- Japan

- /

- Transportation

- /

- TSE:9022

Central Japan Railway (TSE:9022): Valuation Check After Accelerating Its Large-Scale Share Buyback Program

Reviewed by Simply Wall St

Central Japan Railway (TSE:9022) has pushed ahead with its large scale share buyback, repurchasing over 3 million shares in November. The move sharpens focus on how committed management is to shareholder returns.

See our latest analysis for Central Japan Railway.

The buyback news lands on top of a strong run, with a roughly 49% year to date share price return and a 45% one year total shareholder return. This suggests momentum is still building as investors warm to the story.

If this kind of renewed interest in rail and infrastructure has you thinking bigger, it could be a smart moment to explore auto manufacturers for other transport linked opportunities.

But with the stock already rallying hard and now trading slightly above consensus targets, is Central Japan Railway still quietly undervalued, or is the market already paying up for all of its future growth?

Price-to-Earnings of 8.1x: Is it justified?

On a headline basis, Central Japan Railway trades on a price-to-earnings ratio of 8.1x, which screens as attractive versus both the wider Japanese market and transport peers.

The price-to-earnings ratio compares the current share price to the company’s earnings per share and is a common way to gauge how much investors are paying for profits today. For a mature, infrastructure heavy rail operator, it is a useful lens because earnings tend to be relatively stable and capital intensive projects can lock in future cash flows once in operation.

Here, the market appears to be assigning a discount despite strong historic earnings growth, higher net profit margins than last year, and management that is described as seasoned. That discount looks even starker when set beside an estimated fair price-to-earnings ratio of 17.1x. This is a level the market could move towards if confidence in the earnings profile and balance sheet improves.

Relative to the Japanese market price-to-earnings of 14x and the transportation industry average of 11.7x, Central Japan Railway’s 8.1x multiple looks notably lower. This suggests investors are not fully pricing in its track record of profit growth and quality of earnings.

Explore the SWS fair ratio for Central Japan Railway

Result: Price-to-Earnings of 8.1x (UNDERVALUED)

However, softer revenue growth, alongside a recent dip in net income, raises questions about how durable the post rally momentum and valuation case really are.

Find out about the key risks to this Central Japan Railway narrative.

Another View: Our DCF Signals Caution

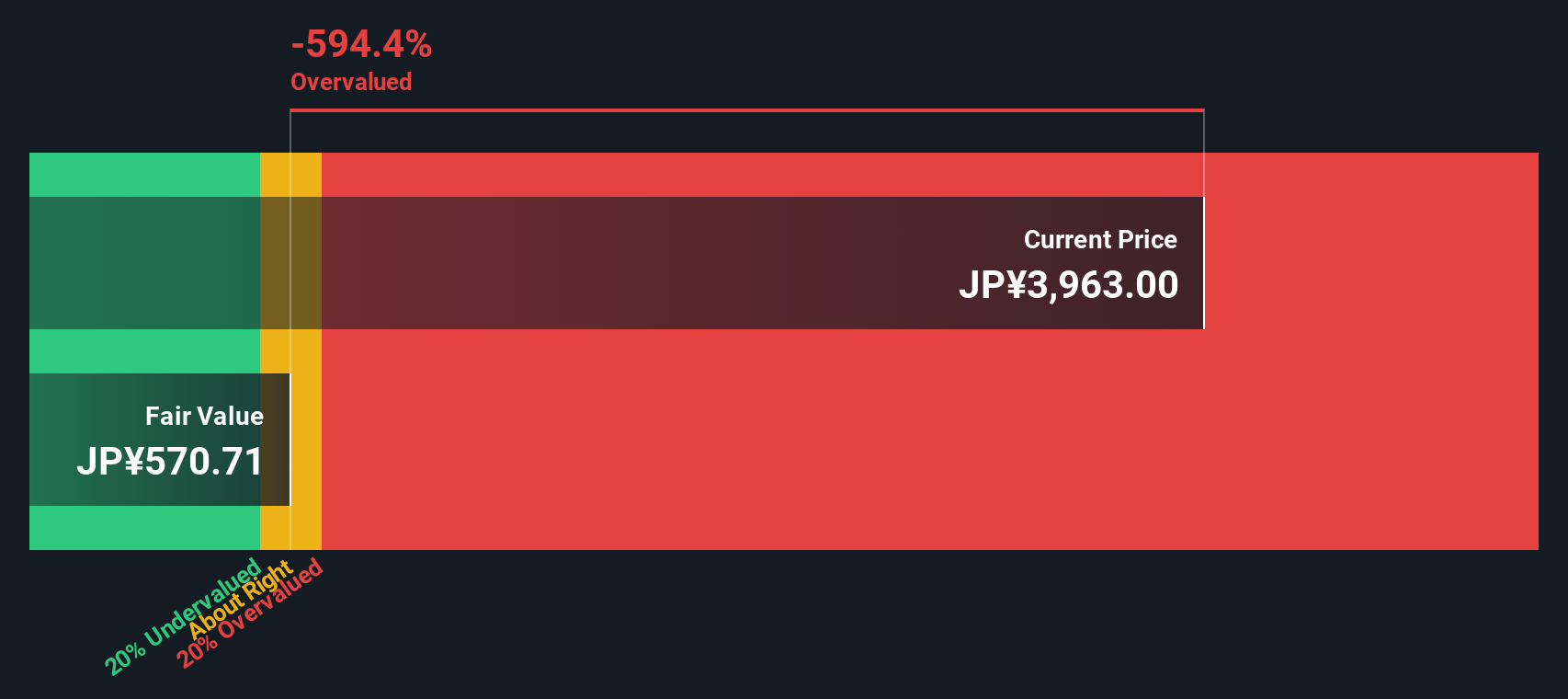

While the earnings multiple points to value, our DCF model paints a very different picture, implying fair value near ¥568 versus today’s ¥4,368. That gap suggests potential overvaluation. Is the market now paying more for the story than the cash flows can support?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Central Japan Railway for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Central Japan Railway Narrative

If you see the numbers differently, or simply want to dig into the details yourself, you can build a personalised view in just a few minutes: Do it your way

A great starting point for your Central Japan Railway research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity when a whole universe of data backed ideas is a click away. Your future portfolio may benefit from thoughtful action and diversification.

- Explore early stage potential by scanning these 3573 penny stocks with strong financials that combine small market capitalizations with resilient financials and clearly defined business strategies.

- Consider long-term structural themes by reviewing these 25 AI penny stocks focused on automation, data, and scalable software models.

- Evaluate your income needs by analyzing these 14 dividend stocks with yields > 3% that seek to balance yield, balance sheet strength, and payout consistency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9022

Central Japan Railway

Engages in the railway and related businesses in Japan.

Proven track record and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026