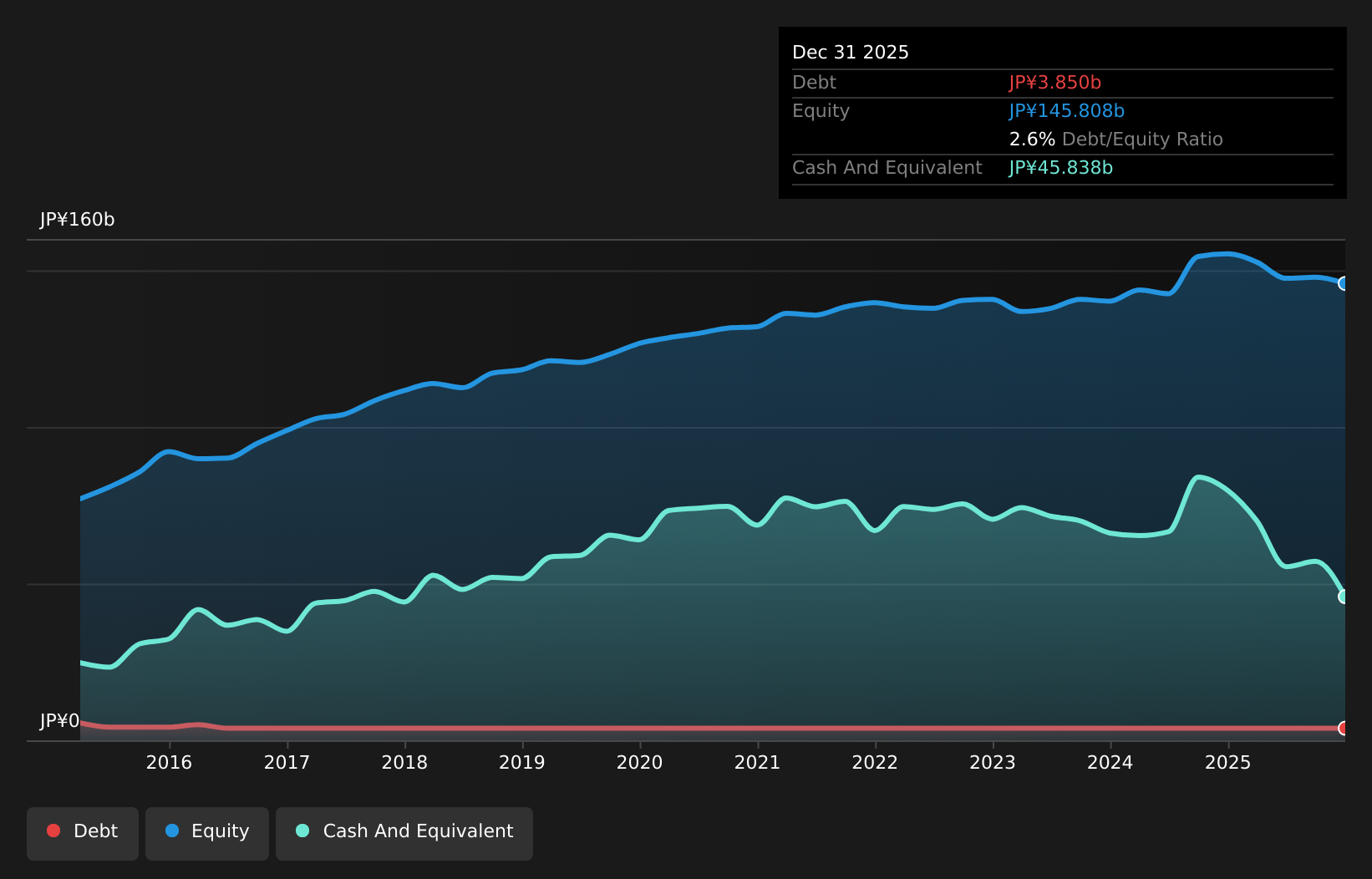

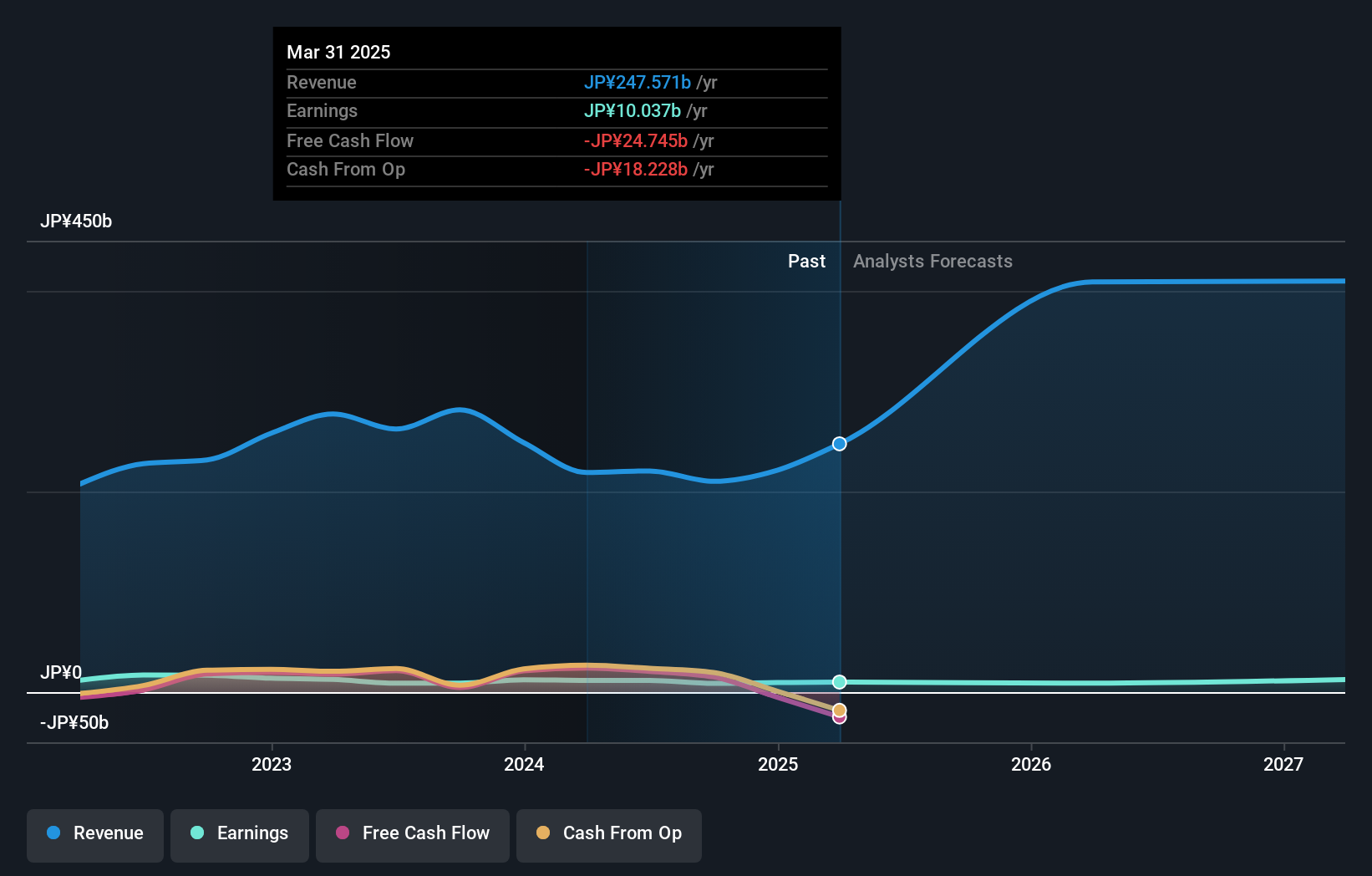

Hosiden, a notable player in the electronics sector, stands out with earnings growth of 31.2% over the past year, surpassing the industry average of 7.3%. Trading at an impressive 71.6% below its estimated fair value suggests potential for investors seeking undervalued opportunities. The company's financial health is robust; it has more cash than total debt and generates positive free cash flow, indicating solid operational efficiency. However, shareholder dilution in the past year could be a concern for some investors. With earnings forecasted to grow by 8.48% annually, Hosiden presents an intriguing mix of growth and value prospects in Japan's market landscape.

- Take a closer look at Hosiden's potential here in our health report.

Gain insights into Hosiden's past trends and performance with our Past report.

Shin-Etsu PolymerLtd (TSE:7970)

Simply Wall St Value Rating: ★★★★★★

Overview: Shin-Etsu Polymer Co., Ltd. manufactures and sells polyvinyl chloride (PVC) products globally, with a market capitalization of ¥121.19 billion.

Operations: Shin-Etsu Polymer generates revenue primarily from the sale of polyvinyl chloride (PVC) products. The company's financial performance is influenced by its ability to manage production costs and optimize its net profit margin, which reflects its overall profitability.

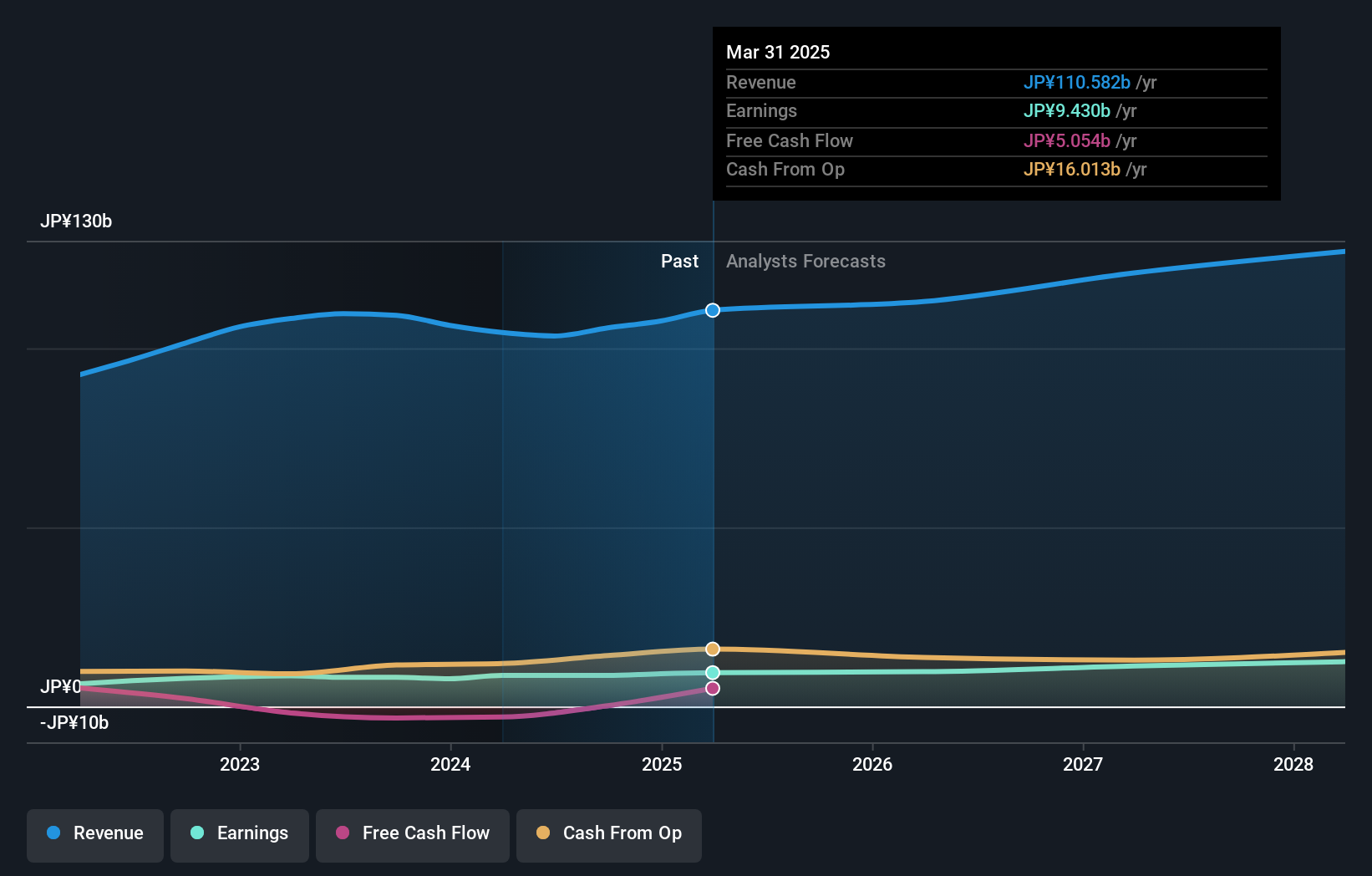

Shin-Etsu Polymer, a nimble player in the Japanese market, has shown consistent earnings growth of 10.5% annually over the last five years. Despite not outpacing the broader Chemicals industry recently, its high-quality earnings and debt-free status stand out. The company is trading at 64.7% below estimated fair value, suggesting potential undervaluation. A recent buyback program aims to repurchase up to 500,000 shares for ¥900 million by year-end, enhancing shareholder value and supporting stock option plans. With forecasts predicting a 13.92% annual growth rate in earnings, Shin-Etsu seems poised for continued progress amidst competitive dynamics.

Next Steps

- Embark on your investment journey to our 718 Japanese Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hosiden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6804

Hosiden

Develops, manufactures, and sells electronic components in Japan and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives