- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7420

Satori Electric (TSE:7420) Net Profit Margins Rise, Reinforcing Bullish View on Operational Strength

Reviewed by Simply Wall St

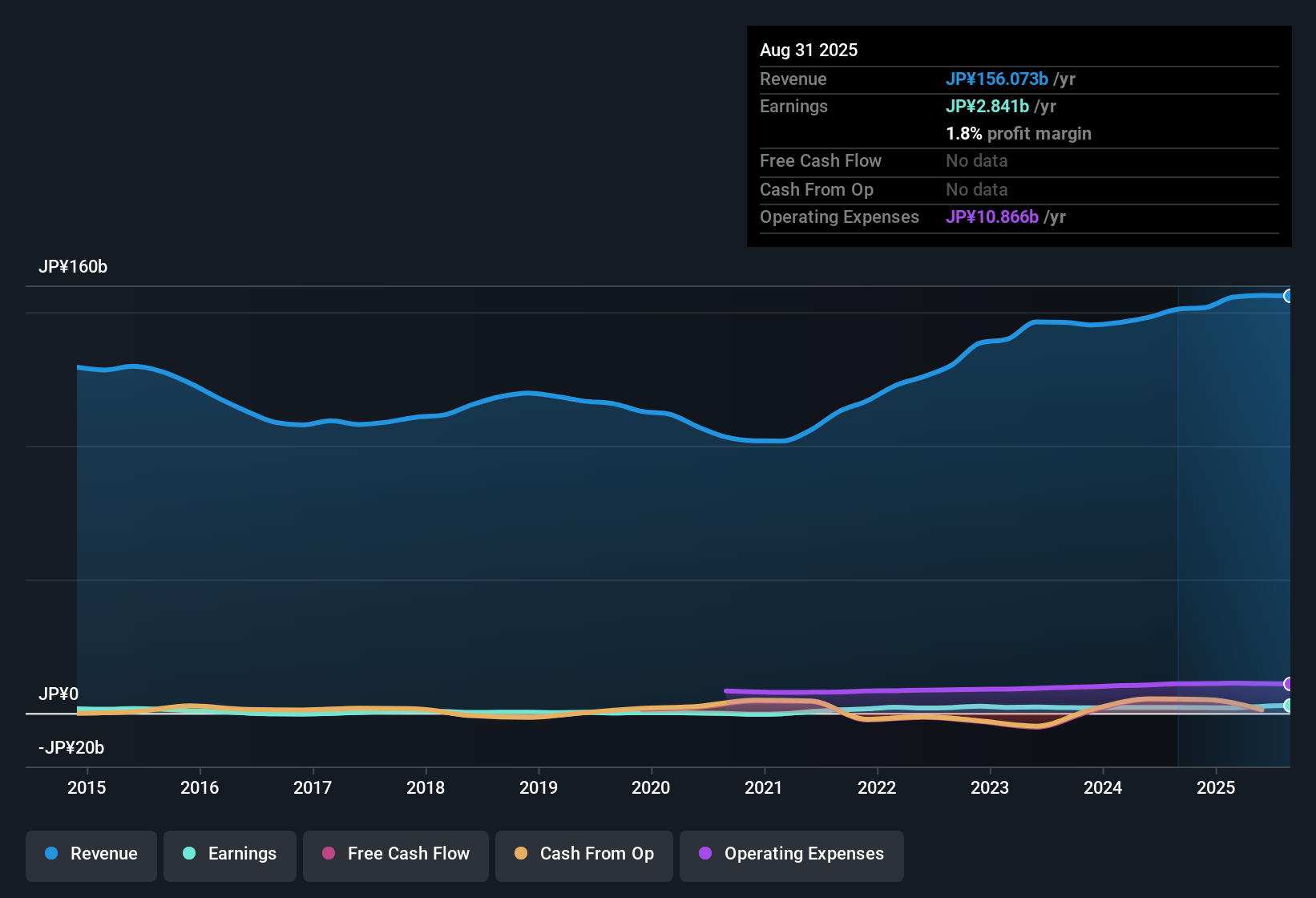

Satori Electric (TSE:7420) delivered high quality earnings, with net profit margins reaching 1.8% compared to 1.4% last year and annual earnings growth accelerating to 31.3%. This outpaced its five-year average of 27.1% per year. The stock trades at a Price-To-Earnings Ratio of 9.3x, which is lower than both its peer group and the broader Japanese electronics industry. However, its current share price of ¥1,844 stands above the estimated fair value of ¥965.75. Investors are likely to see the consistent profit growth and value on offer as strong positives, even as questions remain about the sustainability of the dividend.

See our full analysis for Satori Electric.The next section examines how these earnings compare with broader market trends and explores whether the results support common industry narratives or introduce fresh questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Outpace Historical Average

- Net profit margins have climbed to 1.8%, marking a significant improvement compared to last year’s 1.4% and trending stronger than Satori Electric’s five-year average.

- The latest performance strongly supports the case for ongoing operational strength, as the company has not only sustained profitability but also maintained consistent profit growth that stands out in the electronics sector.

- With a current annual earnings growth rate of 31.3%, above its five-year average of 27.1%, Satori Electric demonstrates a pattern of momentum not typically seen in peers.

- This robust trajectory lends support to views that operational efficiency is a core driver, rather than a short-lived upswing driven by market cycles or external shocks.

Dividend Sustainability Remains in Focus

- The main flagged risk from recent results centers on uncertainty around the sustainability of the dividend, despite a relatively stable financial profile.

- While consistent profit growth underpins positive expectations, critics note that without further clarity on dividend policy and long-term cash allocation, some caution remains warranted.

- The lack of explicit statements regarding dividend increases or steady payouts means some investors may withhold full confidence until the company provides additional detail.

- Bears argue that profit momentum alone does not guarantee uninterrupted future payouts, especially as sector dynamics shift or internal investment priorities compete with distributions.

Share Price Premium Versus DCF Fair Value

- Satori Electric’s share price of ¥1,844 currently stands ahead of its DCF fair value of ¥965.75, indicating the market demands a premium over intrinsic valuation in comparison to industry norms.

- This pricing gap raises key questions for investors, as the prevailing market view acknowledges strong earnings performance while also emphasizing the importance of weighing potential growth against the discipline of valuation.

- The current Price-To-Earnings Ratio of 9.3x is lower than both peer (11.2x) and sector (14.1x) averages; however, market participants have bid up the stock above what a discounted cash flow analysis would justify.

- Investors must balance optimism about sustained profit trends with careful consideration of whether the share price already reflects most of the company’s improvements.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Satori Electric's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust earnings growth, Satori Electric’s shares trade at a substantial premium to their fair value. This raises concerns about overvaluation risks for new investors.

If you want to focus on stocks where the price still looks attractive relative to fundamentals, check out these 881 undervalued stocks based on cash flows for opportunities the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7420

Satori Electric

Distributes electronic parts and equipment in Japan and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives