- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7505

Fuso Dentsu (TSE:7505) Could Easily Take On More Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Fuso Dentsu Co., Ltd. (TSE:7505) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Fuso Dentsu's Net Debt?

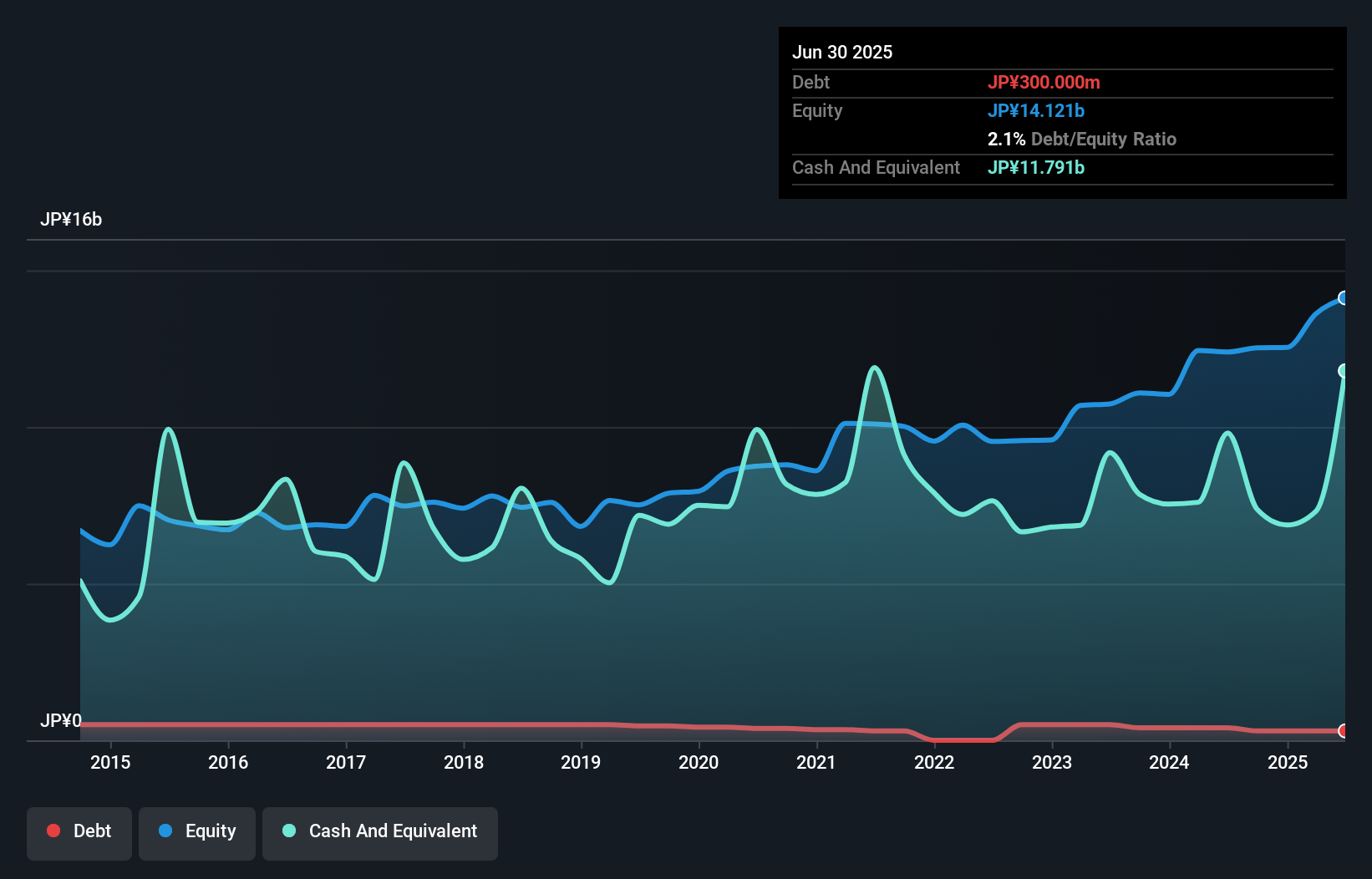

The image below, which you can click on for greater detail, shows that Fuso Dentsu had debt of JP¥300.0m at the end of June 2025, a reduction from JP¥400.0m over a year. However, its balance sheet shows it holds JP¥11.8b in cash, so it actually has JP¥11.5b net cash.

A Look At Fuso Dentsu's Liabilities

According to the last reported balance sheet, Fuso Dentsu had liabilities of JP¥18.3b due within 12 months, and liabilities of JP¥4.08b due beyond 12 months. On the other hand, it had cash of JP¥11.8b and JP¥7.96b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by JP¥2.64b.

Since publicly traded Fuso Dentsu shares are worth a total of JP¥22.3b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Fuso Dentsu also has more cash than debt, so we're pretty confident it can manage its debt safely.

See our latest analysis for Fuso Dentsu

In addition to that, we're happy to report that Fuso Dentsu has boosted its EBIT by 36%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Fuso Dentsu will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Fuso Dentsu has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Fuso Dentsu produced sturdy free cash flow equating to 63% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing Up

Although Fuso Dentsu's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of JP¥11.5b. And we liked the look of last year's 36% year-on-year EBIT growth. So is Fuso Dentsu's debt a risk? It doesn't seem so to us. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example - Fuso Dentsu has 1 warning sign we think you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7505

Fuso Dentsu

Engages in the information and communication technology (ICT) business in Japan.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026