- Japan

- /

- Tech Hardware

- /

- TSE:6588

Assessing Toshiba Tec (TSE:6588) Valuation After Interim Dividend Suspension Due to U.S. Market Headwinds

Reviewed by Kshitija Bhandaru

Toshiba Tec (TSE:6588) shares came into focus after the company’s board decided to hold back its interim dividend. The move is linked to weakening U.S. market conditions resulting from tariffs and higher costs.

See our latest analysis for Toshiba Tec.

While Toshiba Tec’s strategic moves have drawn attention, the 1-year total shareholder return sits at -0.13%. The longer-term picture reveals momentum has faded, with performance trending lower even before the latest dividend decision.

If you’re wondering what other opportunities stand out right now, it could be worth broadening your horizon and discovering fast growing stocks with high insider ownership

With the shares now trading at a notable discount to analyst targets but recent results underwhelming, investors are left to consider whether Toshiba Tec offers hidden value or if the market has already accounted for its future growth prospects.

Price-to-Earnings of 7.4x: Is it justified?

Toshiba Tec’s shares last closed at ¥3,020, which places the company’s price-to-earnings ratio at 7.4x, a figure well below its industry peers and fair value benchmarks.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each yen of earnings the company generates. For a tech sector business like Toshiba Tec, a lower P/E could imply doubts about future growth or recent challenges. This may signal that the market is underappreciating its earnings power based on current sentiment.

Compared to the Japanese Tech industry average of 14.5x and with a fair P/E ratio calculated at 12.2x, Toshiba Tec looks attractively valued on this metric. The discount suggests room for re-rating if earnings stabilize or outperform expectations, and gives investors potential upside should market perceptions shift closer to the fair ratio level.

Explore the SWS fair ratio for Toshiba Tec

Result: Price-to-Earnings of 7.4x (UNDERVALUED)

However, stagnant revenue growth and a decline in net income remain key risks that could limit any near-term upside for Toshiba Tec’s shares.

Find out about the key risks to this Toshiba Tec narrative.

Another View: SWS DCF Model Suggests Deeper Undervaluation

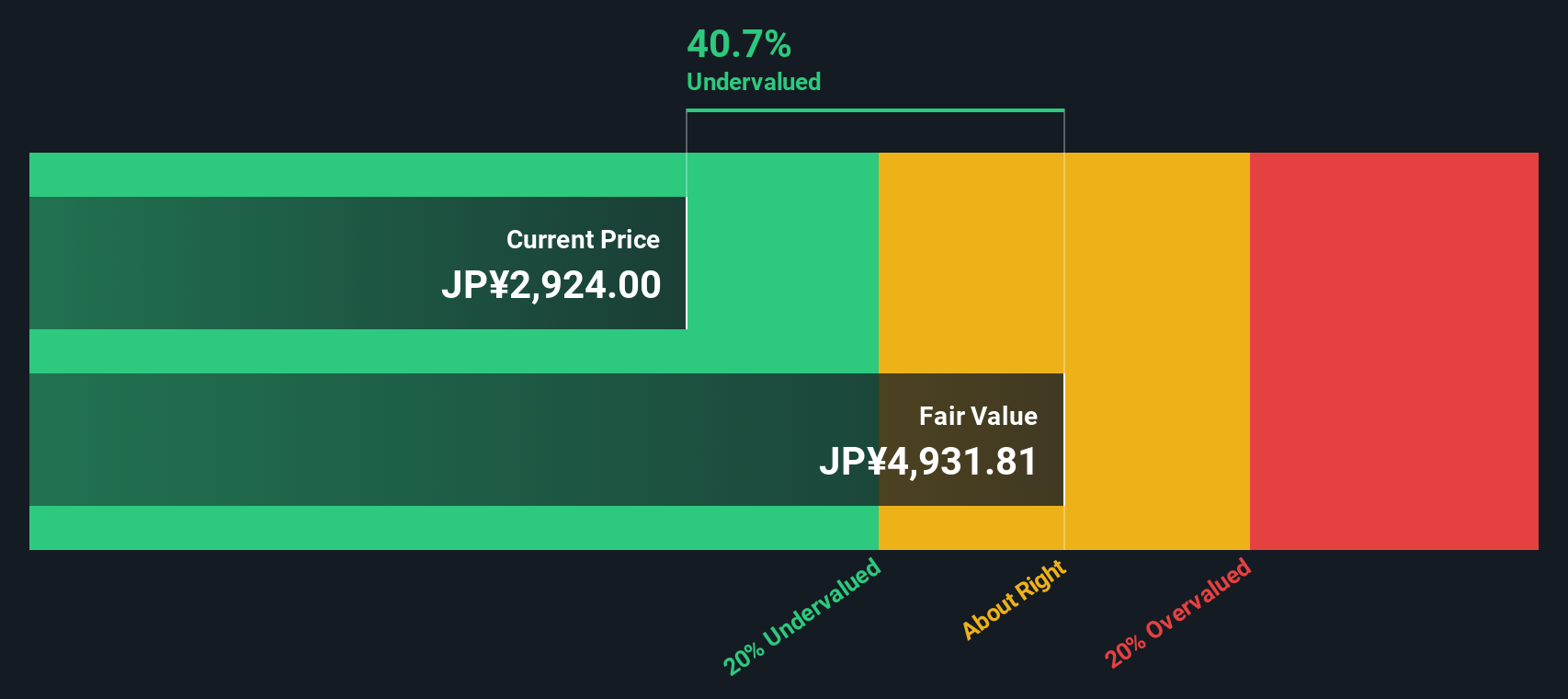

While the price-to-earnings ratio signals undervaluation, our DCF model paints an even starker picture. With shares trading about 39% below the estimated fair value of ¥4,943, the disconnect is notable. Does the market see risks the numbers do not capture? Is this a missed opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toshiba Tec for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toshiba Tec Narrative

If you see the story unfolding differently or want to dive into your own analysis, it takes just a few minutes to craft a unique thesis. Do it your way

A great starting point for your Toshiba Tec research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their options open, and the right stock at the right time can change your whole portfolio. Don’t miss out. See what’s gaining momentum now:

- Uncover untapped opportunities with these 3563 penny stocks with strong financials offering growth potential that could outperform established names in the market.

- Power up your portfolio by browsing these 24 AI penny stocks packed with companies innovating in artificial intelligence and shaping tomorrow’s industries.

- Secure compelling yield possibilities through these 19 dividend stocks with yields > 3% and add steady income streams to your investment mix.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toshiba Tec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6588

Toshiba Tec

Offers retail and workplace solutions in Japan and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives