- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6703

A Piece Of The Puzzle Missing From Oki Electric Industry Co., Ltd.'s (TSE:6703) Share Price

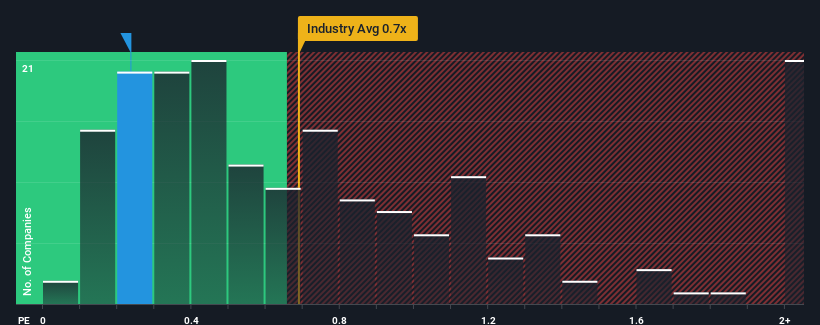

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Electronic industry in Japan, you could be forgiven for feeling indifferent about Oki Electric Industry Co., Ltd.'s (TSE:6703) P/S ratio of 0.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Oki Electric Industry

How Oki Electric Industry Has Been Performing

With revenue growth that's superior to most other companies of late, Oki Electric Industry has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Oki Electric Industry will help you uncover what's on the horizon.How Is Oki Electric Industry's Revenue Growth Trending?

In order to justify its P/S ratio, Oki Electric Industry would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 9.2% over the next year. That's shaping up to be materially higher than the 6.4% growth forecast for the broader industry.

With this information, we find it interesting that Oki Electric Industry is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Oki Electric Industry's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Oki Electric Industry currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Oki Electric Industry you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6703

Oki Electric Industry

Manufactures and sells products, technologies, software, and solutions for telecommunication and information systems in Japan and internationally.

Solid track record with adequate balance sheet.