- Japan

- /

- Tech Hardware

- /

- TSE:7752

Ricoh (TSE:7752) Valuation Check After Recent Share Price Weakness

Reviewed by Simply Wall St

Ricoh Company (TSE:7752) has quietly drifted lower this year, even as its three year total return is still comfortably positive. That disconnect between recent weakness and longer term gains is what makes the stock interesting now.

See our latest analysis for Ricoh Company.

Over the past year, sentiment around Ricoh has cooled, with a year to date share price return of minus 21.46 percent and a one year total shareholder return of minus 20.01 percent. Even though the three year total shareholder return still sits near 40 percent, this suggests long term holders remain ahead, but momentum has clearly faded recently.

If Ricoh's reset has you rethinking where growth might come from next, it could be a good moment to explore fast growing stocks with high insider ownership for new ideas with stronger momentum.

With earnings still growing modestly and the shares trading at a visible intrinsic discount, investors now face a crucial question: Is Ricoh quietly undervalued, or is the market already pricing in its future growth?

Price-to-Earnings of 12.7x: Is it justified?

Ricoh's shares last closed at ¥1363.5, and on a price to earnings ratio of 12.7x the stock screens as undervalued against peers and its own fair range.

The price to earnings multiple compares what investors pay today for each unit of current earnings, a useful yardstick for mature, profitable tech businesses like Ricoh.

In this case, the market is valuing Ricoh at 12.7x earnings, while our analysis suggests a materially higher fair level of 17.7x based on the SWS DCF model inputs and peer behavior. That gap implies investors are pricing in more muted profit strength than the company has recently delivered and is expected to deliver.

Compared to the broader JP Tech industry, where the average price to earnings sits near 12.8x, Ricoh is marginally cheaper despite faster recent earnings growth and a fair ratio that points to a meaningfully higher valuation level the market could migrate toward over time.

Explore the SWS fair ratio for Ricoh Company

Result: Price-to-Earnings of 12.7x (UNDERVALUED)

However, slower revenue growth and a relatively modest analyst upside could signal that Ricoh's valuation discount persists if earnings momentum stalls.

Find out about the key risks to this Ricoh Company narrative.

Another View of Value

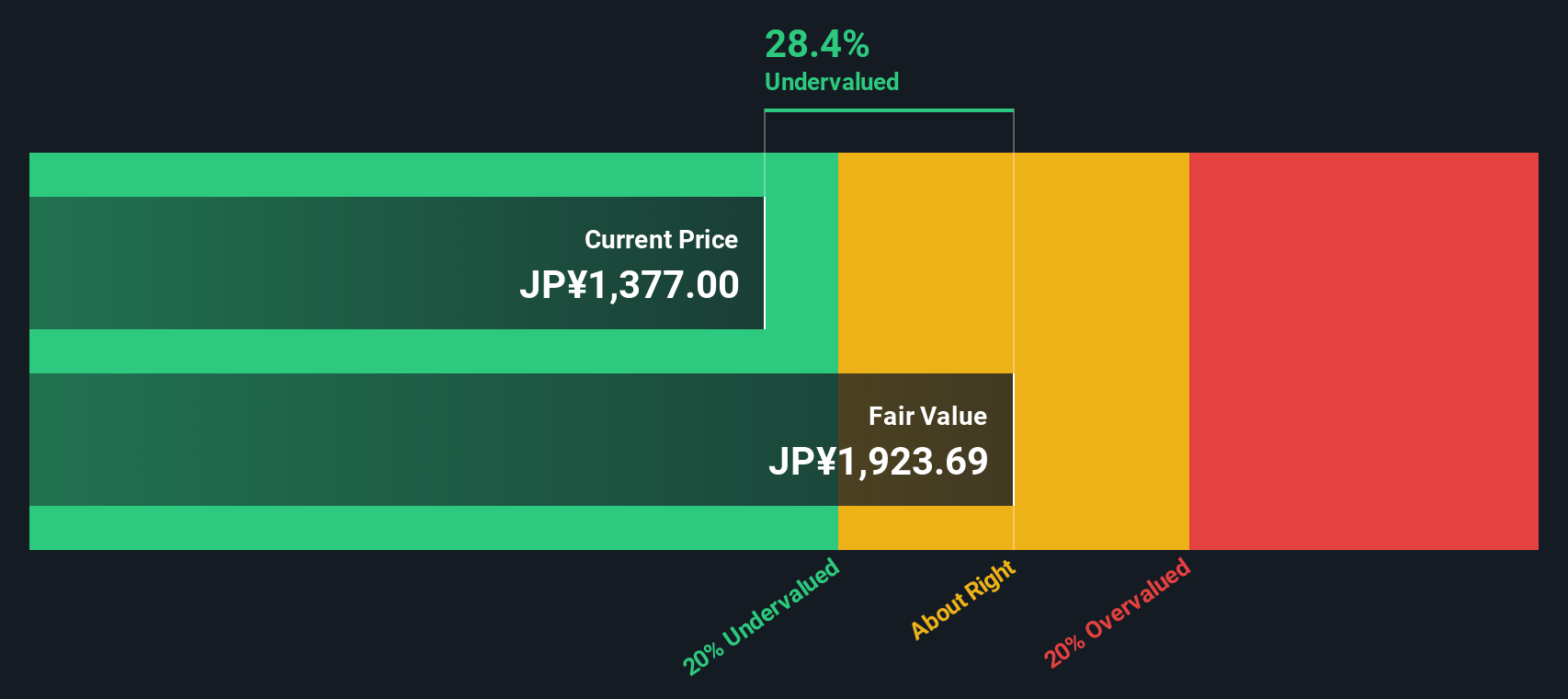

Our DCF model presents an even starker picture, estimating Ricoh's fair value at about ¥1858 versus the current ¥1363.5, a roughly 27 percent gap that also points to undervaluation. Is the market overlooking a slow, steady compounder, or sensing a value trap forming?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ricoh Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ricoh Company Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your Ricoh Company research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, take a moment to line up your next opportunities with targeted screeners on Simply Wall St, so you are not late to the next winner.

- Capture potential bargains early by scanning these 908 undervalued stocks based on cash flows for companies whose cash flows hint at prices the market has not yet fully recognized.

- Ride structural growth trends by using these 26 AI penny stocks to pinpoint businesses harnessing artificial intelligence for scalable, long term earnings power.

- Strengthen your income stream by reviewing these 15 dividend stocks with yields > 3% that combine attractive yields with financial resilience and consistent payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7752

Ricoh Company

Develops, manufactures, and sells digital products and services in Japan, the Americas, Europe, the Middle East, Africa, China, South East Asia, and Oceania.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026