As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are closely watching how fiscal policies might influence growth and inflation. Amidst these dynamic conditions, dividend stocks stand out as a reliable option for those seeking steady income streams, especially when market volatility is a concern.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.51% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.79% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.69% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.88% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

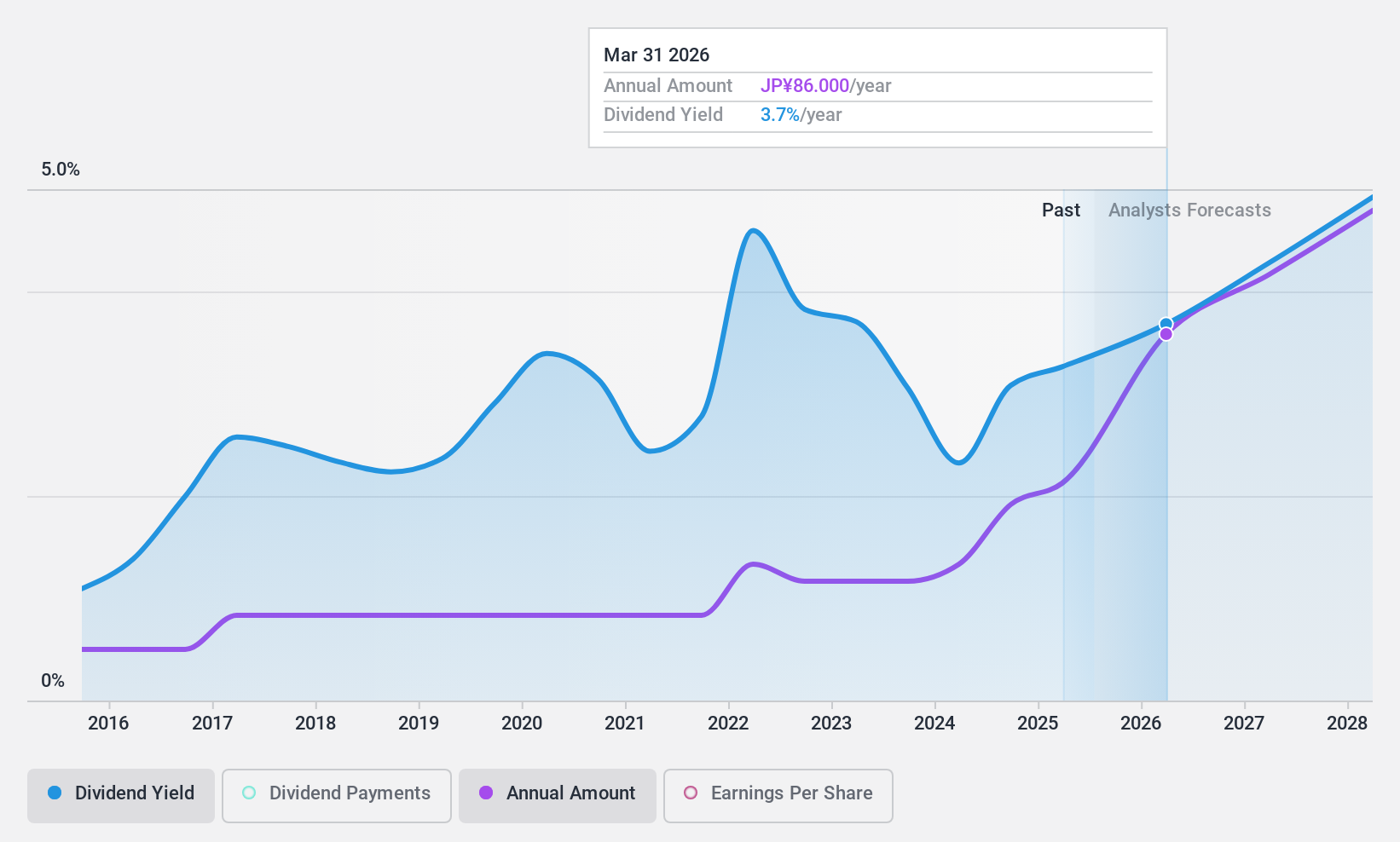

Yurtec (TSE:1934)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yurtec Corporation is a facility engineering company that operates in Japan and internationally, with a market cap of ¥105.90 billion.

Operations: Yurtec Corporation generates revenue primarily from its Facilities Engineering segment, amounting to ¥245.53 billion.

Dividend Yield: 3.4%

Yurtec's dividend payments are well-covered by earnings with a payout ratio of 42%, though cash flow coverage is tighter at 88%. Despite an unstable dividend history, recent increases saw dividends rise to ¥23 per share from ¥14. Earnings have grown 11% annually over five years, yet the yield remains below top-tier levels in Japan. A recent buyback completed for ¥4.51 billion aims to enhance shareholder returns, reflecting strategic capital management efforts.

- Dive into the specifics of Yurtec here with our thorough dividend report.

- Upon reviewing our latest valuation report, Yurtec's share price might be too optimistic.

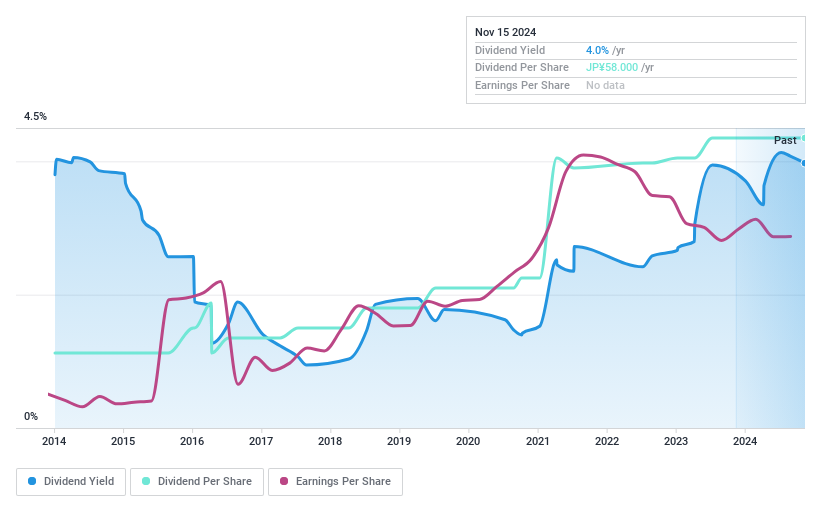

LIKE (TSE:2462)

Simply Wall St Dividend Rating: ★★★★★★

Overview: LIKE Co., Ltd. provides various human resource services in Japan with a market capitalization of ¥26.90 billion.

Operations: LIKE Co., Ltd. generates revenue from multiple segments within the human resource services sector in Japan.

Dividend Yield: 4%

LIKE Co., Ltd. offers a reliable dividend yield of 3.97%, ranking in the top 25% among Japanese dividend payers. The dividends have been stable and growing over the past decade, supported by a low payout ratio of 45.4%. This indicates strong earnings coverage, complemented by cash flow coverage at 51.5%. Trading significantly below estimated fair value suggests potential for capital appreciation alongside its attractive dividend profile, with Q1, 2025 results anticipated on October 11, 2024.

- Click here to discover the nuances of LIKE with our detailed analytical dividend report.

- Our valuation report unveils the possibility LIKE's shares may be trading at a discount.

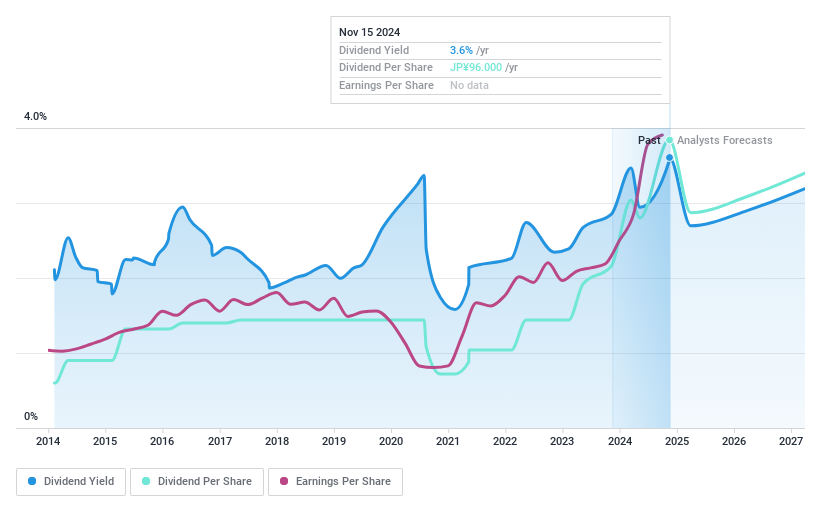

Konoike TransportLtd (TSE:9025)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Konoike Transport Co., Ltd. offers logistics services both in Japan and internationally, with a market cap of ¥145.47 billion.

Operations: Konoike Transport Co., Ltd. generates revenue through its logistics services provided both domestically and internationally.

Dividend Yield: 3.6%

Konoike Transport Ltd. provides a dividend yield of 3.61%, slightly below the top 25% in Japan, with dividends covered by a low payout ratio of 14% and cash flow coverage at 53.8%. Despite recent earnings growth, its dividend history is volatile over the past decade. Trading at a significant discount to estimated fair value, it offers potential for capital gains but faces challenges with forecasted earnings decline and an unstable dividend track record.

- Delve into the full analysis dividend report here for a deeper understanding of Konoike TransportLtd.

- Our comprehensive valuation report raises the possibility that Konoike TransportLtd is priced lower than what may be justified by its financials.

Key Takeaways

- Take a closer look at our Top Dividend Stocks list of 1956 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Konoike TransportLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9025

Konoike TransportLtd

Provides logistics services in Japan and internationally.

Undervalued with solid track record and pays a dividend.