- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6615

UMC Electronics (TSE:6615) Has Announced A Dividend Of ¥5.00

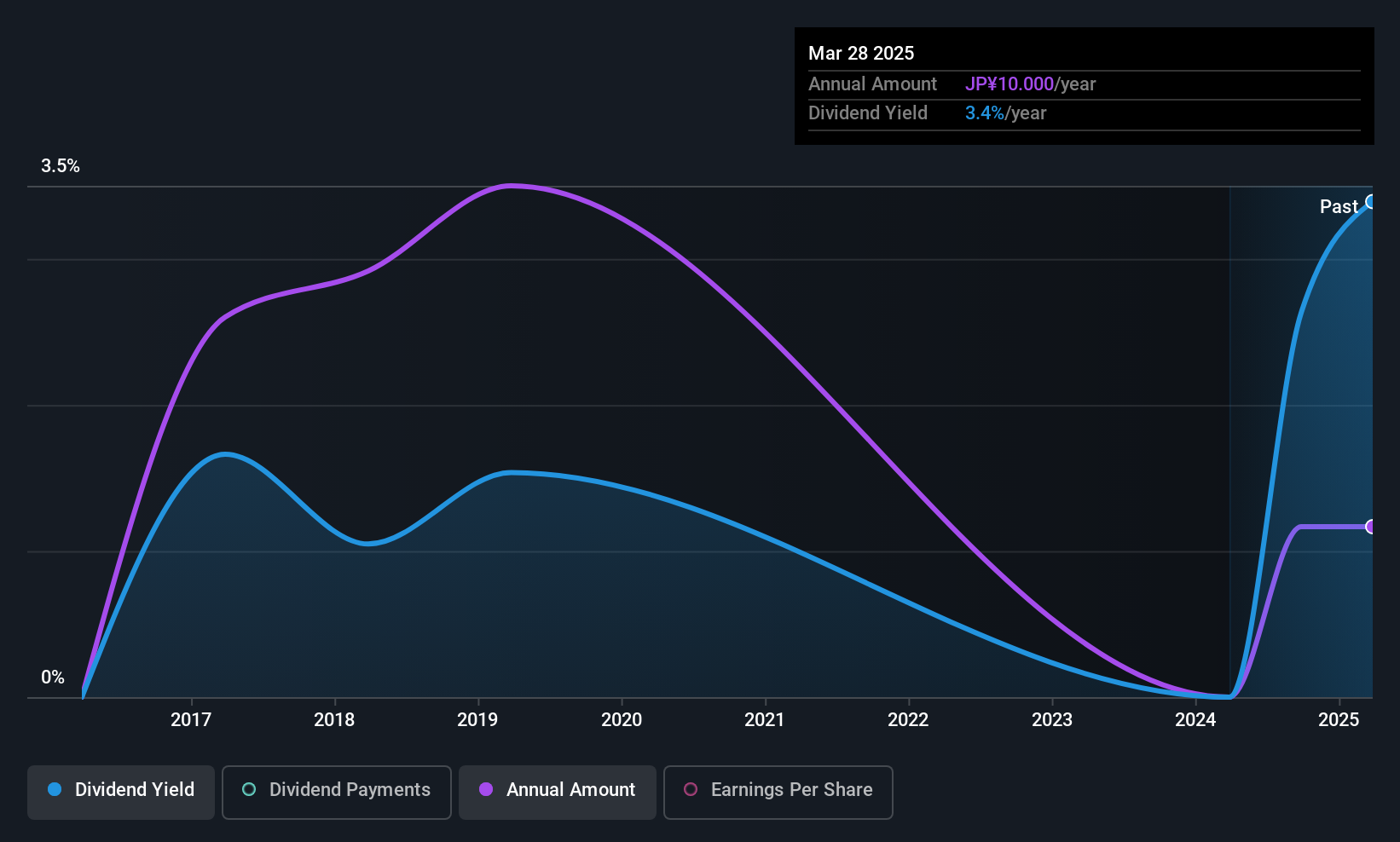

The board of UMC Electronics Co., Ltd. (TSE:6615) has announced that it will pay a dividend on the 15th of December, with investors receiving ¥5.00 per share. The dividend yield will be 3.5% based on this payment which is still above the industry average.

UMC Electronics' Distributions May Be Difficult To Sustain

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. However, UMC Electronics' earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS could expand by 74.5% if recent trends continue. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. The healthy cash flows are definitely as good sign, though so we wouldn't panic just yet, especially with the earnings growing.

Check out our latest analysis for UMC Electronics

UMC Electronics' Dividend Has Lacked Consistency

Even in its relatively short history, the company has reduced the dividend at least once. This makes us cautious about the consistency of the dividend over a full economic cycle. The annual payment during the last 9 years was ¥22.30 in 2016, and the most recent fiscal year payment was ¥10.00. Doing the maths, this is a decline of about 8.5% per year. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Looks Likely To Grow

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. UMC Electronics has seen EPS rising for the last five years, at 75% per annum. Earnings have been growing rapidly, and with a low payout ratio we think that the company could turn out to be a great dividend stock.

We Really Like UMC Electronics' Dividend

Overall, we like to see the dividend staying consistent, and we think UMC Electronics might even raise payments in the future. Earnings are easily covering distributions, and the company is generating plenty of cash. All of these factors considered, we think this has solid potential as a dividend stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 3 warning signs for UMC Electronics (of which 1 doesn't sit too well with us!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6615

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026