- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6971

Kyocera (TSE:6971) Valuation After Completing Major 1.85% Share Buyback Program

Reviewed by Kshitija Bhandaru

Kyocera (TSE:6971) just finished buying back 26,114,100 shares, which is roughly 1.85% of its outstanding shares, wrapping up its announced repurchase program between July and September 2025. This move can shape investor sentiment around the stock.

See our latest analysis for Kyocera.

Kyocera’s latest buyback comes on the heels of a steady build-up in momentum, with its 90-day share price return of 23.8% helping lift the one-year total return to just over 20%. Although the past month saw a slight dip, this recent step shows management’s confidence in the longer-term outlook and may further reshape how investors perceive the stock’s value.

If Kyocera’s strong run has you rethinking your portfolio, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

But with shares up nearly 24% over the past three months and the buyback program complete, is Kyocera now trading below its true worth, or is the market already pricing in all that future growth?

Price-to-Earnings of 112.8x: Is it justified?

Kyocera is currently trading at a price-to-earnings (P/E) ratio of 112.8x, well above both industry peers and its own fair value range. With the last close at ¥1,995, the market seems to be demanding a high premium for its shares.

The P/E ratio compares a company's current share price to its earnings per share, offering a snapshot of how highly investors value the company’s profit potential. For Kyocera, this multiple greatly exceeds what’s typical in the JP Electronic industry, signaling the market may be anticipating significant profit growth or overlooking risks.

Zooming out, Kyocera’s P/E ratio is not just high by sector standards; it dwarfs the Electronic industry’s average of 14.1x and even its fair P/E estimate of 27.1x. The current level may not be sustainable as investor optimism faces future earnings realities. If sentiment changes, there is plenty of room for this multiple to compress toward its fair value.

Explore the SWS fair ratio for Kyocera

Result: Price-to-Earnings of 112.8x (OVERVALUED)

However, slower annual revenue growth and a slight recent dip in share price could challenge the current optimism if these trends persist.

Find out about the key risks to this Kyocera narrative.

Another View: What Does Our DCF Model Say?

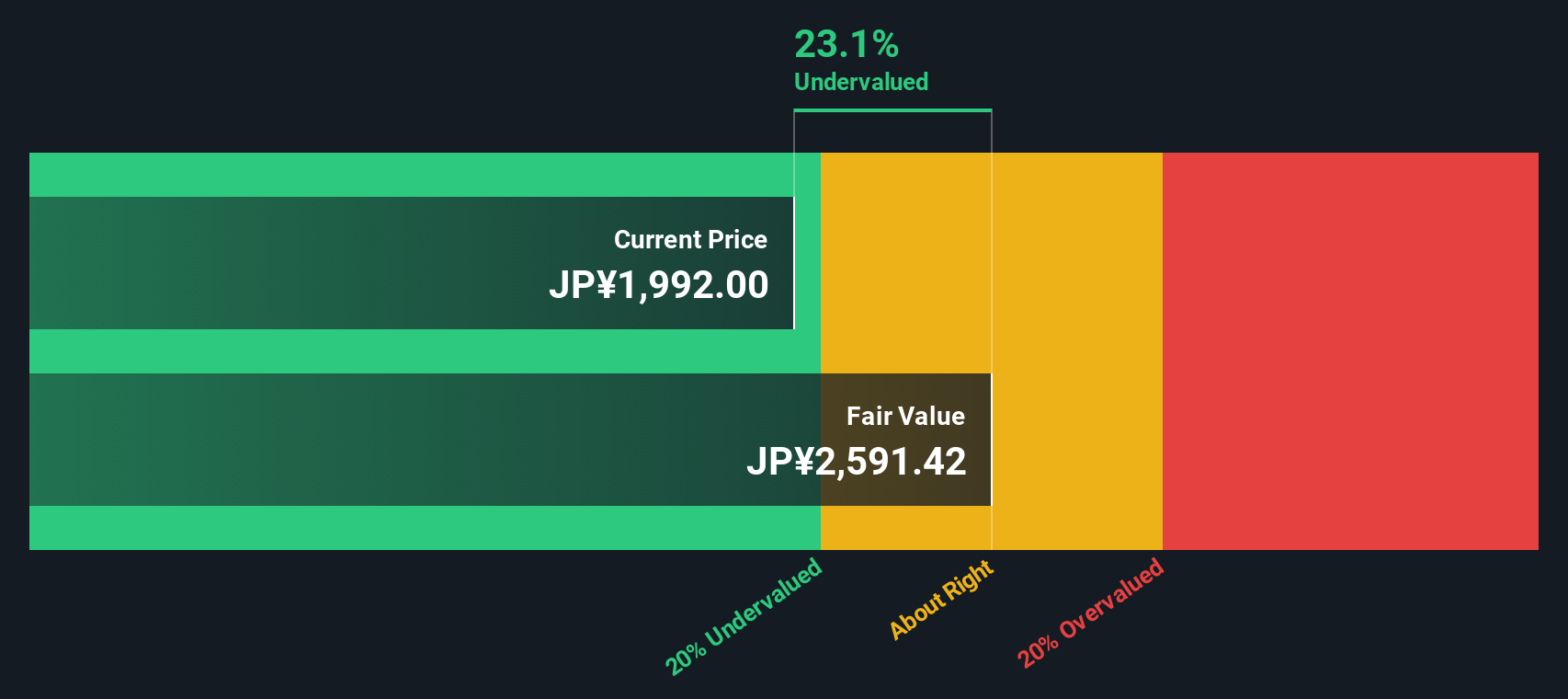

Switching gears to the SWS DCF model presents a very different picture. With this approach, Kyocera appears undervalued, trading 23.2% below our fair value estimate of ¥2,598.7. This suggests the market’s premium on earnings could be overstated or there may be hidden potential yet to be recognized. Which story will play out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kyocera for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kyocera Narrative

If you see things differently or want to dig into the numbers your own way, you can craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your Kyocera research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Opportunities?

If you want to stay a step ahead, don’t just stop at Kyocera. Tap into powerful new themes transforming today’s stock market with just a few clicks.

- Capitalize on long-term trends and boost your ROI by checking out these 18 dividend stocks with yields > 3% offering reliable yields above 3%.

- Strengthen your portfolio with next-generation healthcare disruptors by reviewing these 33 healthcare AI stocks changing medical technology through artificial intelligence.

- Stay ahead of digital currency momentum and cut through the noise as you analyze these 79 cryptocurrency and blockchain stocks delivering genuine innovation and blockchain exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyocera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6971

Kyocera

Develops and sells products based on fine ceramic technologies in Japan, China, rest of Asia, Europe, the United States, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives