- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6742

Kyosan Electric Manufacturing Co., Ltd. (TSE:6742) Looks Inexpensive After Falling 31% But Perhaps Not Attractive Enough

Kyosan Electric Manufacturing Co., Ltd. (TSE:6742) shares have had a horrible month, losing 31% after a relatively good period beforehand. Longer-term shareholders would now have taken a real hit with the stock declining 5.4% in the last year.

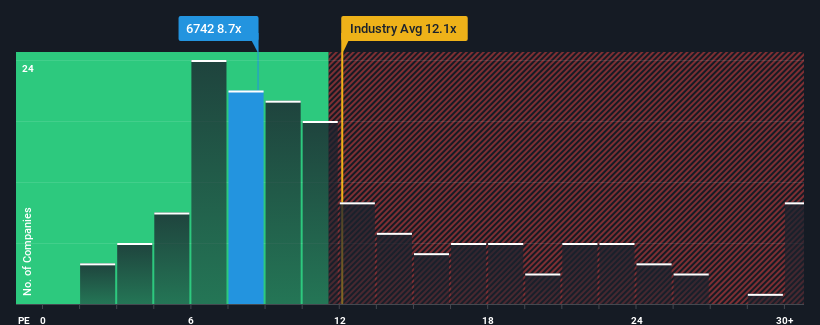

Although its price has dipped substantially, Kyosan Electric Manufacturing's price-to-earnings (or "P/E") ratio of 8.7x might still make it look like a buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 14x and even P/E's above 21x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's exceedingly strong of late, Kyosan Electric Manufacturing has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Kyosan Electric Manufacturing

What Are Growth Metrics Telling Us About The Low P/E?

Kyosan Electric Manufacturing's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered an exceptional 66% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.8% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Kyosan Electric Manufacturing is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

The softening of Kyosan Electric Manufacturing's shares means its P/E is now sitting at a pretty low level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Kyosan Electric Manufacturing revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Kyosan Electric Manufacturing is showing 4 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If these risks are making you reconsider your opinion on Kyosan Electric Manufacturing, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kyosan Electric Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6742

Kyosan Electric Manufacturing

Develops, manufactures, and sells electromechanical interlocking, road traffic signal equipment, and cuprous oxide rectifiers in Japan and internationally.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Community Narratives