- Japan

- /

- Wireless Telecom

- /

- TSE:9984

SoftBank Group Corp. (TSE:9984) Stock Rockets 35% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, SoftBank Group Corp. (TSE:9984) shares have been powering on, with a gain of 35% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 61% in the last year.

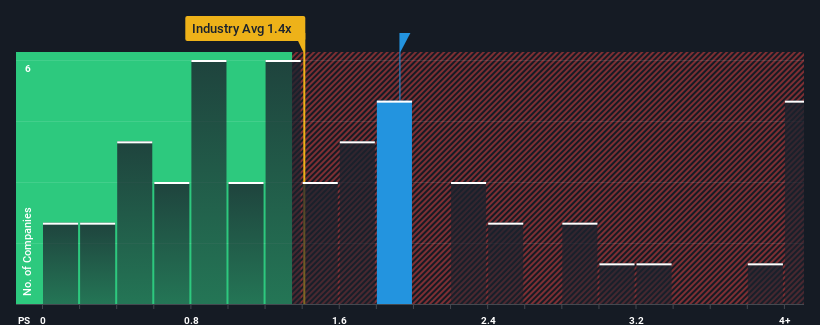

Even after such a large jump in price, there still wouldn't be many who think SoftBank Group's price-to-sales (or "P/S") ratio of 1.9x is worth a mention when the median P/S in Japan's Wireless Telecom industry is similar at about 1.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for SoftBank Group

How SoftBank Group Has Been Performing

SoftBank Group's revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SoftBank Group.Is There Some Revenue Growth Forecasted For SoftBank Group?

In order to justify its P/S ratio, SoftBank Group would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.8% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 3.4% per year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 5.9% per annum growth forecast for the broader industry.

In light of this, it's curious that SoftBank Group's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From SoftBank Group's P/S?

SoftBank Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at the analysts forecasts of SoftBank Group's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

And what about other risks? Every company has them, and we've spotted 2 warning signs for SoftBank Group (of which 1 is concerning!) you should know about.

If you're unsure about the strength of SoftBank Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9984

SoftBank Group

Provides telecommunication services in Japan and internationally.

Slight and overvalued.

Similar Companies

Market Insights

Community Narratives