- South Korea

- /

- Chemicals

- /

- KOSE:A015890

3 Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

As global markets navigate mixed signals, with U.S. stocks closing a strong year despite recent volatility and economic indicators showing both strengths and weaknesses, investors are increasingly looking to stabilize their portfolios. In this environment, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for those seeking balance amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.95% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.35% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.89% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.07% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

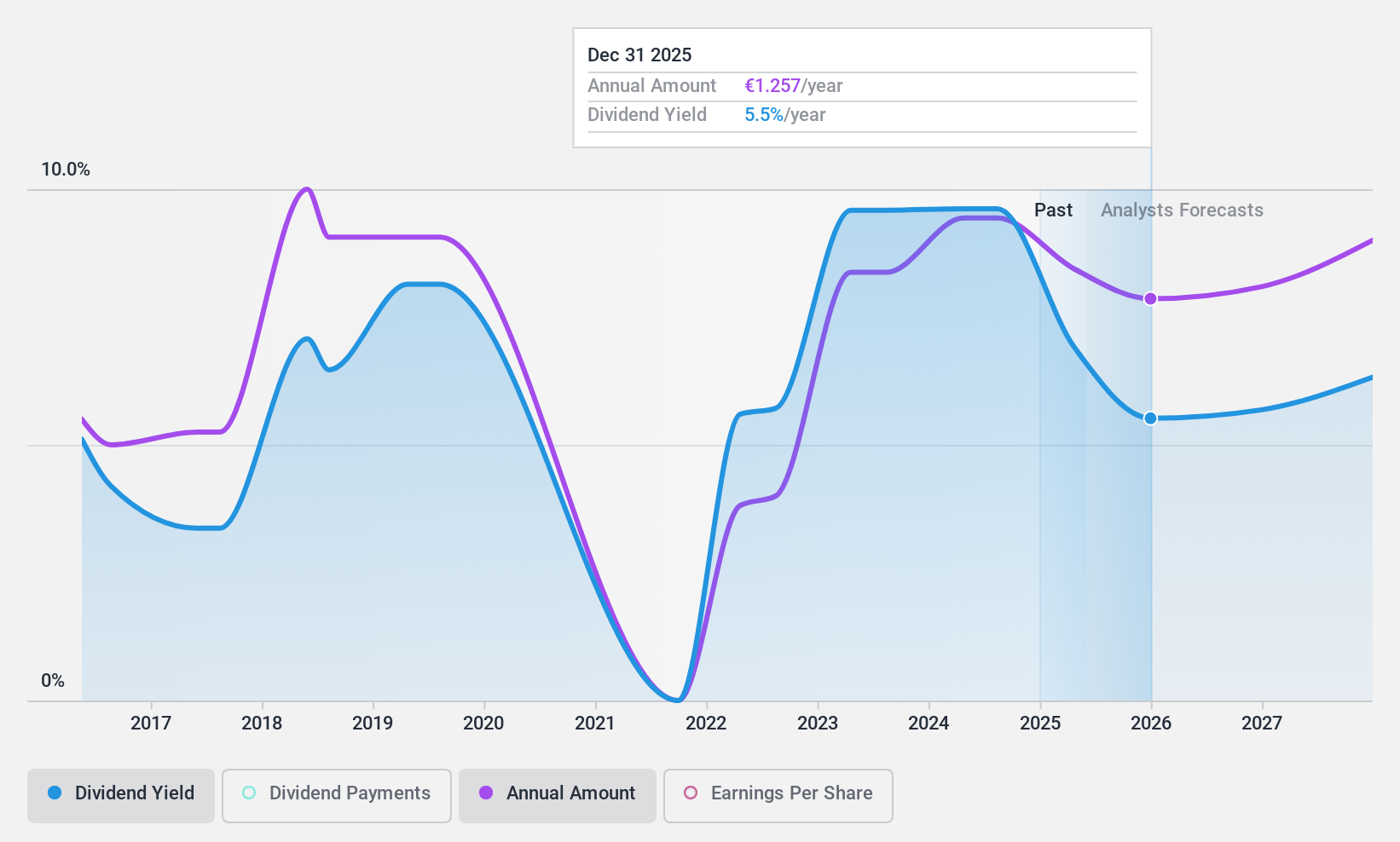

ABN AMRO Bank (ENXTAM:ABN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and internationally, with a market cap of approximately €12.49 billion.

Operations: ABN AMRO Bank's revenue segments include Corporate Banking (€3.40 billion), Wealth Management (€1.55 billion), and Personal & Business Banking (€4.08 billion).

Dividend Yield: 10%

ABN AMRO Bank's dividend is covered by earnings, with a current payout ratio of 72.8% and a forecasted 50.4% in three years, suggesting sustainability despite its volatile nine-year history. The dividend yield is among the top 25% in the Dutch market at 9.99%, but earnings are expected to decline by an average of 8.9% annually over the next three years, potentially impacting future payouts. Recent Q3 results showed decreased net income year-over-year to €690 million from €759 million.

- Click here and access our complete dividend analysis report to understand the dynamics of ABN AMRO Bank.

- Our valuation report here indicates ABN AMRO Bank may be undervalued.

Taekyung Industry.Co (KOSE:A015890)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taekyung Industry.Co., Ltd. is a company that manufactures and sells ferroalloy and calcium carbonate materials both in South Korea and internationally, with a market cap of ₩147.02 billion.

Operations: Taekyung Industry.Co., Ltd.'s revenue is primarily derived from Lime Manufacturing (₩247.29 billion), Non-Ferrous Metals Division including Ferro Alloy (₩137.36 billion), Rest Area and Gas Station (₩106.19 billion), Carbon Dioxide (₩98.43 billion), Fuel (₩80.01 million), and the Light Bulb Business (₩27.46 million).

Dividend Yield: 5.4%

Taekyung Industry's dividend is well-supported by earnings, with a payout ratio of 29.1% and a cash payout ratio of 27.7%. Despite trading significantly below its estimated fair value, the company has only paid dividends for five years, with payments declining over time. Recent Q3 results showed strong growth in net income to KRW 6,613.3 million from KRW 2,989.02 million year-over-year, highlighting potential for future stability despite past volatility in dividend reliability.

- Unlock comprehensive insights into our analysis of Taekyung Industry.Co stock in this dividend report.

- According our valuation report, there's an indication that Taekyung Industry.Co's share price might be on the cheaper side.

