- Japan

- /

- Telecom Services and Carriers

- /

- TSE:9432

How Investors May Respond To NTT (TSE:9432) Unveiling Programmable Photonic Waveguides for Advanced Connectivity

Reviewed by Sasha Jovanovic

- In recent months, NTT Research, Inc., in collaboration with Cornell University and Stanford University, announced the development of the world's first programmable nonlinear photonic waveguide capable of switching between multiple nonlinear-optical functions on a single chip. This advance paves the way for flexible, real-time light-based computing and communications technology, potentially transforming applications across optical and quantum domains.

- The innovation in programmable nonlinear photonics could open new frontiers for tunable light sources, computing, and secure data transmission, representing a material technological leap for NTT and its industry partners.

- We'll examine how this technological breakthrough in photonic waveguides enhances NTT's investment case for next-generation connectivity and digital infrastructure growth.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

NTT Investment Narrative Recap

To be a shareholder in NTT, an investor needs to believe in the company’s ability to drive growth from technological innovation and digital infrastructure expansion amid stiff competition and legacy business headwinds. While the breakthrough in programmable nonlinear photonic waveguides is a significant milestone for long-term technology leadership, it is not expected to materially influence the most important short-term catalyst, which remains rapid data center demand and digital transformation adoption; the biggest immediate risk continues to be pressure on operating margins from declining traditional telecom revenues and rising costs.

Among recent announcements, NTT’s completion of a ¥35,845.6 million share buyback for 224,951,900 shares completed this September stands out. While not directly tied to the photonics achievement, the buyback underscores capital management discipline, which supports shareholder value, an important context as NTT faces the need to fund high capex for next-generation network growth.

However, against a backdrop of breakthrough R&D and shareholder returns, investors should pay close attention to how persistent profit margin pressure could affect ...

Read the full narrative on NTT (it's free!)

NTT is projected to achieve ¥15,111.0 billion in revenue and ¥1,245.9 billion in earnings by 2028. This outlook assumes annual revenue growth of 3.3% and an earnings increase of ¥260.3 billion from current earnings of ¥985.6 billion.

Uncover how NTT's forecasts yield a ¥179 fair value, a 17% upside to its current price.

Exploring Other Perspectives

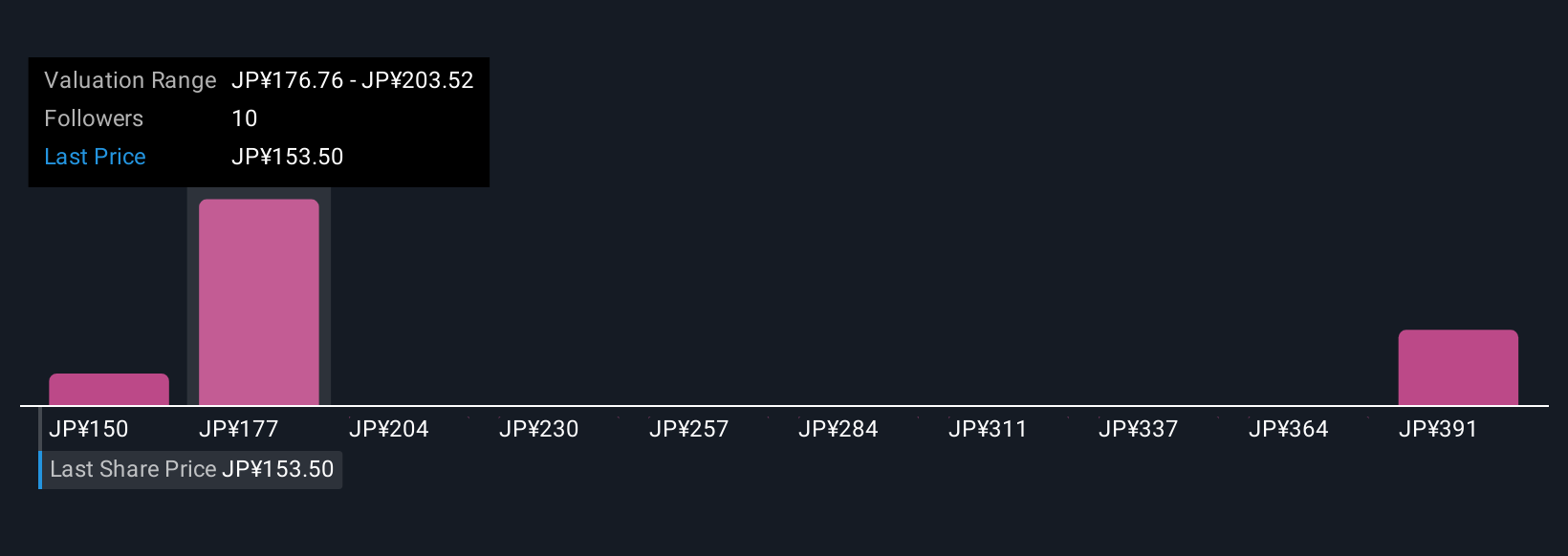

Simply Wall St Community members set fair value estimates from ¥150 to nearly ¥425 across 4 perspectives, reflecting widely varied expectations. Persistent margin pressures continue to be a focal concern for understanding NTT’s future profitability, so be sure to compare these views for a fuller picture.

Explore 4 other fair value estimates on NTT - why the stock might be worth over 2x more than the current price!

Build Your Own NTT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NTT research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NTT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NTT's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NTT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9432

NTT

Operates as a telecommunications company in Japan and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives