- Japan

- /

- Wireless Telecom

- /

- TSE:9984

SoftBank Group (TSE:9984) affirms JPY 22.00 dividend per share, enhancing shareholder returns amidst buybacks.

Reviewed by Simply Wall St

SoftBank Group (TSE:9984) is navigating a complex financial environment, highlighted by its recent dividend affirmation of JPY 22.00 per share and a strategic buyback program aimed at repurchasing up to 6.8% of its shares to bolster shareholder value. The company faces significant challenges, including a sharp decline in earnings growth and operational inefficiencies, which are compounded by high debt levels and market volatility. Readers should expect a detailed analysis of SoftBank's strategies to leverage growth opportunities while addressing these financial constraints and competitive pressures.

Get an in-depth perspective on SoftBank Group's performance by reading our analysis here.

Key Assets Propelling SoftBank Group Forward

SoftBank Group's projected earnings growth of 23.8% annually is a significant indicator of its potential to capture market opportunities. The leadership team, with an average tenure of 5.5 years, brings stability and strategic insight, crucial for navigating complex market dynamics. The company has maintained shareholder value, avoiding dilution over the past year. Additionally, the recent dividend of JPY 22.00 per share, sourced from retained earnings, underscores its commitment to rewarding investors. However, the current share price is trading above the estimated fair value, suggesting it may be overvalued compared to industry peers.

To dive deeper into how SoftBank Group's valuation metrics are shaping its market position, check out our detailed analysis of SoftBank Group's Valuation.Challenges Constraining SoftBank Group's Potential

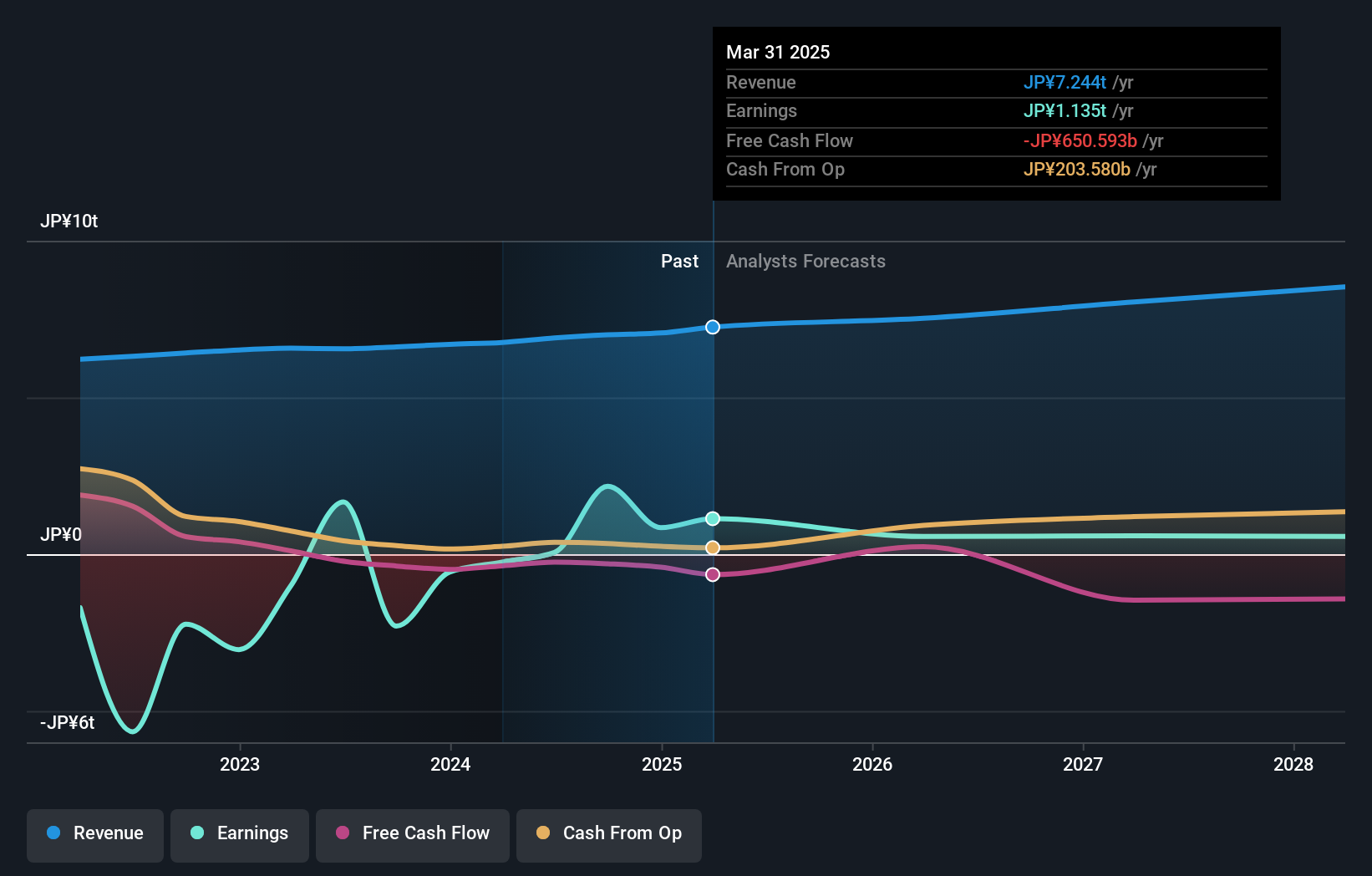

The company faces significant financial hurdles. A negative earnings growth of -96.6% over the past year highlights the volatility in its financial performance. The net profit margin has dropped to 0.8% from 25.5%, indicating operational inefficiencies. Moreover, a high net debt to equity ratio of 107.2% and insufficient interest coverage (1.6x) pose financial risks. These factors, coupled with low forecasted Return on Equity of 2.5% in three years, suggest challenges in achieving sustainable profitability.

Explore the current health of SoftBank Group and how it reflects on its financial stability and growth potential.Potential Strategies for Leveraging Growth and Competitive Advantage

SoftBank has opportunities for growth, particularly with its earnings expected to rise significantly over the next three years. The company's strategic buyback program, repurchasing 6.8% of its shares, aims to enhance shareholder returns and stabilize its stock value. This initiative, along with product-related announcements, positions SoftBank to capitalize on emerging market trends and improve its market stance.

To gain deeper insights into SoftBank Group's historical performance, explore our detailed analysis of past performance.Competitive Pressures and Market Risks Facing SoftBank Group

Market volatility and competitive pressures remain significant threats. The company's share price has been highly volatile over the past three months, compounded by its expensive Price-To-Sales Ratio compared to peers. Additionally, large one-off gains in financial results may not be sustainable, posing risks to long-term financial health. Regulatory changes could further impact operations, necessitating proactive management strategies.

See what the latest analyst reports say about SoftBank Group's future prospects and potential market movements.Conclusion

SoftBank Group's projected annual earnings growth of 23.8% reflects its capacity to seize market opportunities, driven by a stable leadership team and strategic initiatives like share buybacks. However, the company's financial challenges, including a significant drop in net profit margin and high debt levels, highlight the need for operational improvements to ensure sustainable profitability. Despite these hurdles, SoftBank's commitment to rewarding shareholders and its efforts to stabilize stock value through strategic buybacks position it well for future growth. The current share price, trading above estimated fair value, suggests that while the market may have high expectations, investors should remain cautious about potential overpricing relative to industry peers and the company's financial risks.

Next Steps

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:9984

SoftBank Group

Provides telecommunication services in Japan and internationally.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives