- Japan

- /

- Wireless Telecom

- /

- TSE:9984

Is SoftBank Group's Valuation Justified After Robotics Unit Consolidation and Rapid Share Price Surge?

Reviewed by Bailey Pemberton

Thinking about what to do with SoftBank Group stock right now? You are not alone. After all, it is not every day you see a blue-chip tech conglomerate surge nearly 19% in just a week, climb over 51% in a month, and double year-to-date, with jaw-dropping 1-year and multi-year returns of 154.8% and 326% respectively. Whether you have been tracking SoftBank’s headline-grabbing investments or just noticed its eye-popping momentum, it is clear something is making the market sit up and take notice.

Part of the recent buzz comes from big moves in the company’s business strategy. SoftBank is making headlines for consolidating its numerous robotics companies into a single unit, a move meant to streamline innovation and maximize returns. On top of that, SoftBank’s rumored participation in a major crypto funding round alongside Ark Investment, as well as workforce shifts as it redirects focus towards artificial intelligence, keep investors speculating about what is next. These shifts have helped fuel the perception of future growth, but also reflect evolving risks as the company navigates disruptions and some project delays. For example, its joint venture with OpenAI in Japan is taking longer to materialize.

But before you get swept up in the excitement of soaring charts and bold headlines, you might want to look closer at valuation. By our standard scorecard, SoftBank Group is currently undervalued in exactly zero out of six typical valuation checks, giving a value score of 0 out of 6. What does that mean for potential investors or those already holding shares? In the next section, we will break down the major valuation methods and see how the company stacks up. Stick around, because a smarter way to think about valuation might surprise you at the end.

SoftBank Group scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: SoftBank Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their value today. This approach helps investors gauge what a business is fundamentally worth, rather than relying solely on market prices or recent trends.

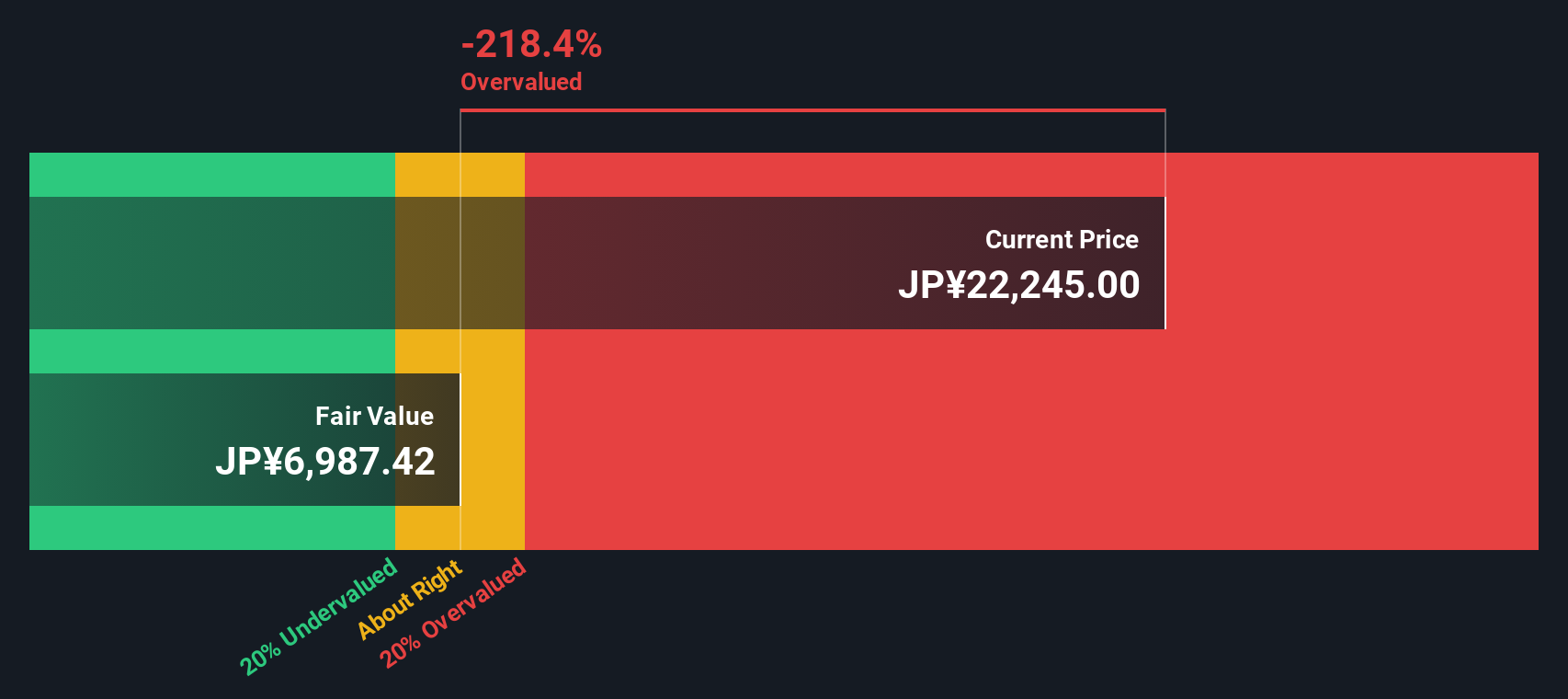

For SoftBank Group, the DCF uses a 2 Stage Free Cash Flow to Equity model, working in Japanese yen (¥). At present, SoftBank's latest twelve-month free cash flow stands at negative ¥787.0 billion, reflecting a period of heavy outflows. Analyst projections suggest a gradual turnaround, forecasting ¥504 billion in free cash flow by 2030.

The first five years rely on analyst estimates, while cash flows further out are extrapolated using industry and company trends. Looking at the ten-year trajectory, SoftBank's cash flows are expected to recover from deep negative territory to positive figures, though the path involves some significant swings.

Taking all these cash flow projections and discounting them to present value, the DCF model arrives at an estimated intrinsic value per share of ¥6,987. This suggests a 228.4% premium to current pricing, indicating that SoftBank Group stock is significantly overvalued according to this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SoftBank Group may be overvalued by 228.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: SoftBank Group Price vs Earnings

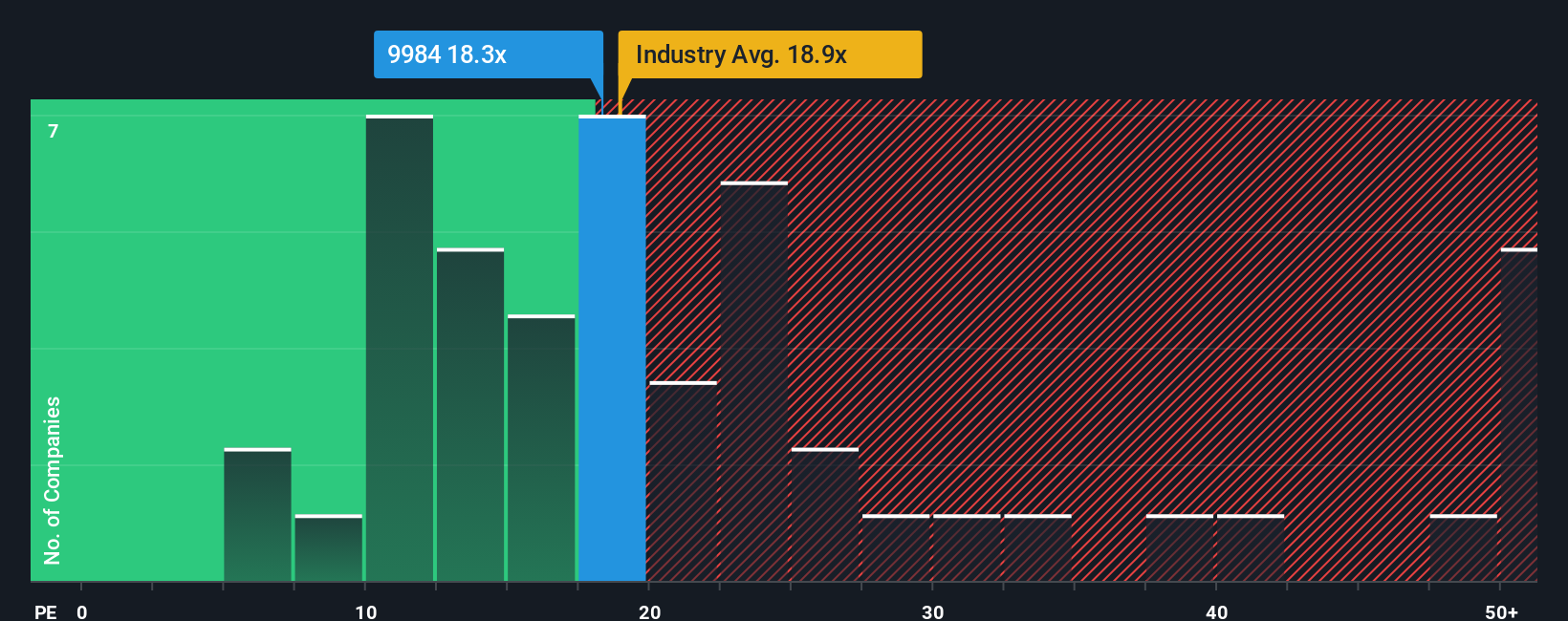

For profitable companies like SoftBank Group, the price-to-earnings (PE) ratio is a popular measure of valuation because it anchors a company’s market value to the profits it consistently generates. Investors tend to pay higher PE ratios for companies with strong growth prospects and lower risk, while slower growth or heightened risks tend to pull that number down. What is considered “normal” is always a moving target, shaped by both company and industry-specific factors.

SoftBank Group currently trades at a PE ratio of 18.88x. For context, this sits above its peer average of 16.59x and is slightly higher than the broader wireless telecom industry average of 18.03x. While these benchmarks offer useful reference points, they do not tell the whole story for a complex company like SoftBank.

This is where Simply Wall St's proprietary “Fair Ratio” comes in. The Fair Ratio, calculated at 17.48x for SoftBank, aims to reflect what investors should pay relative to this specific company, considering future earnings growth, risk profile, profit margin, industry trends, and market cap. By blending all these factors, it can be more insightful than typical peer or industry comparisons.

Given that SoftBank's actual PE of 18.88x is moderately above its Fair Ratio, the shares currently appear somewhat overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SoftBank Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative links your view of a company's story—why you believe it will win or face challenges—with a quantitative financial forecast and an estimated fair value. On Simply Wall St's platform, Narratives provide an easy, accessible tool, found on the Community page, that helps millions of investors explain their investment thesis, clarify assumptions about future revenue, margin, and earnings, and see how these translate to potential upside or downside.

Narratives are dynamic. As news breaks or earnings are released, your assumptions and fair value update in real time, making it possible to react quickly and more confidently. By comparing your fair value to the current price, Narratives can signal when you might want to buy, sell, or hold. For example, in the SoftBank Group Community, some users believe regulatory hurdles and fading hype around Arm and OpenAI justify a low price target of ¥9,400, while others see surging AI demand and asset monetization supporting a bullish target as high as ¥20,000. Your Narrative grounds your decision making in your own research and expectations, making complex investing more approachable and actionable.

Do you think there's more to the story for SoftBank Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9984

SoftBank Group

Provides telecommunication services in Japan and internationally.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives