In the current global market landscape, characterized by declining consumer confidence and heightened economic uncertainty, investors are increasingly seeking stability amidst volatility. Dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive option for those looking to enhance their portfolios in such uncertain times.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.44% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.01% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.08% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.05% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.05% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.32% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.27% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.22% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.51% | ★★★★★★ |

Click here to see the full list of 1412 stocks from our Top Global Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Sakata INX (TSE:4633)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sakata INX Corporation manufactures and sells a range of printing inks and auxiliary agents both in Japan and internationally, with a market cap of ¥93.41 billion.

Operations: Sakata INX Corporation generates revenue from several segments, including Printing Ink in Asia (¥58.28 billion), Europe (¥21.45 billion), and the Americas (¥87.86 billion), as well as Digital and Specialty Products (¥19.41 billion) and Printing Ink Equipment in Japan (¥52.81 billion).

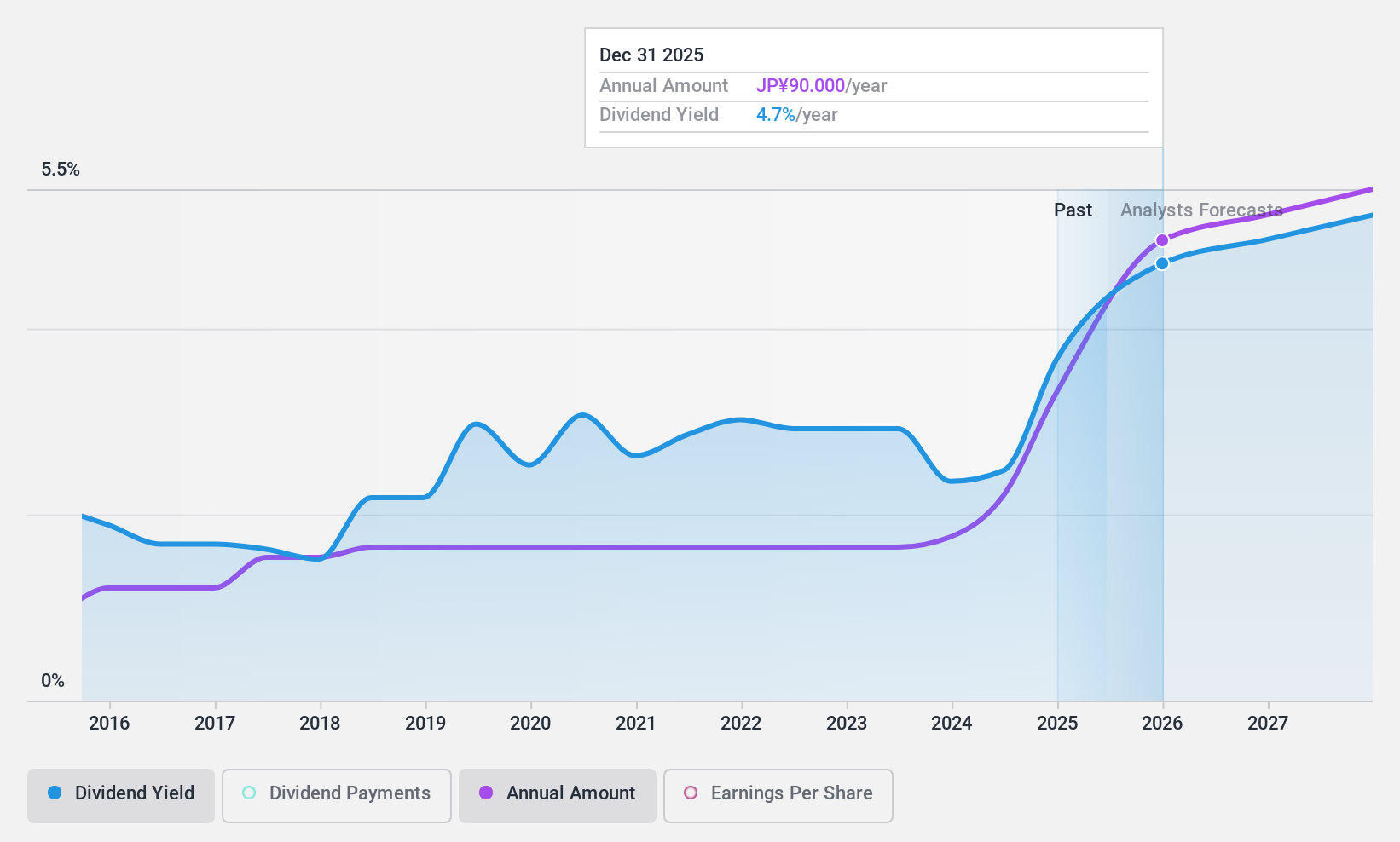

Dividend Yield: 4.6%

Sakata INX's dividends have been stable and reliable over the past decade, with a recent increase in guidance to JPY 45 per share for 2024, up from JPY 30. Despite a high cash payout ratio of 299.1%, its low earnings payout ratio of 38.8% suggests dividends are well covered by earnings but not by free cash flows. The dividend yield of 4.63% is among the top in Japan, though sustainability concerns persist due to cash flow coverage issues.

- Unlock comprehensive insights into our analysis of Sakata INX stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Sakata INX is priced lower than what may be justified by its financials.

Tokyo Tekko (TSE:5445)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tokyo Tekko Co., Ltd. manufactures and sells steel products for the construction industry in Japan, with a market cap of ¥53.03 billion.

Operations: Tokyo Tekko Co., Ltd.'s revenue primarily comes from its Steel Business segment, which generated ¥83.37 billion.

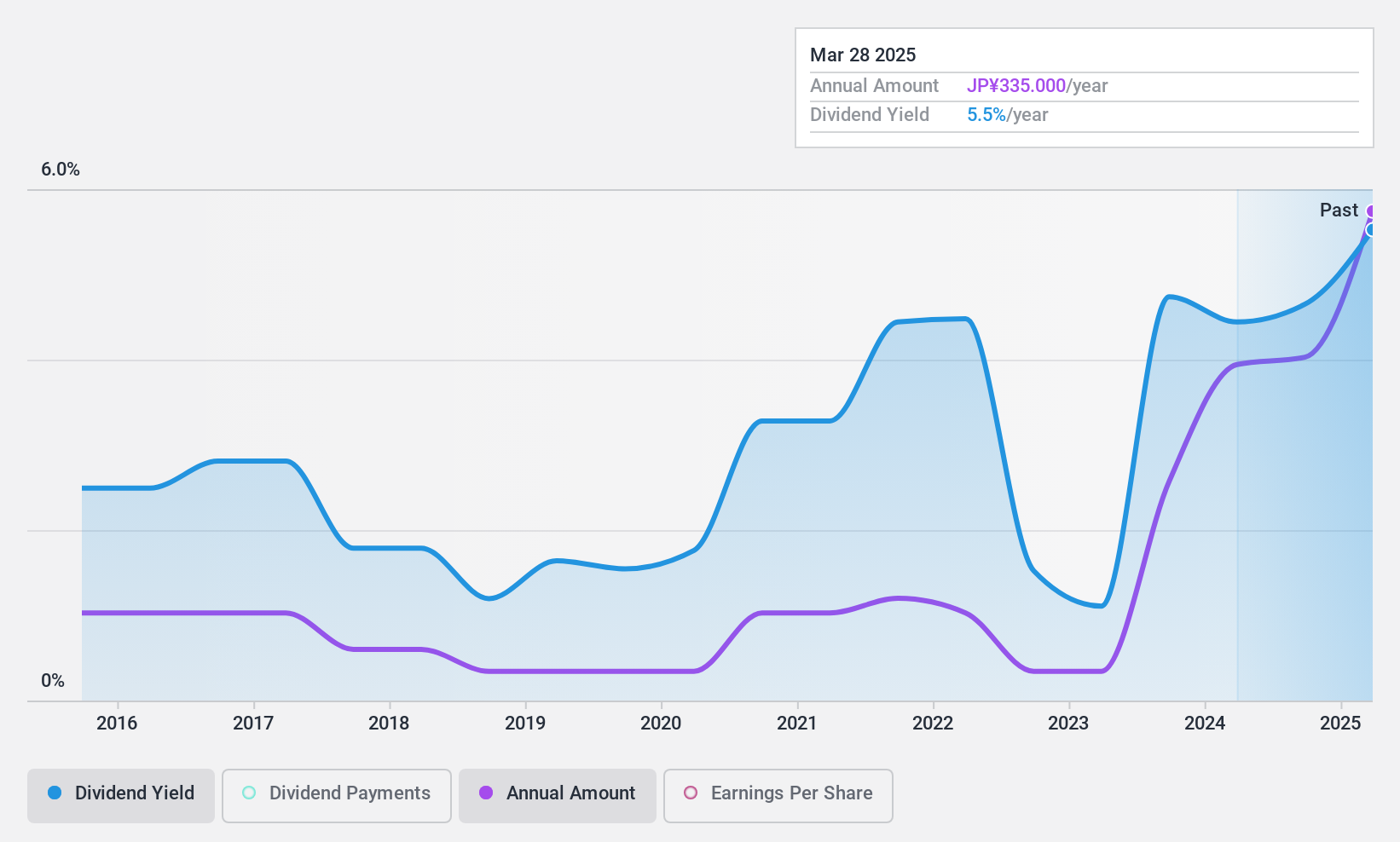

Dividend Yield: 5.4%

Tokyo Tekko's dividend yield of 5.38% places it among the top 25% in Japan, although its dividend history has been volatile over the past decade. Despite this instability, dividends are well covered by earnings and cash flows, with payout ratios of 27.1% and 32.5%, respectively. The recent buyback of shares for ¥499.41 million may signal management's confidence in financial stability, yet investors should be cautious due to historical volatility in payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Tokyo Tekko.

- Upon reviewing our latest valuation report, Tokyo Tekko's share price might be too pessimistic.

Furuno Electric (TSE:6814)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Furuno Electric Co., Ltd. manufactures and sells marine and industrial electronics equipment, wireless LAN systems, and handy terminals across Japan, the Americas, Europe, Asia, and internationally with a market cap of ¥79.03 billion.

Operations: Furuno Electric Co., Ltd.'s revenue segments include the manufacture and sale of marine and industrial electronics equipment, wireless LAN systems, and handy terminals across various global markets.

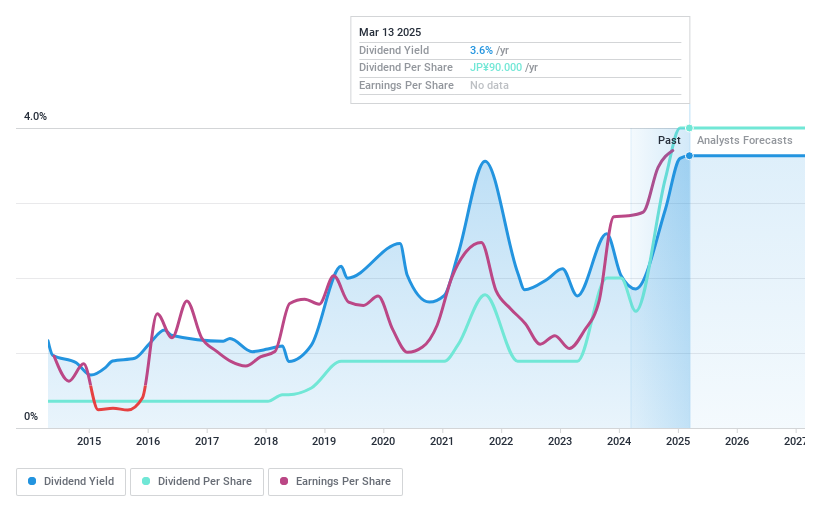

Dividend Yield: 3%

Furuno Electric's dividend yield of 3.01% is below the top tier in Japan, and its dividend history has been volatile over the past decade. Despite this, dividends are well covered by earnings and cash flows, with payout ratios of 14.6% and 73.5%, respectively. The company's price-to-earnings ratio of 9.1x suggests good value compared to the broader market, although investors should consider its historically unstable dividend track record when evaluating potential returns.

- Click here and access our complete dividend analysis report to understand the dynamics of Furuno Electric.

- The analysis detailed in our Furuno Electric valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Dive into all 1412 of the Top Global Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4633

Sakata INX

Manufactures and sells various printing inks and auxiliary agents in Japan, Asia, the America, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)