- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6856

HORIBA (TSE:6856): Assessing Valuation After a Strong 60% Share Price Gain This Year

Reviewed by Simply Wall St

HORIBA (TSE:6856) has quietly turned into one of Japan’s stronger compounders, with the share price climbing over 60% this year and roughly 76% over the past year on steady earnings growth.

See our latest analysis for HORIBA.

That sharp move has not come out of nowhere, with investors rewarding both HORIBA’s solid earnings progress and steady demand for its semiconductor and environmental testing equipment, as the 90 day share price return of just over 30 percent shows.

If HORIBA’s strong run has you thinking about what else could surprise to the upside, this is a good moment to explore high growth tech and AI stocks as potential next candidates.

With the share price now hovering just below analyst targets but still trading at a notable intrinsic discount, is HORIBA flashing an overlooked buying opportunity, or is the market already banking on years of future growth?

Price-to-Earnings of 16.5x: Is it justified?

Anchored by a last close of ¥14,820, HORIBA trades on a 16.5x price-to-earnings multiple, hinting at modest undervaluation versus select benchmarks.

The price-to-earnings ratio compares the company’s market price with its earnings. This makes it a useful shorthand for what investors are willing to pay for each unit of profit, especially for profitable, established businesses like HORIBA.

In HORIBA’s case, the current 16.5x multiple sits below both the peer average of 18.8x and our estimated fair price-to-earnings ratio of 18.5x. This suggests the market is not fully pricing in its consistent earnings growth and improving profit margins, even though it screens as more expensive than the broader Japanese Electronic industry average of 14.4x.

Relative to the sector, that means investors are attaching a premium versus the typical electronics name. However, there may still be room for the share price multiple to move closer to the higher peer and fair ratio levels if earnings momentum continues.

Explore the SWS fair ratio for HORIBA

Result: Price-to-Earnings of 16.5x (UNDERVALUED)

However, investors should still consider risks such as cyclicality in semiconductor equipment demand and potential policy shifts affecting energy and environmental spending pipelines.

Find out about the key risks to this HORIBA narrative.

Another View Using Our DCF Model

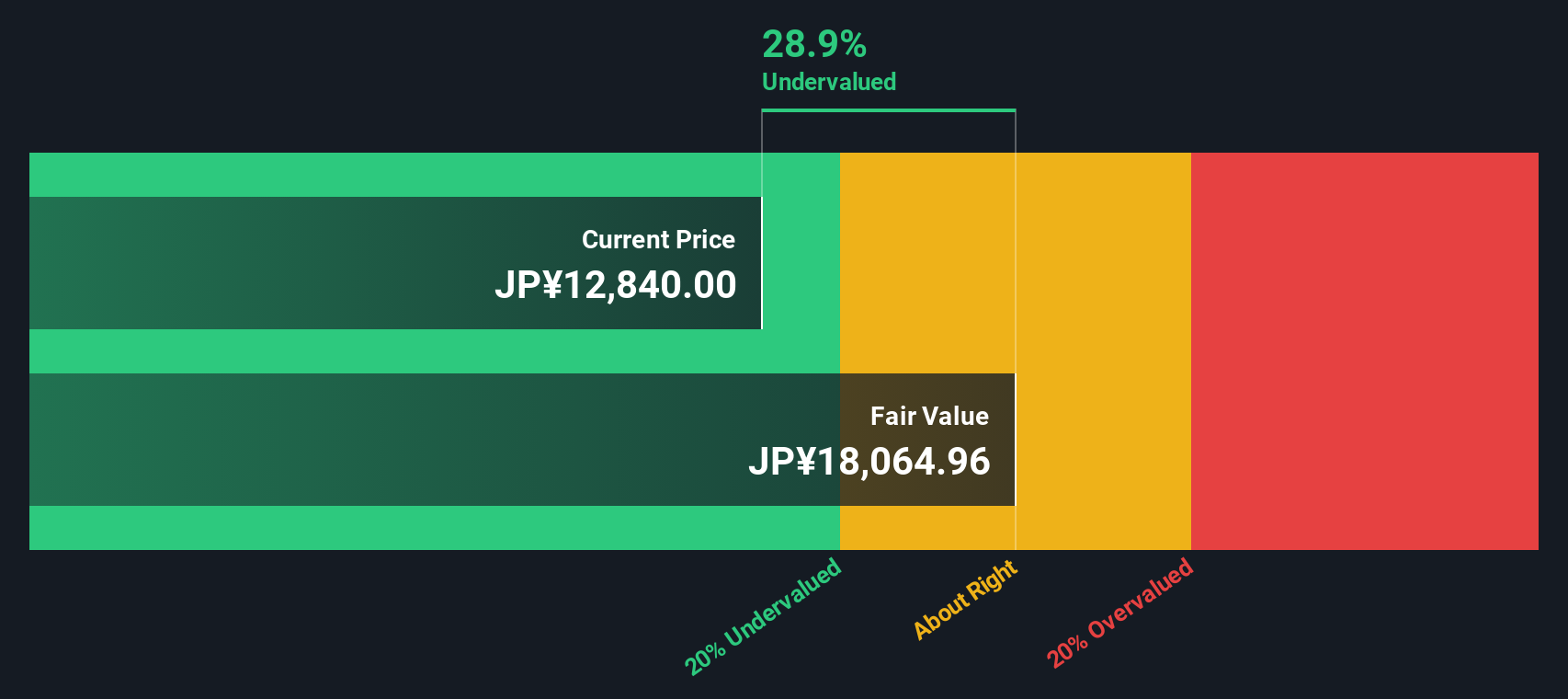

Our DCF model paints an even stronger picture, suggesting HORIBA is trading around 17.7% below its fair value at roughly ¥18,005. While that supports the earnings based undervaluation story, it also raises a tougher question: how much of this gap can realistically close?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HORIBA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HORIBA Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes, starting with Do it your way.

A great starting point for your HORIBA research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investing edge?

Turn today’s HORIBA insight into a wider strategy by using the Simply Wall St Screener, so you do not miss the market’s next quiet outperformers.

- Capture mispriced opportunities early by targeting these 927 undervalued stocks based on cash flows that pair solid fundamentals with meaningful upside potential.

- Position yourself for the next technology shift by focusing on these 24 AI penny stocks shaping automation, data intelligence, and long term productivity gains.

- Strengthen your portfolio’s income engine with these 14 dividend stocks with yields > 3% that balance attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HORIBA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6856

HORIBA

Provides analytical and measurement solutions in Japan and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026