- Japan

- /

- Tech Hardware

- /

- TSE:6724

These 4 Measures Indicate That Seiko Epson (TSE:6724) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Seiko Epson Corporation (TSE:6724) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Seiko Epson

What Is Seiko Epson's Debt?

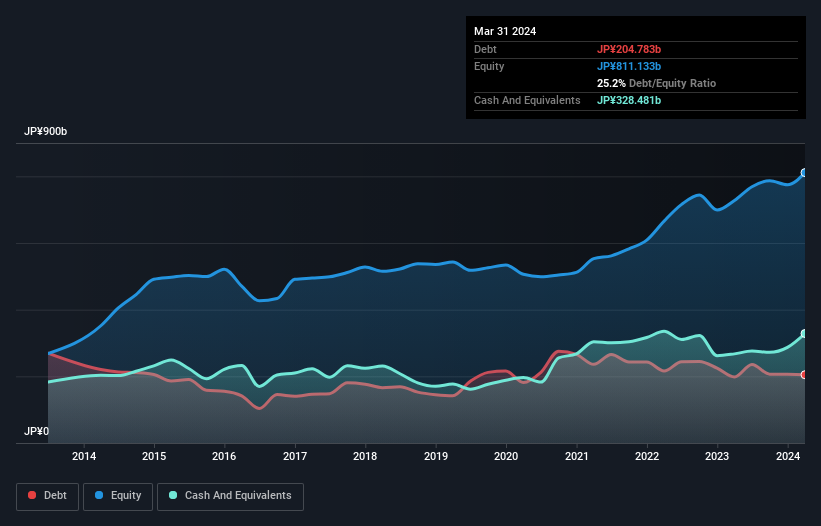

As you can see below, Seiko Epson had JP¥204.8b of debt, at March 2024, which is about the same as the year before. You can click the chart for greater detail. But it also has JP¥328.5b in cash to offset that, meaning it has JP¥123.7b net cash.

How Strong Is Seiko Epson's Balance Sheet?

We can see from the most recent balance sheet that Seiko Epson had liabilities of JP¥372.4b falling due within a year, and liabilities of JP¥229.6b due beyond that. Offsetting these obligations, it had cash of JP¥328.5b as well as receivables valued at JP¥222.9b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by JP¥50.6b.

Of course, Seiko Epson has a market capitalization of JP¥802.0b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, Seiko Epson also has more cash than debt, so we're pretty confident it can manage its debt safely.

The modesty of its debt load may become crucial for Seiko Epson if management cannot prevent a repeat of the 39% cut to EBIT over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Seiko Epson's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Seiko Epson may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the most recent three years, Seiko Epson recorded free cash flow worth 73% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Summing Up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Seiko Epson has JP¥123.7b in net cash. And it impressed us with free cash flow of JP¥109b, being 73% of its EBIT. So we don't have any problem with Seiko Epson's use of debt. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Seiko Epson's dividend history, without delay!

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6724

Seiko Epson

Develops, manufactures, sells, and provides services for products in the printing solutions, visual communications, manufacturing-related and wearables, and other businesses.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026