- Japan

- /

- Tech Hardware

- /

- TSE:7752

Ricoh Company, Ltd.'s (TSE:7752) Earnings Haven't Escaped The Attention Of Investors

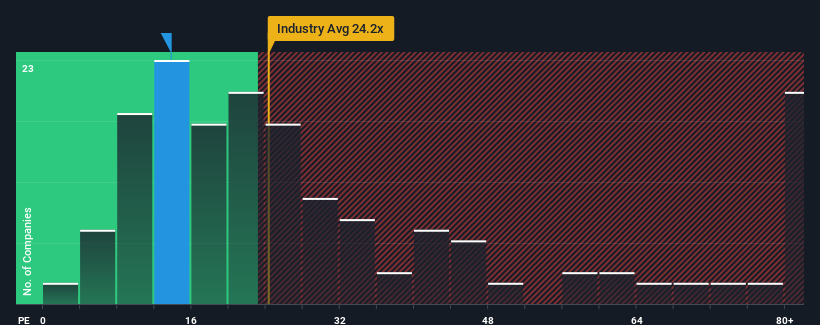

With a median price-to-earnings (or "P/E") ratio of close to 15x in Japan, you could be forgiven for feeling indifferent about Ricoh Company, Ltd.'s (TSE:7752) P/E ratio of 13.8x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's superior to most other companies of late, Ricoh Company has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Ricoh Company

How Is Ricoh Company's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Ricoh Company's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 69%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 9.9% per year during the coming three years according to the nine analysts following the company. That's shaping up to be similar to the 10% per year growth forecast for the broader market.

With this information, we can see why Ricoh Company is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Ricoh Company's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Ricoh Company's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Ricoh Company that you should be aware of.

You might be able to find a better investment than Ricoh Company. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Ricoh Company, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7752

Ricoh Company

Engages in the provision of office, commercial printing, and related solutions worldwide.

Flawless balance sheet average dividend payer.