- Japan

- /

- Marine and Shipping

- /

- TSE:9171

Not Many Are Piling Into Kuribayashi Steamship Co., Ltd. (TSE:9171) Stock Yet As It Plummets 26%

The Kuribayashi Steamship Co., Ltd. (TSE:9171) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 30%, which is great even in a bull market.

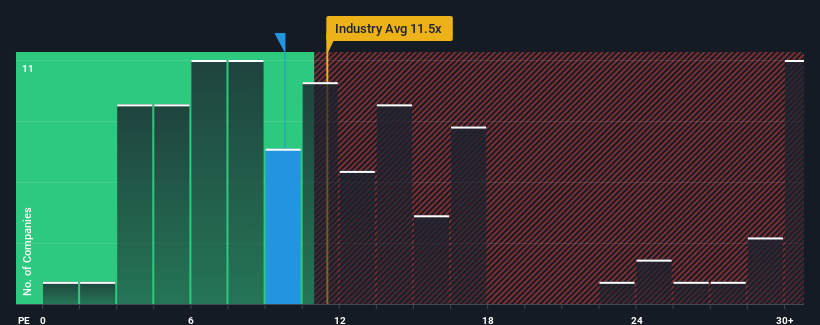

In spite of the heavy fall in price, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 15x, you may still consider Kuribayashi Steamship as an attractive investment with its 9.8x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For instance, Kuribayashi Steamship's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Kuribayashi Steamship

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Kuribayashi Steamship would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 17%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 146% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 11% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Kuribayashi Steamship is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Kuribayashi Steamship's P/E?

Kuribayashi Steamship's recently weak share price has pulled its P/E below most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Kuribayashi Steamship currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Kuribayashi Steamship (1 is concerning) you should be aware of.

You might be able to find a better investment than Kuribayashi Steamship. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kuribayashi Steamship might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9171

Kuribayashi Steamship

Engages in the marine transportation business in Japan and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives