- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6866

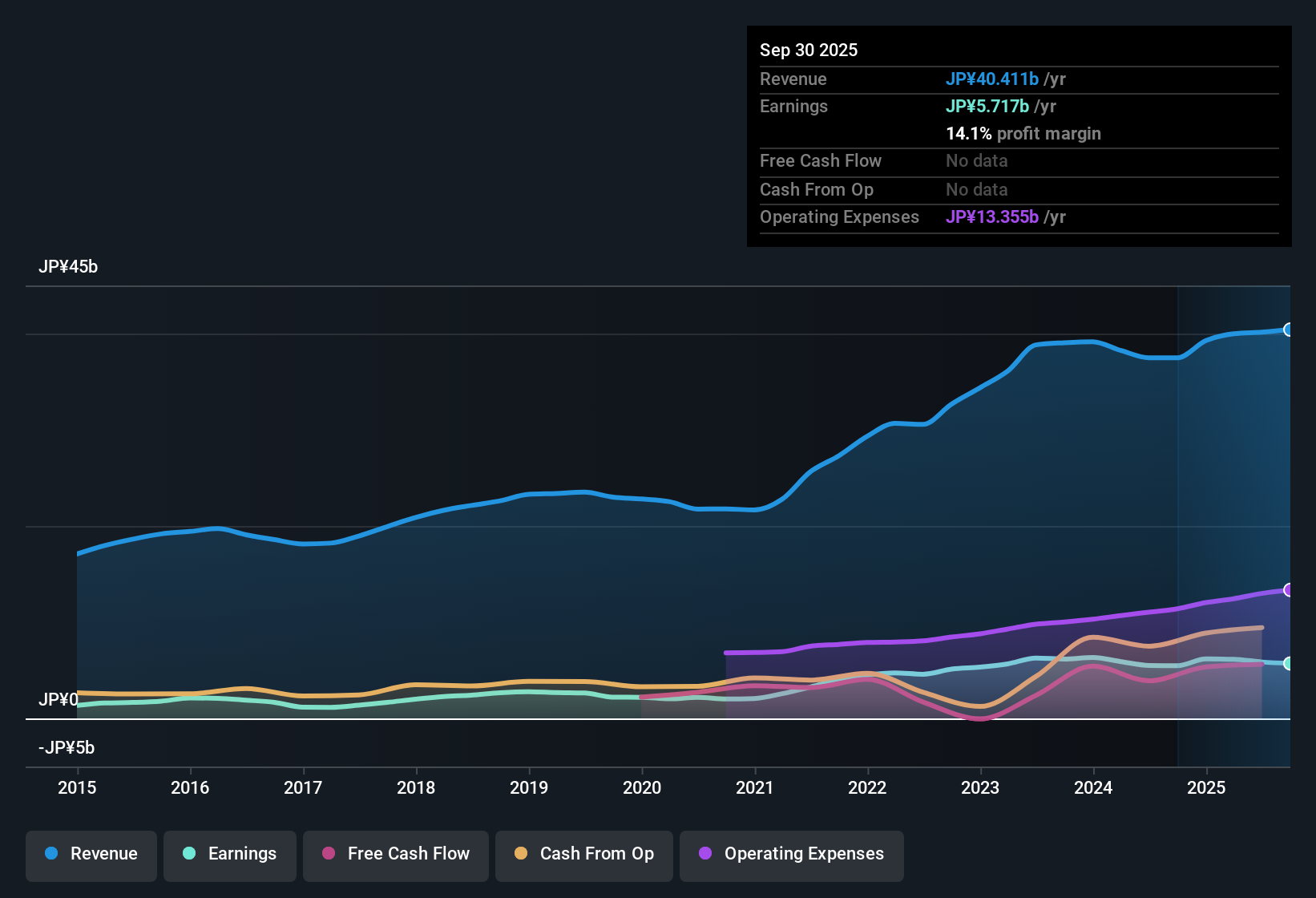

Hioki E.E (TSE:6866) Net Profit Margin Declines to 14.1%, Underscoring Durable Growth Narrative

Reviewed by Simply Wall St

Hioki E.E (TSE:6866) has seen its earnings grow by an impressive 15.5% per year over the past five years, though the most recent profit growth came in at 3.4%, lagging the longer-term average. The company’s earnings are forecast to grow at 9.7% per year, ahead of the Japanese market’s 8.1%. Revenue is expected to rise 7.5% annually, also outpacing the market. Although the net profit margin slipped to 14.1% from last year’s 14.7%, Hioki E.E’s high quality earnings and attractive valuation metrics continue to be supported by both its relative industry standing and growth outlook.

See our full analysis for Hioki E.E.Up next, we will look at how Hioki E.E’s numbers measure up to the key narratives shaping investor sentiment and expectations, highlighting where the market view gets validated and where surprises might emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Stays Solid Despite Mild Dip

- Hioki E.E’s net profit margin of 14.1% this period reflects a modest decrease from last year’s 14.7%, but remains robust for its sector and signals consistent profitability even as overall profit growth slightly lagged its five-year average.

- Positive sentiment centers on Hioki E.E's track record for quality and disciplined management,

- The company is seen as a steady growth option in digital automation trends, with evidence that margins are holding up even as market conditions shift.

- This aligns with the narrative that Hioki focuses on long-term reliability over hype, offering incremental upside for risk-averse investors.

Growth Forecast Edges Past Market

- Earnings are projected to rise at 9.7% per year and revenue at 7.5% per year, both comfortably ahead of the respective Japanese market forecasts of 8.1% and 4.4%, highlighting management’s expectation that Hioki can outpace its local peers in core operating metrics.

- Long-term investors highlight that Hioki’s revenue and profit outlook are underpinned by sector megatrends like electrification and automation,

- Steady annual growth projections above the market average reinforce the view that Hioki is positioned as a “stable innovator” able to benefit from tailwinds without relying on speculative leaps.

- Though recent earnings growth slowed, sector alignment and conservative guidance support a narrative of durability and compounding returns.

Valuation Attractive Versus Peers and Fair Value

- Hioki trades below its estimated DCF fair value of 8,973.40 and is also considered a good relative buy based on industry and peer Price-to-Earnings ratios, while the current share price is 5,900.00.

- Investors favor the combination of stable growth, strong quality metrics, and a discount to intrinsic value,

- This valuation gap heavily supports the case that Hioki is not pricing in its competitive advantages and sector positioning despite strong business fundamentals.

- Potential concerns about dividend sustainability have not impacted the risk-reward balance for those prioritizing long-term value.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Hioki E.E's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Hioki E.E’s recent slowdown in profit growth and slightly declining margins suggest it may struggle to deliver the same steady gains as in prior years.

If you want to focus on companies that maintain robust and consistent earnings and revenue growth, use our stable growth stocks screener (2097 results) to find businesses built for reliable long-term performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hioki E.E might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6866

Hioki E.E

Develops, manufactures, sells, and services electrical measuring instruments in Japan, China, rest of Asia, America, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives