- Japan

- /

- Capital Markets

- /

- TSE:8704

Three Japanese Dividend Stocks Offering Up To 3.8% Yield

Reviewed by Simply Wall St

Amid a backdrop of modest declines in Japanese stock markets and heightened uncertainty around the Bank of Japan's monetary policy directions, investors may find reassurance and potential stability in dividend-yielding stocks. These stocks can offer a semblance of predictability in returns, which could be particularly appealing given the current economic uncertainties and market fluctuations.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.87% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.59% | ★★★★★★ |

| Globeride (TSE:7990) | 3.72% | ★★★★★★ |

| Open House Group (TSE:3288) | 3.48% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.77% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.11% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.18% | ★★★★★★ |

| Seibu Electric & Machinery (TSE:6144) | 4.36% | ★★★★★★ |

| Nichimo (TSE:8091) | 4.16% | ★★★★★★ |

| Innotech (TSE:9880) | 4.04% | ★★★★★★ |

Click here to see the full list of 387 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

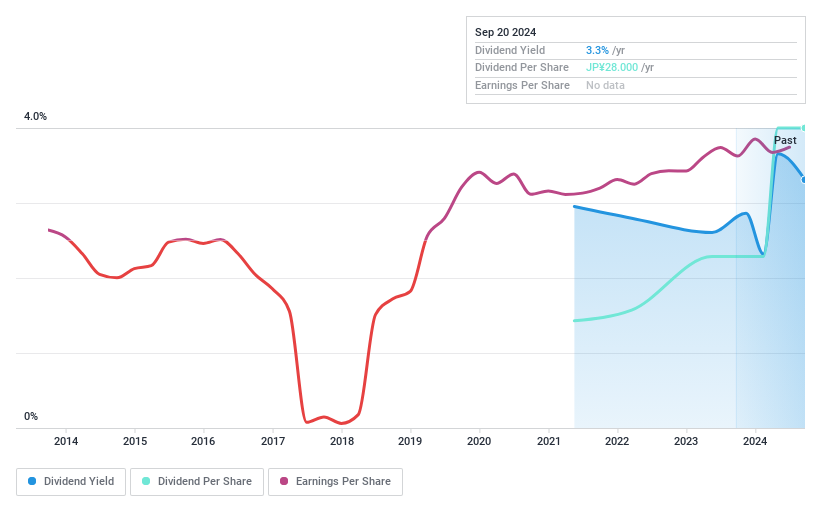

HITO-Communications HoldingsInc (TSE:4433)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HITO-Communications HoldingsInc operates in outsourcing, temporary staffing, e-commerce support, and wholesale sectors both domestically and internationally, with a market capitalization of ¥16.93 billion.

Operations: HITO-Communications HoldingsInc generates revenue through activities in outsourcing, temporary staffing, e-commerce support, and wholesale sectors across global markets.

Dividend Yield: 3.4%

HITO-Communications HoldingsInc. maintains a conservative payout ratio of 30.9%, ensuring dividends are well-covered by earnings and cash flows, with a cash payout ratio at 26.4%. Dividends have shown stability and reliability over the past decade, though recent profit margins dipped to 1.5% from last year's 4.3%. The dividend yield stands at 3.44%, slightly below the top quartile in Japan's market by just 0.01%. Despite this, earnings are expected to grow by an annual rate of 23.79%.

- Delve into the full analysis dividend report here for a deeper understanding of HITO-Communications HoldingsInc.

- Our comprehensive valuation report raises the possibility that HITO-Communications HoldingsInc is priced higher than what may be justified by its financials.

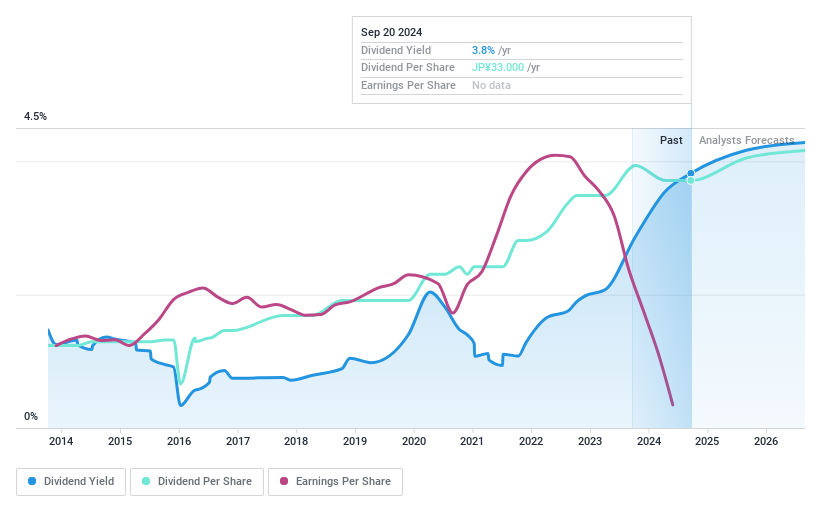

SMK (TSE:6798)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SMK Corporation, with a market cap of ¥16.16 billion, specializes in manufacturing and selling parts for electro-communication devices and electronic equipment across Japan, Asia, North America, and Europe.

Operations: SMK Corporation generates ¥20.59 billion from its Connection Systems segment and ¥25.54 billion from its Sensing, Communication & Interface division.

Dividend Yield: 3.8%

SMK Corporation's dividend profile presents challenges with a recent cut from JPY 100 to JPY 50 per share, reflecting underlying financial struggles including projected operating losses through March 2025. Despite these issues, the dividend yield remains competitive at 3.85%, above the market average of 3.45%. The dividends are reasonably supported by cash flows with a cash payout ratio of 49.5%, but overall earnings do not cover these payments, indicating potential sustainability concerns if financial performance doesn't improve.

- Unlock comprehensive insights into our analysis of SMK stock in this dividend report.

- In light of our recent valuation report, it seems possible that SMK is trading behind its estimated value.

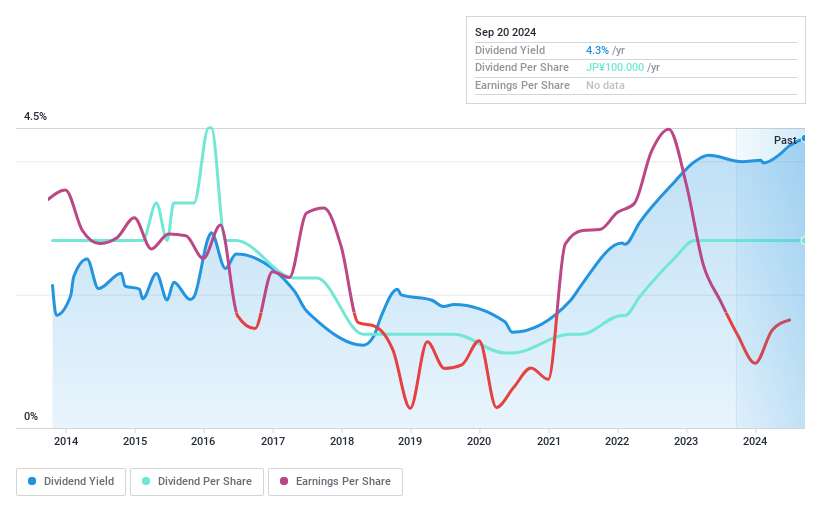

Traders HoldingsLtd (TSE:8704)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Traders Holdings Co., Ltd. operates in Japan, focusing on foreign exchange and securities trading, with a market capitalization of approximately ¥20.17 billion.

Operations: Traders Holdings Co., Ltd. generates revenue primarily from its Financial Instruments Trading Business, which brought in ¥9.87 billion, and its System Development and System Consulting Business, contributing ¥2.61 billion.

Dividend Yield: 3.8%

Traders Holdings Ltd. has demonstrated a growing dividend, increasing from JPY 8.00 to JPY 12.00 per share for the second quarter-end of FY2025, despite a recent cut in annual dividend from JPY 17.00 to JPY 16.00 per share as of FY2024 end. With earnings growth of 20.8% annually over the past five years and forecasts suggesting operating revenue reaching JPY 11.80 billion by March 2025, the dividends appear sustainable with low payout ratios: earnings at 20.4% and cash flows at 16.4%.

- Click here to discover the nuances of Traders HoldingsLtd with our detailed analytical dividend report.

- Our valuation report here indicates Traders HoldingsLtd may be undervalued.

Taking Advantage

- Unlock our comprehensive list of 387 Top Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Traders HoldingsLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Traders HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8704

Traders HoldingsLtd

Through its subsidiaries, engages in the foreign exchange and securities trading activities in Japan.

Excellent balance sheet and good value.