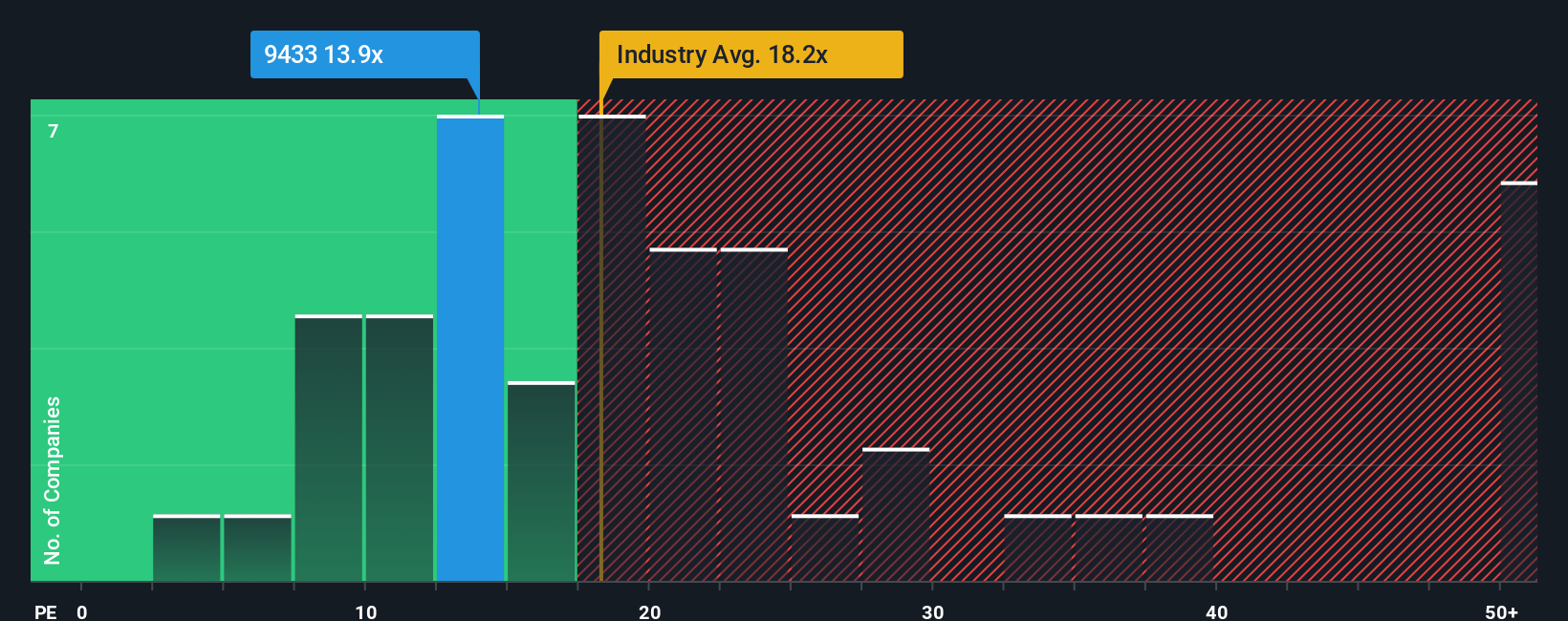

With a median price-to-earnings (or "P/E") ratio of close to 13x in Japan, you could be forgiven for feeling indifferent about KDDI Corporation's (TSE:9433) P/E ratio of 13.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for KDDI as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for KDDI

Does Growth Match The P/E?

In order to justify its P/E ratio, KDDI would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 125% gain to the company's bottom line. The latest three year period has also seen a 19% overall rise in EPS, aided extensively by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings growth is heading into negative territory, declining 13% each year over the next three years. With the market predicted to deliver 8.7% growth per annum, that's a disappointing outcome.

In light of this, it's somewhat alarming that KDDI's P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Bottom Line On KDDI's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of KDDI's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for KDDI that you should be aware of.

Of course, you might also be able to find a better stock than KDDI. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if KDDI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9433

KDDI

Engages in the provision of mobile telecommunications services in Japan and internationally.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026