- Japan

- /

- Infrastructure

- /

- TSE:9066

3 Top Dividend Stocks Yielding Up To 4.5%

Reviewed by Simply Wall St

In the wake of a significant "red sweep" in the U.S. elections, global markets have experienced notable shifts, with major benchmarks like the S&P 500 reaching record highs and investors anticipating policy changes that could impact growth and inflation. Amidst this backdrop of economic optimism tempered by uncertainty, dividend stocks present an attractive option for investors seeking steady income streams. In such a dynamic market environment, selecting dividend stocks requires careful consideration of factors like yield stability and company fundamentals to ensure long-term value.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.77% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.98% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.46% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.88% | ★★★★★★ |

Click here to see the full list of 1934 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

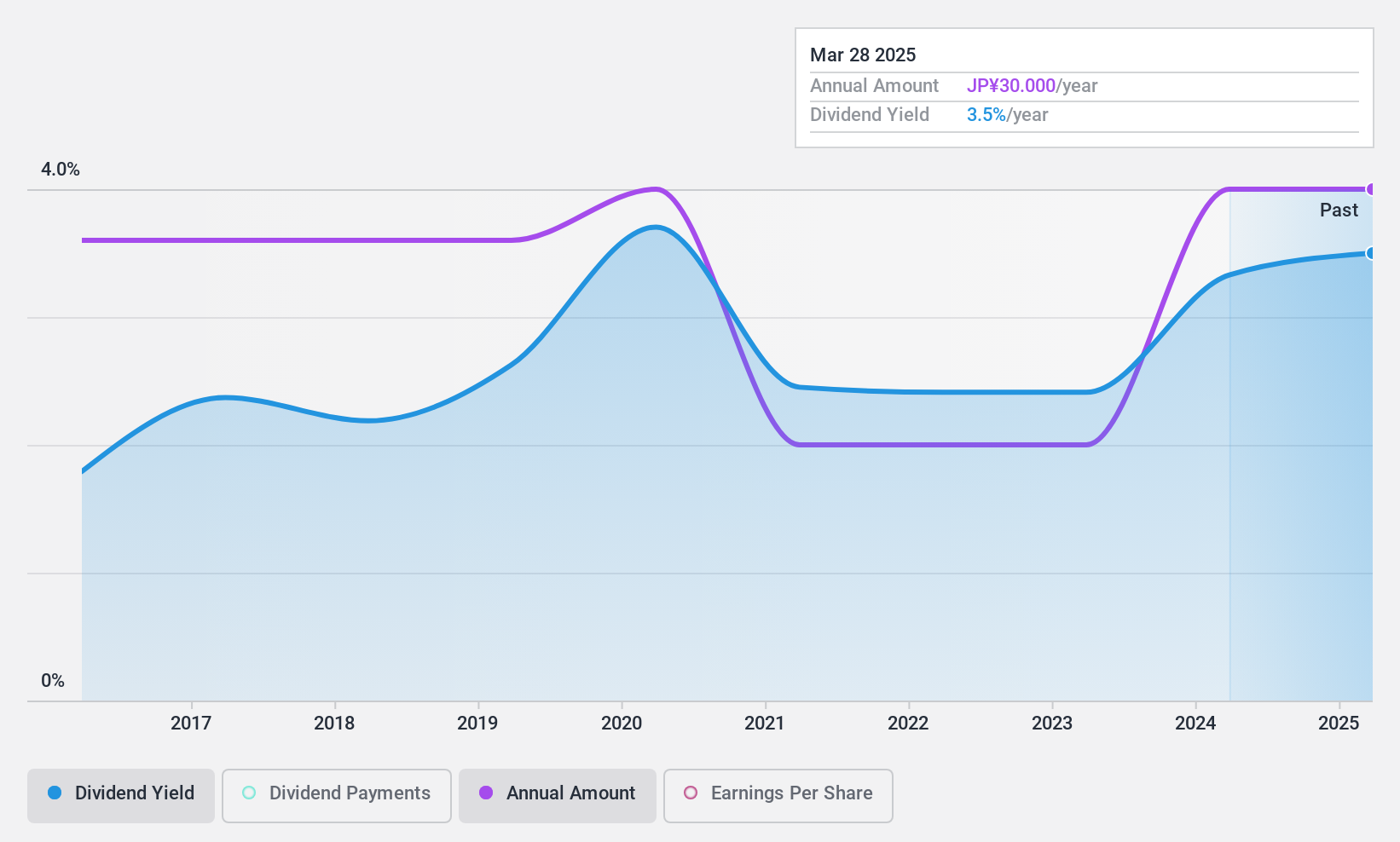

Rengo (TSE:3941)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Rengo Co., Ltd. and its subsidiaries manufacture and sell paperboard and packaging-related products both in Japan and internationally, with a market cap of approximately ¥223.28 billion.

Operations: Rengo Co., Ltd.'s revenue segments include ¥207.45 billion from Overseas Related Business, ¥48.30 billion from Heavy Duty Packaging Business, ¥150.86 billion from Flexible Packaging-Related Business, and ¥515.01 billion from Paperboard and Paper Processing-Related Business.

Dividend Yield: 3.3%

Rengo's dividend yield of 3.32% is below the top 25% in Japan, yet it remains reliable and stable over the past decade with growing payments. The company's low payout ratios (earnings: 22.2%, cash: 30.2%) suggest dividends are well-covered by earnings and cash flows, despite a high debt level. Trading at a favorable price-to-earnings ratio of 6.7x, Rengo offers good value relative to peers while analysts expect significant stock price appreciation.

- Take a closer look at Rengo's potential here in our dividend report.

- Upon reviewing our latest valuation report, Rengo's share price might be too pessimistic.

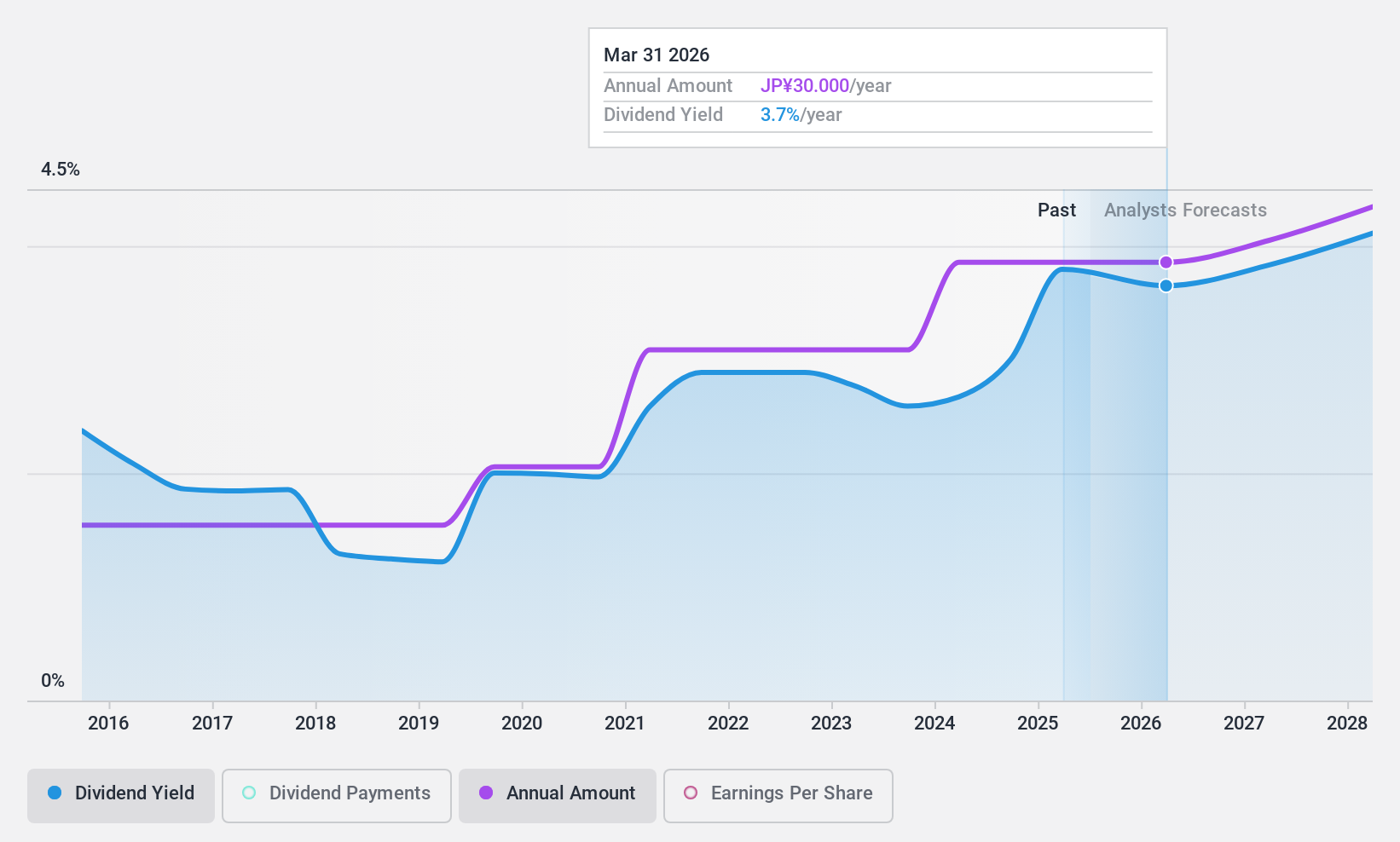

Nissin (TSE:9066)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Nissin Corporation offers logistics services across Japan, Europe, the Americas, China, Russia, and other parts of Asia with a market capitalization of approximately ¥61.77 billion.

Operations: Nissin Corporation's revenue is primarily derived from its Logistics Business, which generates ¥167.01 billion, supplemented by its Travel Business at ¥7.72 billion and Real Estate Business contributing ¥1.66 billion.

Dividend Yield: 4.5%

Nissin offers an attractive dividend yield of 4.51%, ranking in the top 25% of Japanese dividend payers, with stable and growing payments over the past decade. The dividends are well-covered by earnings, with a low payout ratio of 15.5%, and cash flows, maintaining a cash payout ratio of 55.8%. Despite recent one-off items affecting results, Nissin trades at a significant discount to its estimated fair value, enhancing its appeal for income-focused investors.

- Click to explore a detailed breakdown of our findings in Nissin's dividend report.

- According our valuation report, there's an indication that Nissin's share price might be on the cheaper side.

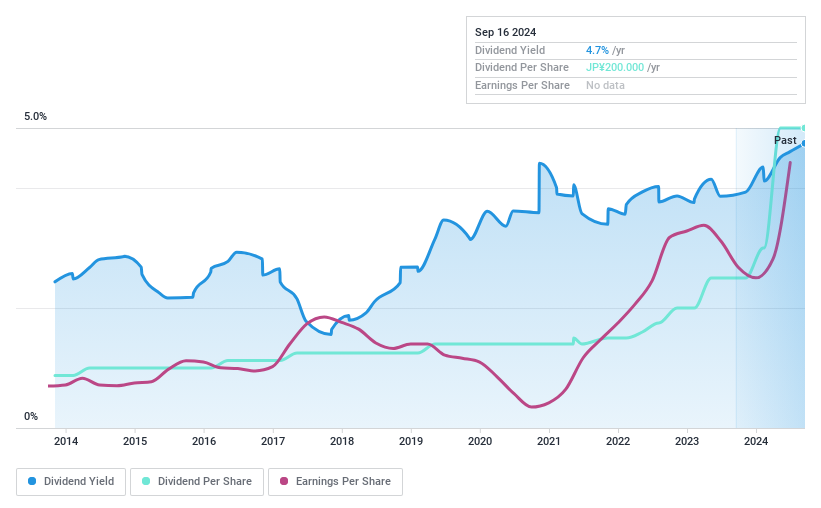

Sac's Bar Holdings (TSE:9990)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sac's Bar Holdings Inc. operates in Japan, focusing on the retail sale of bags, fashion goods, and related accessories, with a market cap of ¥27.46 billion.

Operations: Sac's Bar Holdings Inc. generates revenue primarily through product sales centered on bags and pouches, amounting to ¥52.42 billion.

Dividend Yield: 3.1%

Sac's Bar Holdings' dividend yield of 3.11% is lower than the top quartile of Japanese dividend payers. Although dividends are covered by earnings and cash flows, with payout ratios of 33.9% and 20.6% respectively, their reliability has been inconsistent over the past decade due to volatility and lack of growth. The stock trades at a significant discount to its estimated fair value, which may interest value-focused investors despite its unstable dividend history.

- Unlock comprehensive insights into our analysis of Sac's Bar Holdings stock in this dividend report.

- Our valuation report unveils the possibility Sac's Bar Holdings' shares may be trading at a discount.

Where To Now?

- Dive into all 1934 of the Top Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9066

Nissin

Provides logistics services in Japan, Europe, the Americas, China, Russia, rest of Asia, and internationally.

Flawless balance sheet established dividend payer.