- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6981

Assessing Murata Manufacturing (TSE:6981) Valuation After Recent Share Price Fluctuations

Reviewed by Simply Wall St

Price-to-Earnings of 20.8x: Is it justified?

On a price-to-earnings (P/E) basis, Murata Manufacturing trades above the Japanese electronic industry average. This signals the market views it as relatively expensive compared to domestic sector peers.

The P/E ratio reflects what investors are willing to pay for one unit of current or projected earnings. For manufacturing firms, especially in tech, it is a key gauge of whether the market expects future growth, improved profitability, or just stability compared to competitors.

Murata’s elevated P/E could mean there is confidence in its earnings resilience and innovation pipeline. It may also suggest investors are already paying up for expected progress, which adds pressure to deliver on those expectations.

Result: Fair Value of ¥2,770.00 (ABOUT RIGHT)

See our latest analysis for Murata Manufacturing.However, slowing revenue growth or falling short of earnings expectations could quickly shift market sentiment and pose risks to Murata’s current valuation.

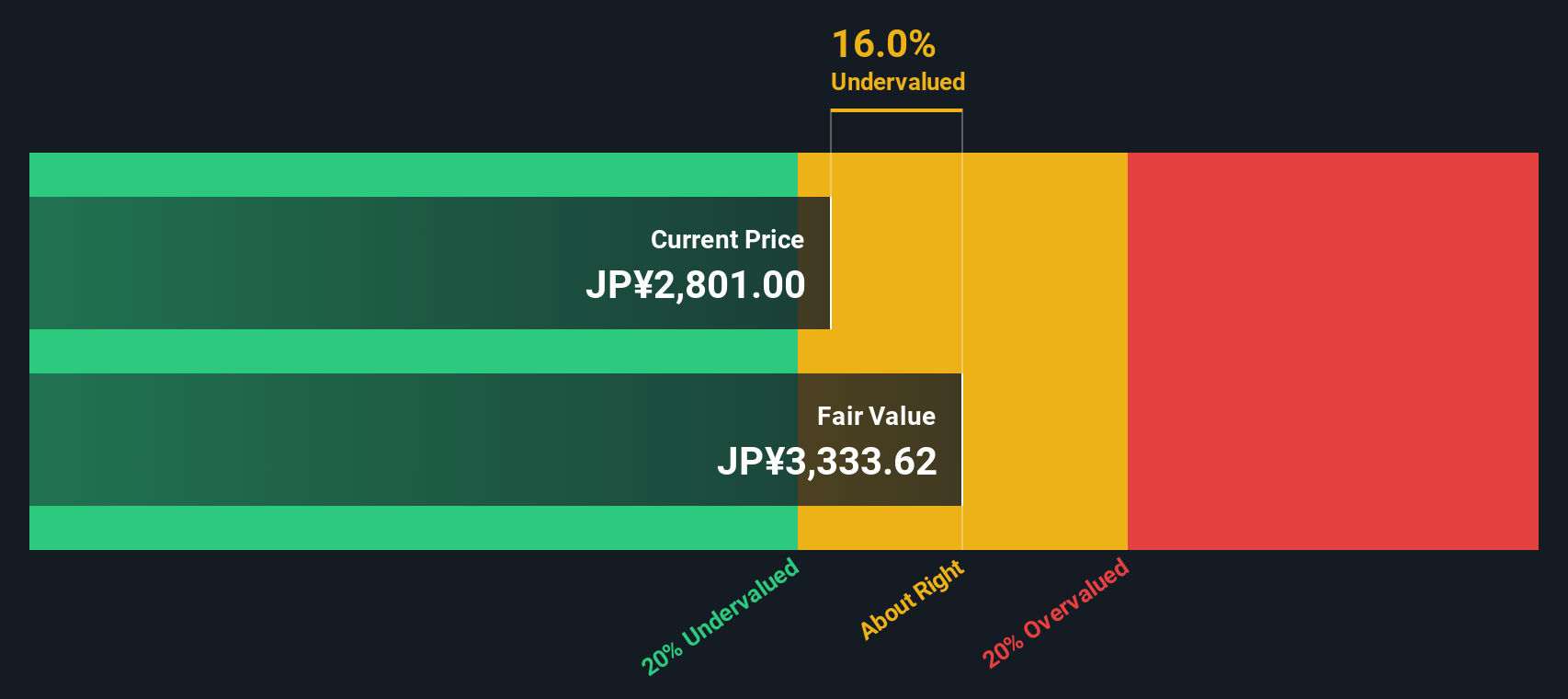

Find out about the key risks to this Murata Manufacturing narrative.Another View: SWS DCF Model Tells a Different Story

Looking from a different perspective, our DCF model highlights a potentially undervalued situation for Murata Manufacturing, which challenges the conclusion drawn from earnings multiples. Do market expectations overlook something that the DCF is capturing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Murata Manufacturing Narrative

If you see things differently or want to dig deeper into the numbers, you can dive in and craft your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Murata Manufacturing.

Looking for more investment ideas?

Why settle for just one potential win when you can discover more? Explore opportunities across innovative sectors with Simply Wall Street’s curated stock ideas below.

- Find high-growth potential in today's market by focusing on shares with stable cash flows and attractive prices, using our list of undervalued stocks based on cash flows.

- Benefit from tech trends that are changing healthcare by identifying companies transforming patient care and diagnostics, all featured in our healthcare AI stocks.

- Start your portfolio’s income stream with companies offering standout yields above 3 percent, showcased in our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:6981

Murata Manufacturing

Develops, manufactures, and sells ceramic-based passive electronic components and solutions in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives