- Japan

- /

- Transportation

- /

- TSE:9023

Tokyo Metro (TSE:9023): Evaluating Valuation Following Director Resignation and Compliance Overhaul

Reviewed by Kshitija Bhandaru

Tokyo Metro (TSE:9023) made headlines after Director Akiyoshi Yamamura resigned following confirmed inappropriate behavior toward an employee. The company responded by outlining steps to reinforce its compliance system and introducing voluntary pay reductions for top executives.

See our latest analysis for Tokyo Metro.

Yamamura’s resignation and the compliance overhaul arrive at a challenging time for Tokyo Metro, with the share price slipping 5.97% over the past 30 days as investors weigh the impact of governance concerns. Despite steady long-term financial performance, recent share price return trends reflect fading momentum as the market reassesses risk.

Given the heightened attention on company leadership and change, now could be a great moment to broaden your perspective and discover fast growing stocks with high insider ownership.

With shares down nearly 6% over the last month and analysts still assigning a higher price target, the question is whether Tokyo Metro is trading at a discount or if the market is already factoring in its future prospects.

Price-to-Earnings of 16.2x: Is it justified?

Tokyo Metro trades at a price-to-earnings (P/E) ratio of 16.2x compared to its industry and peer benchmarks, signaling that the market is valuing its earnings at a premium relative to many sector counterparts.

The P/E ratio measures what investors are prepared to pay today for a yen of the company’s current earnings. For Tokyo Metro, this ratio stands above the average for both the Japanese transportation industry and its closest peers. This suggests the market expects future growth or stability not reflected in the sector overall.

Compared to the transportation industry average of 12.6x and a peer group average of just 12.2x, Tokyo Metro's premium is pronounced. Additionally, the fair P/E ratio estimated by regression analysis is 15.5x, which is below the company’s current 16.2x level. This hints the share price may be running ahead of fundamentals.

Explore the SWS fair ratio for Tokyo Metro

Result: Price-to-Earnings of 16.2x (OVERVALUED)

However, risks remain if compliance reforms are slow to take hold or if revenue and earnings growth fall short of expectations in coming quarters.

Find out about the key risks to this Tokyo Metro narrative.

Another View: What Does the SWS DCF Model Say?

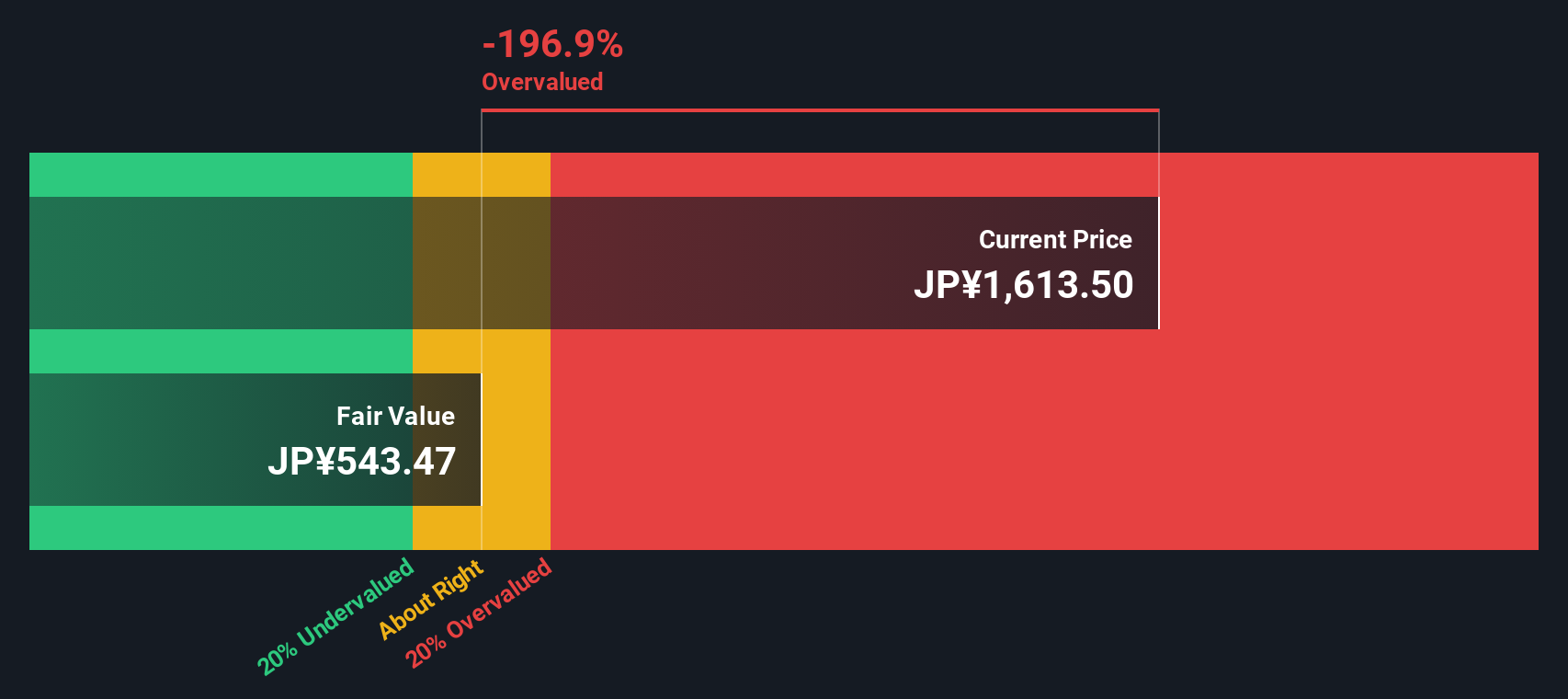

While the earnings-based approach suggests Tokyo Metro may be priced high, our SWS DCF model paints an even starker picture. According to this analysis, the current share price of ¥1,615 is significantly above the estimated fair value of ¥543.74, casting doubt on the growth assumptions that support today's valuation.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tokyo Metro for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tokyo Metro Narrative

If you want to dive deeper or look at the numbers from a different perspective, you can quickly build your own view of Tokyo Metro in just a few minutes, and Do it your way.

A great starting point for your Tokyo Metro research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Angles?

Don’t let the market’s best new trends slip past you. The right screener can highlight high-potential companies and put you ahead of the curve. Here are three excellent places to start:

- Supercharge your portfolio with generous annual yields by checking out these 19 dividend stocks with yields > 3% designed for reliable returns over time.

- Pursue untapped technology opportunities by targeting these 26 quantum computing stocks that powers breakthroughs in quantum computing and advanced applications.

- Get in early on future market leaders by tracking these 3585 penny stocks with strong financials featuring robust financials and notable growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Metro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9023

Tokyo Metro

Engages in the operation and management of railways in Japan.

Proven track record with imperfect balance sheet.

Market Insights

Community Narratives