- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6981

Murata Manufacturing (TSE:6981) Valuation in Focus After Strategic QuantumScape Partnership in Next-Gen Battery Tech

Reviewed by Kshitija Bhandaru

Murata Manufacturing (TSE:6981) is stepping into a new phase by partnering with QuantumScape to accelerate mass production of ceramic separators, a major component for next-generation solid-state batteries. This collaboration is focused on solving operational scale-up challenges.

See our latest analysis for Murata Manufacturing.

Shares in Murata Manufacturing have gained momentum this year, with a 14% share price return over the last month and a 31% surge over the past quarter, outpacing market averages. While the latest year-to-date share price return stands at 12%, the one-year total shareholder return is around 2%. This suggests that the stock’s recent rally is building on long-term, steady but modest gains. Recent news, including the share buyback completed in September, underscores growing confidence in the company's prospects as it pivots into advanced battery materials.

If the latest strategic moves caught your attention, it’s a good time to expand your watchlist and discover fast growing stocks with high insider ownership

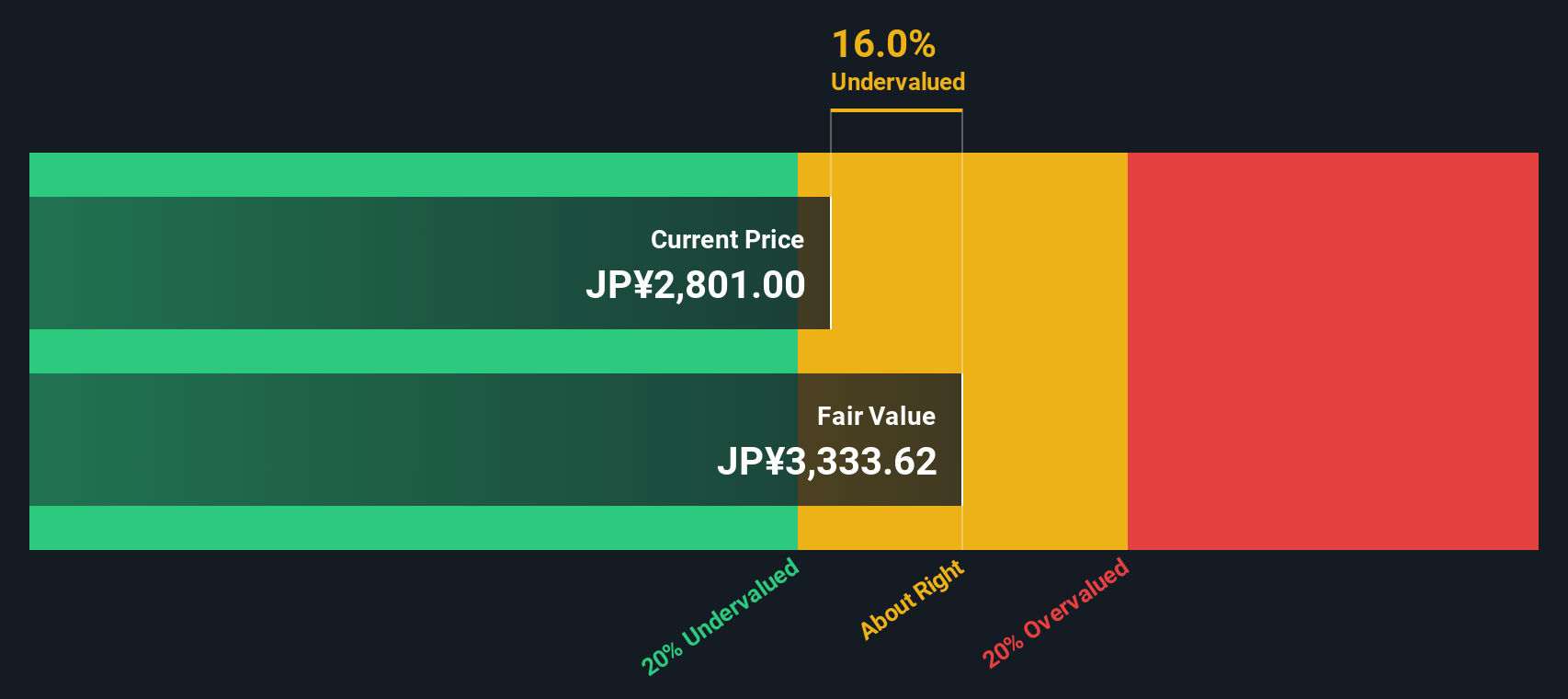

After such a strong rebound, the question for investors is clear: does Murata Manufacturing remain undervalued with more upside to come, or has the recent surge already priced in the company’s growth prospects?

Price-to-Earnings of 23.9x: Is it justified?

Murata Manufacturing currently trades at a price-to-earnings (P/E) ratio of 23.9x, based on its last closing price of ¥2,842. This is significantly lower than its peer group, where the average P/E is 51x. This suggests the market prices Murata at a discount relative to many competitors.

The P/E ratio is a key valuation metric, especially for technology and manufacturing companies like Murata, because it measures how much investors are willing to pay for each yen of earnings. A lower P/E can indicate undervaluation or reflect tempered growth expectations compared to industry peers.

It is notable that Murata’s earnings growth over the past year has been solid and has outpaced its industry. Yet, its P/E ratio remains well below that of peers. This could mean the market is cautious about sustainability, or there may be upside potential if recent operational momentum continues. For comparison, the estimated fair price-to-earnings ratio is 23.7x, which is not far from its current level. The market could potentially move toward this value over time.

Explore the SWS fair ratio for Murata Manufacturing

Result: Price-to-Earnings of 23.9x (UNDERVALUED)

However, slowing revenue growth or unexpected shifts in demand could challenge Murata Manufacturing's ability to sustain its current momentum in the near term.

Find out about the key risks to this Murata Manufacturing narrative.

Another View: SWS DCF Model Offers a Deeper Look

While the P/E ratio paints Murata Manufacturing as relatively undervalued compared to its peers, our DCF model suggests an even larger margin of safety. The SWS DCF model estimates fair value at ¥3,327.73, about 14.6% above the current price. This could hint at untapped upside. However, DCF models rely on future cash flow assumptions. What happens if growth or margins shift more than expected?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Murata Manufacturing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Murata Manufacturing Narrative

If you want to dig into the numbers for yourself or shape your own perspective, you can build a custom Murata Manufacturing view in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Murata Manufacturing.

Looking for More Investment Ideas?

Unlock even more investment opportunities that could give your strategy a winning edge. Don’t sit on the sidelines when there are standout stocks to consider right now.

- Capitalize on high yields by targeting income opportunities through these 19 dividend stocks with yields > 3% with attractive returns above 3%.

- Stay ahead in AI innovation by checking out these 24 AI penny stocks setting the pace in artificial intelligence advancements.

- Tap into tomorrow’s breakthrough technology by tracking these 26 quantum computing stocks making strides in the quantum computing race.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6981

Murata Manufacturing

Develops, manufactures, and sells ceramic-based passive electronic components and solutions in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives