- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7762

Assessing Citizen Watch (TSE:7762)’s Valuation After Treasury Stock Disposal Plan Raises Capital Structure Questions

Reviewed by Simply Wall St

Citizen Watch (TSE:7762) just put its capital structure under the spotlight, with a board meeting to consider disposing of treasury stock via third party allotment, a move that can subtly reshape future ownership dynamics.

See our latest analysis for Citizen Watch.

The timing of this move lines up with a powerful run in the shares, with a roughly 44 percent year to date share price return and a standout five year total shareholder return above 450 percent, suggesting momentum is still firmly building.

If Citizen’s capital reshuffle has you thinking about what else could be compounding in the background, now is a good moment to explore fast growing stocks with high insider ownership.

Yet with Citizen now trading above analyst targets despite only modest revenue growth and flat earnings, investors must decide: is this a late-cycle momentum story, or is the market correctly pricing in a new phase of growth?

Price-to-Earnings of 13.7x: Is it justified?

Based on a price-to-earnings ratio of 13.7x and a last close of ¥1,318, Citizen Watch still screens as attractively valued against peers despite its strong run.

The price-to-earnings multiple compares the share price to the company’s earnings per share. It is a straightforward gauge of how much investors are willing to pay for current profits. For a diversified electronics manufacturer like Citizen, this metric is a useful shorthand for how the market prices its established profitability and future earnings potential.

Citizen’s 13.7x multiple sits below both the Japanese market average of around 14x and the domestic electronic industry average of 14.3x. This indicates investors are not paying a premium despite solid net profit margins and high quality earnings. Relative to an estimated fair price-to-earnings ratio of 14.7x, there is also room for the valuation to drift higher if sentiment and fundamentals stay intact, which underlines how conservative today’s pricing looks in context.

Against the broader electronic industry, this discount stands out, especially given Citizen has exceeded both market and sector returns over the past year, a combination that can often compress rather than widen valuation gaps.

Explore the SWS fair ratio for Citizen Watch

Result: Price-to-Earnings of 13.7x (UNDERVALUED)

However, stretched valuations compared with analyst targets and modest revenue and earnings trends could quickly sour sentiment if growth or margins weaken from here.

Find out about the key risks to this Citizen Watch narrative.

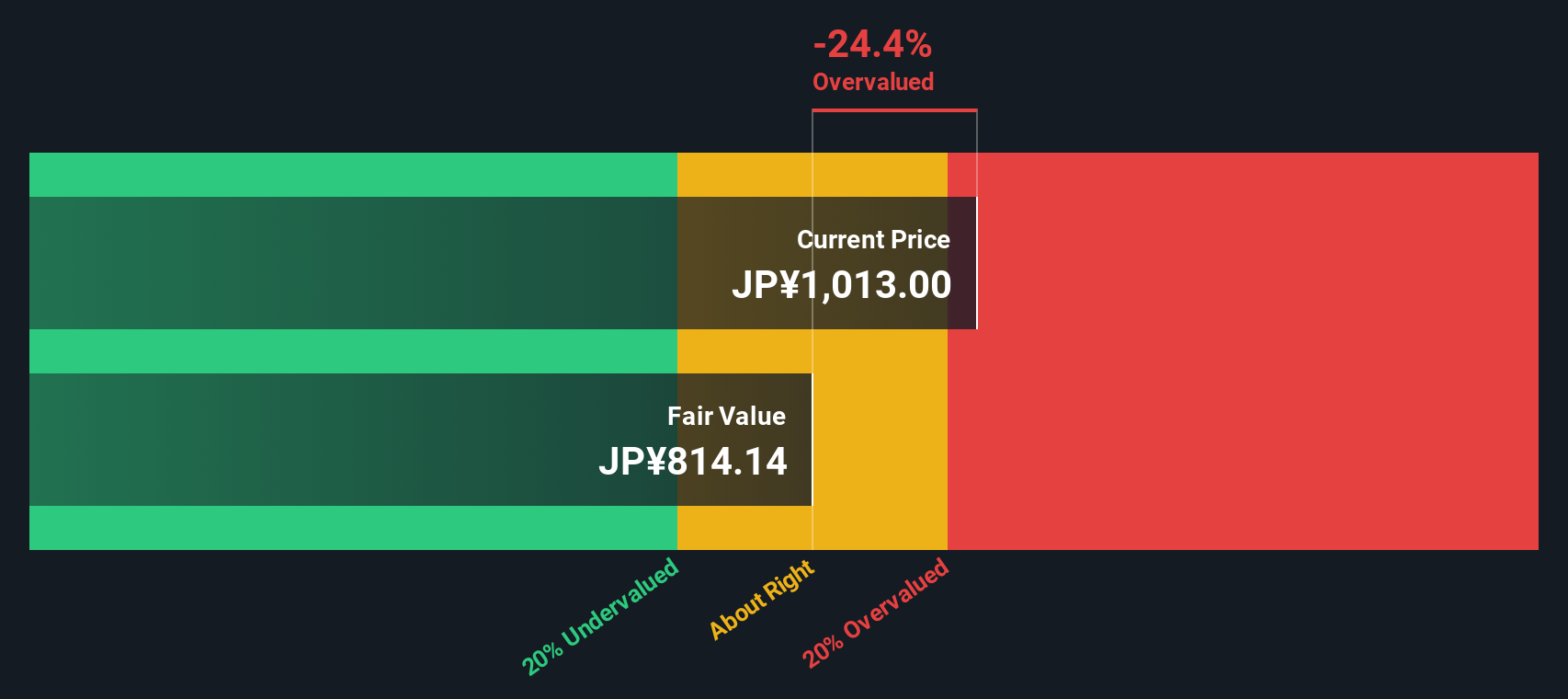

Another View: Our DCF Signals Caution

While earnings multiples suggest Citizen looks modestly cheap, our DCF model tells a different story. At ¥1,318, the shares sit around 18 percent above our estimated fair value of roughly ¥1,111, implying investors are paying up today for cash flows that may not actually materialise.

That gap does not make a crash inevitable. However, it does mean less margin of safety if earnings disappoint or forecasts continue to point to flat profits. Is the market accurately sensing hidden resilience here, or simply getting carried away with recent share price strength?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Citizen Watch for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Citizen Watch Narrative

If this view does not quite fit your own thinking, or you would rather dig through the numbers yourself, you can craft a personalised storyline in just a few minutes, Do it your way.

A great starting point for your Citizen Watch research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with a single company. Use the Simply Wall Street Screener to uncover fresh ideas before the market fully catches on to them.

- Capture potential big movers early by scanning these 3571 penny stocks with strong financials that already show strong balance sheets and improving fundamentals.

- Position your portfolio for the next wave of innovation by targeting these 25 AI penny stocks reshaping entire industries with artificial intelligence.

- Lock in quality at sensible prices by focusing on these 915 undervalued stocks based on cash flows that still trade below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7762

Citizen Watch

Manufactures and sells watches and related components worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026