In a week marked by cautious commentary from the Federal Reserve and political uncertainty over a potential government shutdown, global markets have experienced notable volatility. Despite these challenges, dividend stocks continue to attract investors seeking steady income streams and potential resilience during turbulent times. A good dividend stock in such an environment is one that not only offers reliable payouts but also demonstrates financial stability and the ability to weather economic fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.20% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1935 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Daicel (TSE:4202)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Daicel Corporation operates in the materials, medical/healthcare, smart, safety, and engineering plastics sectors across Japan, China, and internationally with a market cap of ¥371.92 billion.

Operations: Daicel Corporation's revenue is primarily derived from its Engineering Plastics Business at ¥242.85 billion, followed by the Material Business at ¥195.47 billion, Safety Business at ¥95.51 billion, Smart Business at ¥35.82 billion, and Medical/Healthcare sector contributing ¥14.24 billion.

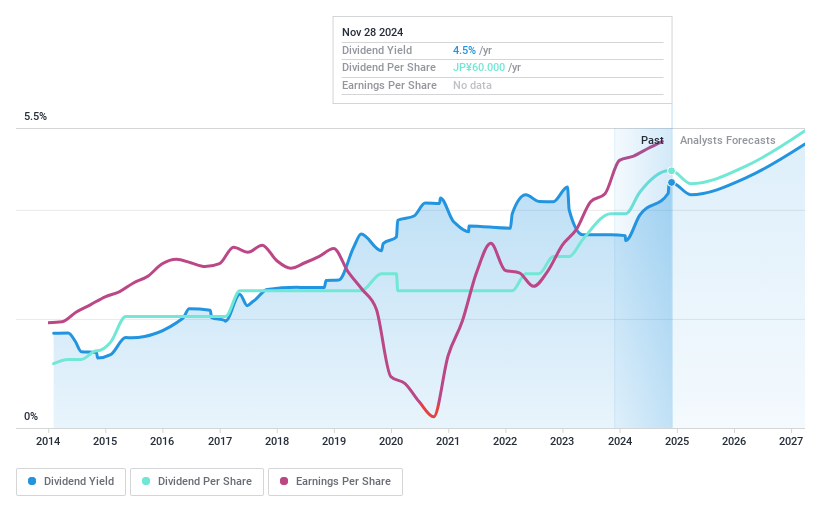

Dividend Yield: 4.3%

Daicel has announced a share buyback program and increased its interim and year-end dividends, reflecting a focus on shareholder returns despite recent earnings guidance revisions. The company aims for a total return ratio of over 40%, combining dividends and buybacks, with a new target DOE ratio of 4% or more. While dividends have been stable over the past decade, they are not covered by free cash flows, though the payout ratio remains low at 26.3%.

- Unlock comprehensive insights into our analysis of Daicel stock in this dividend report.

- Upon reviewing our latest valuation report, Daicel's share price might be too pessimistic.

AiphoneLtd (TSE:6718)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Aiphone Co., Ltd. manufactures and sells telecommunication equipment under the AIPHONE brand for various sectors including housing, healthcare, and business globally, with a market cap of ¥44.34 billion.

Operations: Aiphone Co., Ltd.'s revenue is primarily derived from Japan (¥55.62 billion), with additional contributions from North America (¥11.53 billion), Thailand (¥9.44 billion), Vietnam (¥6.67 billion), Europe (¥4.39 billion), and other regions (¥1.51 billion).

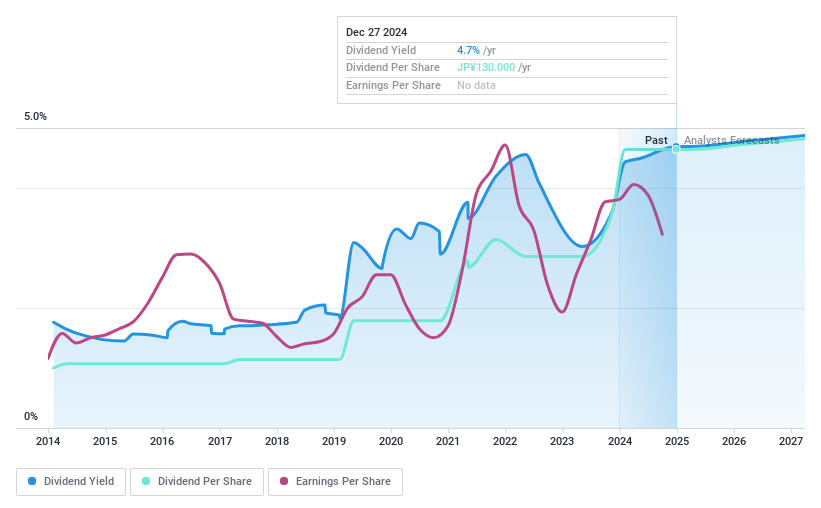

Dividend Yield: 4.7%

Aiphone Ltd. offers a compelling dividend profile with a yield of 4.75%, placing it in the top 25% of Japanese market payers. The company's dividends have been stable and growing over the past decade, supported by a reasonable payout ratio of 57.5%. This coverage is reinforced by strong cash flow management, as indicated by a cash payout ratio of just 35.4%. Additionally, Aiphone's stock trades at approximately 12.8% below its estimated fair value, enhancing its attractiveness for dividend-focused investors amidst projected earnings growth of 4.07% annually.

- Click here and access our complete dividend analysis report to understand the dynamics of AiphoneLtd.

- Our valuation report unveils the possibility AiphoneLtd's shares may be trading at a discount.

T3EX Global Holdings (TWSE:2636)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: T3EX Global Holdings Corp. is an investment holding company that offers integrated logistics services across Taiwan, Hong Kong, China, East Asia, and internationally with a market cap of NT$10.86 billion.

Operations: T3EX Global Holdings Corp. generates revenue primarily from Sea Freight/Transportation at NT$14.79 billion and Air Freight/Transportation at NT$5.15 billion.

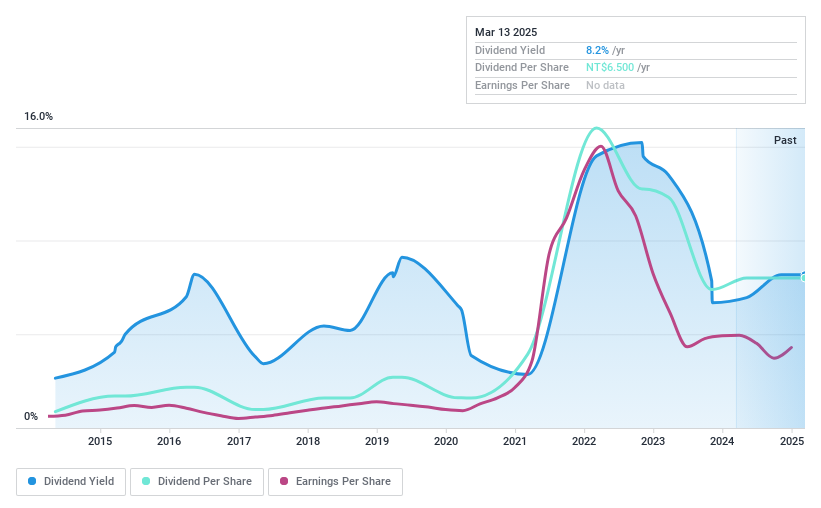

Dividend Yield: 8.2%

T3EX Global Holdings offers a high dividend yield of 8.17%, ranking in the top 25% of the Taiwanese market, but its sustainability is questionable due to insufficient free cash flow coverage and volatile payments over the past decade. Despite a low price-to-earnings ratio of 9.8x, recent leadership changes and declining net profit margins from 9.7% to 4.8% could impact future stability, although dividends have increased over ten years.

- Delve into the full analysis dividend report here for a deeper understanding of T3EX Global Holdings.

- The valuation report we've compiled suggests that T3EX Global Holdings' current price could be inflated.

Taking Advantage

- Delve into our full catalog of 1935 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4202

Daicel

Engages in the materials, medical/healthcare, smart, safety, engineering plastics, and other businesses in Japan, China, and internationally.

Undervalued established dividend payer.