- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7734

Riken Keiki Co., Ltd.'s (TSE:7734) Earnings Haven't Escaped The Attention Of Investors

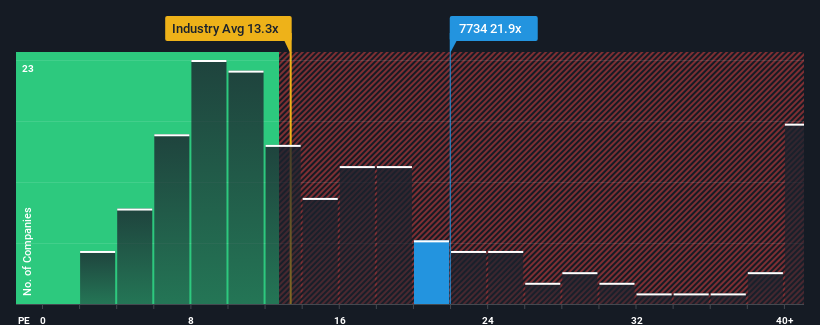

Riken Keiki Co., Ltd.'s (TSE:7734) price-to-earnings (or "P/E") ratio of 21.9x might make it look like a strong sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 13x and even P/E's below 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, Riken Keiki's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Riken Keiki

How Is Riken Keiki's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Riken Keiki's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 15%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 26% overall rise in EPS. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 17% per year as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 11% each year growth forecast for the broader market.

With this information, we can see why Riken Keiki is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Riken Keiki's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Riken Keiki's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with Riken Keiki.

Of course, you might also be able to find a better stock than Riken Keiki. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7734

Riken Keiki

Engages in research, development, manufacturing, sales and after-sales maintenance of industrial gas detection and alarm equipment and analyzers in Japan and internationally.

Flawless balance sheet with moderate growth potential.