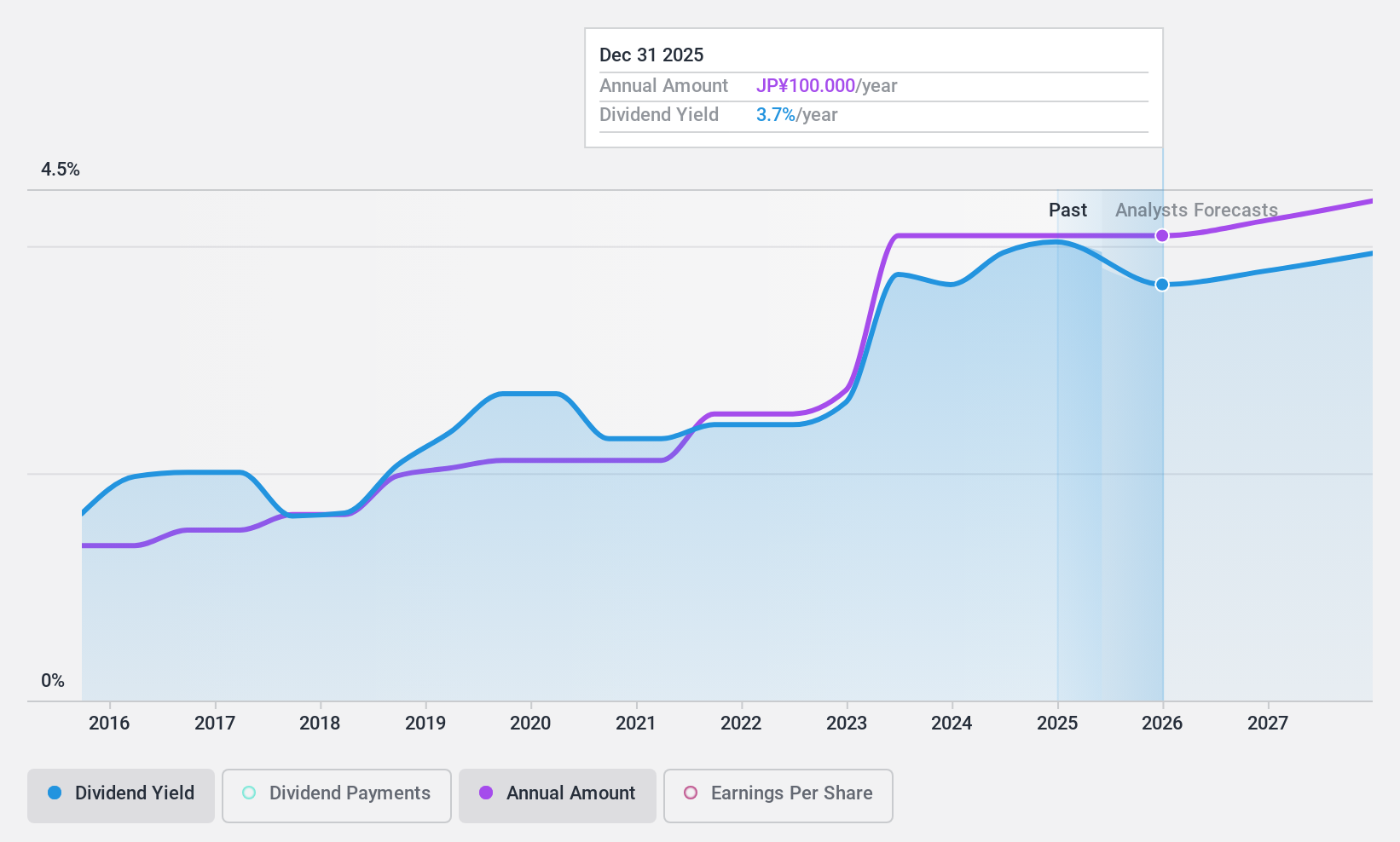

Nippon Express Holdings (TSE:9147)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Express Holdings, Inc., along with its subsidiaries, offers logistics services across Japan, the Americas, Europe, East Asia, South Asia, and Oceania and has a market cap of ¥630.92 billion.

Operations: Nippon Express Holdings generates revenue from several segments, including Logistics - Japan (¥1.24 billion), Logistics Support (¥419.01 million), Logistics - Europe (¥421.35 million), Logistics - Americas (¥155.56 million), Logistics - East Asia (¥169.29 million), Security Transportation (¥68.59 million), Heavy Goods Construction (¥47.70 million), and Logistics - South Asia / Oceania (¥150.33 million).

Dividend Yield: 4.1%

Nippon Express Holdings' dividend yield of 4.12% ranks in the top 25% of Japanese market payers but is not well-supported by earnings, with a high payout ratio of 105%. Despite a low cash payout ratio of 21.3%, indicating coverage by cash flows, dividends have been volatile over the past decade. Recent earnings results show sales at ¥1.9 trillion for nine months ending September 2024, yet large one-off items affect financial stability and reliability.

- Dive into the specifics of Nippon Express Holdings here with our thorough dividend report.

- Our expertly prepared valuation report Nippon Express Holdings implies its share price may be too high.

Turning Ideas Into Actions

- Delve into our full catalog of 1981 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taekyung Industry.Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A015890

Taekyung Industry.Co

Manufactures and sells ferroalloy and calcium carbonate materials in South Korea and internationally.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives